Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

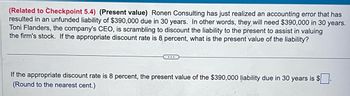

Transcribed Image Text:(Related to Checkpoint 5.4) (Present value) Ronen Consulting has just realized an accounting error that has

resulted in an unfunded liability of $390,000 due in 30 years. In other words, they will need $390,000 in 30 years.

Toni Flanders, the company's CEO, is scrambling to discount the liability to the present to assist in valuing

the firm's stock. If the appropriate discount rate is 8 percent, what is the present value of the liability?

...

If the appropriate discount rate is 8 percent, the present value of the $390,000 liability due in 30 years is $.

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An officer for a large construction company is feeling nervous. The anxiety is caused by a new excavator just released onto the market. The new excavator makes the one purchased by the company a year ago obsolete. As a result, the market value for the company’s excavator has dropped significantly, from $600,000 a year ago to $50,000 now. In ten years, it would be worth only $3,000. The new excavator costs only $950,000 and would increase operating revenues by $90,000 annually. The new equipment has a ten-year life and expected salvage value of $175,000. The tax rate is 35%, the CCA rate, 25% for both excavators, and the required rate of return for the company is 14%. What is the NPV of the new excavator?arrow_forwardCullumber Company is a private company with sales of $1,100,000 a year. Management wants to take the company public but has to wait until the sales reach $2,000,000. If sales are expected to grow 15 percent annually, when is the earliest that Cullumber will go public? (If you solve this problem with algebra round intermediate calculations to 4 decimal places, in all cases round your final answer to 1 decimal place, e.g. 5.4.) Excel Template(Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you’ve been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.)arrow_forwardSuppose that over the next year, one of three things could happen to a company's credit rating. It could remain investment grade, drop to non-investment grade or default. The value of a credit derivative that pays $100 in 1-year if the company's credit rating remain investment grade is $93. The value of a credit derivative that pays $200 in 1-year if the company's credit rating drops to non-investment grade is $7. The value of a credit derivative that pays $300 in 1-year if the company defaults is $6. Calculate the risk-free rate and the risk-neutral probability of default. (answers to 4 decimal places)arrow_forward

- Sara is trying to analyze Henley Company finances but realizes that she was missing the company's net profits after taxes for the current year. Find the company's net profits after tax.ROA = 2.5%Total asset turnover = 0.5COGS = $105,000Gross profit margin = 0.30arrow_forwardAn officer for a large construction company is feeling nervous. The anxietyis caused by a new excavator just released onto the market. The newexcavator makes the one purchased by the company a year ago obsolete.As a result, the market value for the company’s excavator has droppedsignificantly, from $600,000 a year ago to $50,000 now. In ten years, itwould be worth only $3,000. The new excavator costs only $950,000 andwould increase operating revenues by $90,000 annually. The newequipment has a ten-year life and expected salvage value of $175,000. Thetax rate is 35%, the CCA rate, 25% for both excavators, and the requiredrate of return for the company is 14%. What is the NPV of the newexcavator? (Negative answer should be indicated by a minus sign. Do notround your intermediate calculations. Round the final answer to 2decimal places. Omit $ sign in your response.)NPV $arrow_forwardIs it possible that I can get help with this? I am not understanding why it is wrong. I have attached an example of the correct solution. Futuristic Development (FD) generated $3 million in sales last year with assets equal to $6 million. The firm operated at full capacity last year. According to FD's balance sheet, the only current liabilities are accounts payable, which equals $480,000. The only other liability is long-term debt, which equals $1,035,000. The common equity section is comprised of 500,000 shares of common stock with a book value equal to $3 million and $1,485,000 of retained earnings. Next year, FD expects its sales will increase by 20 percent. The company's net profit margin is expected to remain at its current level, which is 16 percent of sales. FD plans to pay dividends equal to $0.60 per share. It also plans to issue 70,000 shares of new common stock, which will raise $460,000. Estimate the additional funds needed (AFN) to achieve the forecasted sales next…arrow_forward

- Fifteen years ago, Jackson Supply set aside $130,000 in case of a financial emergency. Today, that account has increased in value to $330,582. What rate of interest is the firm earning on this money?arrow_forwardThe firm purchases a vehicle with equity capital only, no debt. The purpose of the vehicle is to operate a taxi service for one year. This is the problem as we worked in class, but now the life of the vehicle is only one year, after which time the vehicle is worthless. Also some of the other values are different. The firm is contemplating the following: Vehicle acquisition cost $30,000 Years of useful life (economic life) 1 Tax rate0% Required rate of return on equity10% Annual revenues$ 145,000 Operating expenses (excluding depreciation)$ 100,000 Tips: 1.Depreciate straight-line over the year of useful life,down to $0 over one year. 2. The maximum dividend is paid annually. 3. Ignore any working capital effects. 4. Capital charge will be based on the assets at the beginning of each year. Please include in the analysis: P&L - OCF analysis EVA analysis Does this project deserve consideration? How much wealth, if any, will it create?arrow_forwardSouthern California Publishing Company is trying to decide whether to revise its popular textbook Financial Psychoanalysis Made Simple. The company has estimated that the revision will cost $ 75,000. Cash flows from increased sales will be $20, 900 the first year. These cash flows will increase by 3 percent per year. The book will go out of print four years from now. Assume that the initial cost is paid now and revenues are received at the end of each year. If the company requires a return of 8 percent for such an investment, calculate the present value of the cash inflows of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education