FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

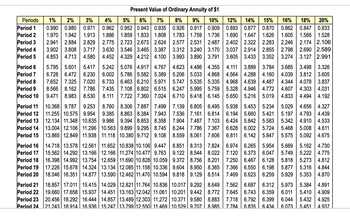

Transcribed Image Text:Periods 1%

Period 1

Period 2

Period 3

Period 4

Period 5

Period 6

Period 7

Period 8

Period 9

Period 10

Period 11

Period 12

Period 13

Period 14

Period 15

Period 16

Period 17

Period 18

Period 19

Period 20

Present Value of Ordinary Annuity of $1

0.990 0.980

2% 3%

0.971

1.913

4%

0.962

1.886

3.902 3.808 3.717 3.630 3.546 3.465 3.387

4.853 4.713 4.580 4.452 4.329 4.212 4.100

6.728 6.472

5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20%

0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833

1.970 1.942

1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.626 1.605 1.566 1.528

2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 2.174 2.106

3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589

3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991

5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.889 3.784 3.685 3.498 3.326

6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 4.039 3.812 3.605

7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837

8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 4.607 4.303 4.031

9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192

10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 5.029 4.656 4.327

11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.421 5.197 4.793 4.439

12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.842 5.583 5.342 4.910 4.533

13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611

13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.847 5.575 5.092 4.675

8.851 8.313 7.824 6.974 6.265 5.954 5.669 5.162 4.730

9.122 8.544 8.022 7.120 6.373 6.047 5.749 5.222 4.775

9.372 8.756 8.201 7.250 6.467 6.128 5.818 5.273 4.812

9.604 8.950 8.365 7.366 6.550 6.198 5.877

9.818 9.129 8.514 7.469 6.623 6.259 5.929

5.316 4.844

5.353 4.870

7.562 6.687 6.312 5.973 5.384

4.891

7.645 6.743 6.359 6.011 5.410 4.909

7.718 6.792 6.399 6.044 5.432 4.925

7.784 6.835 6.434 6.073 5.451 4.937

Period 21

Period 22

Period 23

Period 24

10.838 10.106 9.447

11.274 10.477 9.763

11.690 10.828 10.059

13.134 12.085 11.158 10.336

12.462 11.470 10.594

18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649

19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 8.772

20.456 18.292 | 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883

21.243 18.914 | 16.936 | 15.247 | 13.799 12.550 11.469 | 10.529 | 9.707 | 8.985

14.718 13.578 12.561 11.652

15.562 14.292 13.166 12.166

16.398 14.992 13.754 12.659

17.226 15.678 14.324

18.046 16.351 14.877 13.590

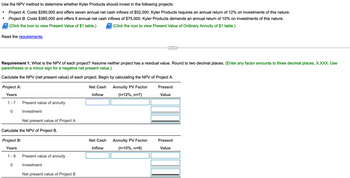

Transcribed Image Text:Use the NPV method to determine whether Kyler Products should invest in the following projects:

Project A: Costs $280,000 and offers seven annual net cash inflows of $52,000. Kyler Products requires an annual return of 12% on investments of this nature.

Project B: Costs $385,000 and offers 9 annual net cash inflows of $75,000. Kyler Products demands an annual return of 10% on investments of this nature.

(Click the icon to view Present Value of $1 table.)

(Click the icon to view Present Value of Ordinary Annuity of $1 table.)

Read the requirements.

Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use

parentheses or a minus sign for a negative net present value.)

Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A.

Project A:

Years

1-7

0

Present value of annuity

Investment

Net present value of Project A

Calculate the NPV of Project B.

0

Project B:

Years

1-9 Present value of annuity

Investment

Net present value of Project B

Net Cash

Inflow

Net Cash

Inflow

Annuity PV Factor

(i=12%, n=7)

Annuity PV Factor

(i=10%, n=9)

Present

Value

Present

Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a. They payback period of project A is ___ years (round to two decimal places) The payback period of project B is ____ years. (round to two decimal places) According to the payback method, which project should the firm choose? b. The NPV of project A is $___ The NPV of project B is $___ c. The IRR of project A is ___ The IRR of project B is ___ d. Make a reccomendationarrow_forwardAssume that the net present value of a project is $ 3870 at 10%, and -$1853 at 12%. Use linear interpolation to compute the rate of return correct to the nearest tenth of a percent. A) 11.2% B) 10.8% C) 10.5% D) 11.9% E) 11.4%arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (X) Cash Flow (Y)0-$19.100-$ 19,100 18,625 9,650 2 8,650 7,575 3 8,575 8,475 Calculate the IRR for each project. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) What is the crossover rate for these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) What is the NPV of Projects X and Y at discount rates of 0 percent, 15 percent, and 25 percent?arrow_forward

- Compute the payback statistic for Project A if the appropriate cost of capital is 7 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: −$1,400 $510 $600 $600 $380 $180 Payback years: _______.__arrow_forwardNPV and IRR Analysis Cummings Products Company is considering two mutually exclusive investments whose expected net cash flows are as follows: EXPECTED NET CASH FLOWS Year Project A Project B -$340 -$630 -528 210 -219 210 3. -150 210 4. 1,100 210 820 210 6. 990 210 7. -325 210 a. Construct NPV profiles for Projects A and B. Select the correct graph. VPVS) 1400 VPVS) VPVS) 1400 1400 1200 1200 1200+ 1000 1000 1000 800 Project B 800 Pioject A 800+ C1arrow_forwardWhen calculating the annual rate of return, the average investment is equal to initial investment divided by life of project. (initial investment plus $0) divided by 2. (initial investment plus salvage value) divided by 2. initial investment divided by 2.arrow_forward

- Compute the net present value for each project. (Round answers to 0 decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project Bono Project Edge Project Clayton Net present value $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places Save for Laterarrow_forwardCalculate the NPVs of both Project X and Project Y. Show the NPVs for each project. If the Projects are Independent which would you approve? If the Projects are Mutually Exclusive which would you approve?arrow_forward1. What is the project’s net present value? 2. What is the project’s internal rate of return to the nearest whole percent? 3. What is the project’s simple rate of return?arrow_forward

- a) b) Consider the following two projects: Project A B Year 0 Cash Flow -100 -73 17.3% C. d. Year 1 Cash Flow 40 30 a. 30 percent. b. 20 percent. 0 percent. 10 percent. Year 2 Cash Flow What is the incremental IRR of Project B over Project A? a. 12.6% b. 23.3% C. 1.7% d. 50 30 Year 3 Cash Flow 60 30 Year 4 Cash Flow N/A 30 Discount Rate If the standard deviation of returns on the market is 20 percent, and the beta of a well- diversified portfolio is 1.5, calculate the standard deviation of this portfolio. .15 .15arrow_forwardplease ASAP, direct thumps up :)arrow_forwardFind internal rate of return of a project with an initial cost of $43,000, expected net cash inflows of $9,550 per year for 8 years, and a cost of capital of 10.50%.Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. Group of answer choices 15.05% 14.60% 14.90% 16.24% 17.73%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education