Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

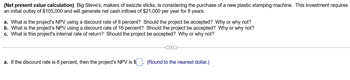

Transcribed Image Text:(Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires

an initial outlay of $105,000 and will generate net cash inflows of $21,000 per year for 8 years.

a. What is the project's NPV using a discount rate of 8 percent? Should the project be accepted? Why or why not?

b. What is the project's NPV using a discount rate of 16 percent? Should the project be accepted? Why or why not?

c. What is this project's internal rate of return? Should the project be accepted? Why or why not?

a. If the discount rate is 8 percent, then the project's NPV is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Big Steve's, a maker of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $130,000 and will generate cash inflows of $37,000 per year for 7 years. If the discount rate is 17%, what is the project's IRR? (Round to two decimal places.) O A.17.00% OB. 20.94% O C. 32.52% OD. 37.33% MacBook Airarrow_forwardPlease answer this problems manually. Thank youarrow_forward1. what amount should be used as the initial cash flow for this project and why?? 2. What is the after-tax salvage value for the spectrometer? 3. What is the MPV of the project? Should the firm accept or reject this project?arrow_forward

- What is the value of the abandonment option (in millions), in the question below? Round your answer to two decimal places... Sunshine Smoothies Company (SSC) manufactures and distributes smoothies.It is considering the introduction of a "weight loss" smoothie.The project would require a $4 million investment outlay today (t = 0).The after-tax cash flows would depend on whether the weight loss smoothie is well received by consumers.There is a 30% chance that demand will be good, in which case the project will produce after-tax cash flows of $2 million at the end of each of the next 3 years.There is a 70% chance that demand will be poor, in which case the after-tax cash flows will be $1 million for 3 years.The project is riskier than the firm's other projects, so it has a WACC of 12%.The firm will know if the project is successful after receiving first year's cash flows.After receiving the first year's cash flows it will have the option to abandon the project.If the firm decides to…arrow_forwardGive me step by step full answerarrow_forwardQuestion: Big Steve's, maker of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $105,000 and will generate net cash inflows of $19,000 per year for 8 years. a. What is the project's NPV using a discount rate of 8 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 17 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not?arrow_forward

- 1. A project requires an initial capital cost of (40 million ID). The investor expects the project will generate annual returns of (12 million ID), with expenditures about (4 million ID) annually. If you know that the economic life is (12) years, and the salvage value after the end of the economic life is (4 million ID). Considering that the less acceptable interest rate for the investor is (10%): A. Determining the economic feasibility for investing using the present worth method? B. What is the equivalent annual worth of this investment? C. Find the internal rate of return?arrow_forwarda. What is the net present value (at the discount rate of 10%) of this project?b. Perot’s engineers have determined that spending $10 million more on development will allow them to add even more advanced features. Having a more advanced chip will allow them to price the chip $50 higher in both years ($870 for year 1 and $700 for year 2). What is the NPV of the project if this option is implemented?c. If sales are only 200,000 the first year and 100,000 the second year, what would the NPV of the project be? Assume the development costs and sales price are as originally estimated. Development cost - $1,250,000Estimated development time - 9 monthsPilot testing - $200,000Ramp-up cost - $400,000Marketing and support cost - $150,000/yrSales & Production volume - $60,000/yrUnit production cost - $100Unit price - $205Interest rate - 8%arrow_forward1. Comparing all methods. Given the following after-tax cash flow on a new toy for Tyler's Toys, find the project's payback period, NPV, and IRR. The appropriate discount rate for the project is 14%. If the cutoff period is 6 years for major projects, determine whether management will accept or reject the project under the three different decision models. (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cash outflow: $11,700,000 Years one through four cash inflow: $2,925,000 each year Year five cash outflow: $1,170,000 Years six through eight cash inflow: $503,000 each year What is the payback period for the new toy at Tyler's Toys? years (Round to two decimal places.) Under the payback period, this project would be (1) What is the NPV for the new toy at Tyler's Toys? $ (Round to the nearest cent.) Under the NPV rule, this project would be (2) What is the IRR for the new toy at Tyler's Toys? % (Round to two decimal places.) Under the IRR rule,…arrow_forward

- What is the net present value of the flier project, which is a 3-year project where Dispersion would spread fliers all over Fairfax? The project would involve an initial investment in equipment of $232,000.00 today. To finance the project, Dispersion would borrow $232,000.00. The firm would receive $232,000.00 from the bank today and would pay the bank $294,695.40 in 3 years (consisting of an interest payment of $62,695.40 and a principal payment of $232,000.00). Cash flows from capital spending would be $0.00 in year 1, $0.00 in year 2, and $30,500.00 in year 3. Operating cash flows are expected to be $144,900.00 in year 1, $99,400.00 in year 2, and -$28,200.00 in year 3. The cash flow effects from the change in net working capital are expected to be -$8,310.00 at time 0; -$21,700.00 in year 1; $12,100.00 in year 2, and $16,900.00 in year 3. The tax rate is 35.00 percent. The cost of capital is 7.45 percent and the interest rate on the loan would be 8.03 percent. -$13,600.79 (plus or…arrow_forwardam. 123.arrow_forwardMaster Lock is evaluating whether to replace an older laser engraving machine to inscribe logos with a new machine. – The initial investment to acquire the machine is $380,000. – The machine has an expected useful life of 5 years. – The new machine would generates annual cost savings of $100,0000 (cash flows) one each of the five years. – The discount rate (or required rate of return) is 8%. • What’s the NPV (assume no taxes or inflation)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education