Essentials of Economics (MindTap Course List)

8th Edition

ISBN: 9781337091992

Author: N. Gregory Mankiw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:References

Mailings Review View

Help

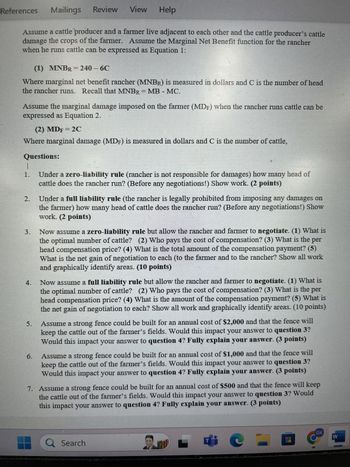

Assume a cattle producer and a farmer live adjacent to each other and the cattle producer's cattle

damage the crops of the farmer. Assume the Marginal Net Benefit function for the rancher

when he runs cattle can be expressed as Equation 1:

(1) MNBR = 240 - 6C

Where marginal net benefit rancher (MNBR) is measured in dollars and C is the number of head

the rancher runs. Recall that MNBR = MB - MC.

Assume the marginal damage imposed on the farmer (MDF) when the rancher runs cattle can be

expressed as Equation 2.

(2) MDF = 2C

Where marginal damage (MDF) is measured in dollars and C is the number of cattle,

Questions:

1.

2.

3.

4.

5.

6.

Under a zero-liability rule (rancher is not responsible for damages) how many head of

cattle does the rancher run? (Before any negotiations!) Show work. (2 points)

Under a full liability rule (the rancher is legally prohibited from imposing any damages on

the farmer) how many head of cattle does the rancher run? (Before any negotiations!) Show

work. (2 points)

Now assume a zero-liability rule but allow the rancher and farmer to negotiate. (1) What is

the optimal number of cattle? (2) Who pays the cost of compensation? (3) What is the per

head compensation price? (4) What is the total amount of the compensation payment? (5)

What is the net gain of negotiation to each (to the farmer and to the rancher? Show all work

and graphically identify areas. (10 points)

Now assume a full liability rule but allow the rancher and farmer to negotiate. (1) What is

the optimal number of cattle? (2) Who pays the cost of compensation? (3) What is the per

head compensation price? (4) What is the amount of the compensation payment? (5) What is

the net gain of negotiation to each? Show all work and graphically identify areas. (10 points)

Assume a strong fence could be built for an annual cost of $2,000 and that the fence will

keep the cattle out of the farmer's fields. Would this impact your answer to question 3?

Would this impact your answer to question 4? Fully explain your answer. (3 points)

Assume a strong fence could be built for an annual cost of $1,000 and that the fence will

keep the cattle out of the farmer's fields. Would this impact your answer to question 3?

Would this impact your answer to question 4? Fully explain your answer. (3 points)

7. Assume a strong fence could be built for an annual cost of $500 and that the fence will keep

the cattle out of the farmer's fields. Would this impact your answer to question 3? Would

this impact your answer to question 4? Fully explain your answer. (3 points)

Search

GK

W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Would you consider an interest payment on a loan to a film an explicit or implicit cost?arrow_forwardDon't answer by pen paper and don't use chatgpt otherwise we will give dounvotearrow_forwardcan someone pls explain if marginal product function (i.) and (ii) are either convex or concave? what is their economic implication?arrow_forward

- urgent i will 5 upvotes both answers.arrow_forward10arrow_forwardSuppose a fisherman owns a fish farm that has a boat and only one worker (the fisherman himself)Currentlyfish are captured and sold in the every dayEventually the to an additional worker so that he can dedicate all his time to capturing the fish, and the can sell the fish per day With the additional worker, the total of the farm is 200 The marginal returns of the second worker is The fisherman now decides to add one more workerWith the two workers capturing and the one worker , output the fish 300 dayThe marginal returns of the third worker per dayarrow_forward

- The marginal product of effort, a typical worker in fast-food burger joint, is one- fourth burgers per hour; that is, MPe = .25The price of a burger is $2. The figure graphs Mac’s marginal cost of effort. If Mac increases his effort by one unit per hour, the change in the burger joint’s revenue is $ per hour. That is, what is VMPe , the value of Mac ‘s marginal product of effort ? Plot the VMPe curve in the figure. Mac efficient effort e^ is the solution to what equation? Illustrate the solution in the figure. Mac efficient…arrow_forwardSuppose the production function for high quality brandy is given by : Q = √KL Where q is the output of brandy per week and L is labor hours per week ., in the short run K is fixed at 100, so the short run production function is Q = 10√L a. Ifthecapitalrentsfor10$andthewageare5$perhour.,writetheshortruntotalcost function. b. How much will the firm produce at a price of 20$ per bottles of brandy ? c. Howmanylaborhourswillbehiredperweek?arrow_forwardGive me both answer with full explanationarrow_forward

- If Farmer Jones plants no seeds on his farm, he gets no harvest. If heplants 1 bag of seeds, he gets 3 bushels of wheat. If he plants 2 bags, he gets 5 bushels.If he plants 3 bags, he gets 6 bushels. A bag of seeds costs $100, and seeds are his onlycost. Use these data to graph the farmer’s production function and total-cost curve. Explaintheir shapes.arrow_forwardThe manager of the donut shop tells you that hesells donuts for $1 each, and that if he were to makeadditional donuts, based on his current level ofoutput, it would cost him $0.80 per donut. Do yourecommend that the manager increase or decreasethe number of donuts he makes?arrow_forwardI need explain answer question 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning