Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

answer the blank part please ASAP

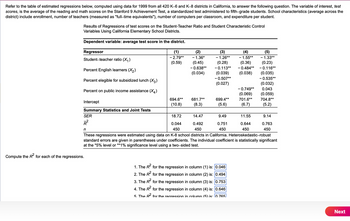

Transcribed Image Text:Refer to the table of estimated regressions below, computed using data for 1999 from all 420 K-6 and K-8 districts in California, to answer the following question. The variable of interest, test

scores, is the average of the reading and math scores on the Stanford 9 Achievement Test, a standardized test administered to fifth-grade students. School characteristics (average across the

district) include enrollment, number of teachers (measured as "full-time equivalents"), number of computers per classroom, and expenditure per student.

Results of Regressions of test scores on the Student-Teacher Ratio and Student Characteristic Control

Variables Using California Elementary School Districts.

Dependent variable: average test score in the district.

Regressor

Student-teacher ratio (✗₁)

Percent English learners (X2)

Percent elegible for subsidized lunch (X3)

Percent on public income assistance (X4)

(1)

- 2.79**

(0.59)

(2)

- 1.36*

(0.45)

- 0.638**

(0.034)

(3)

- 1.26**

(0.28)

- 0.113**

(0.039)

- 0.507**

(0.027)

(4)

- 1.55**

(0.36)

- 0.484**

(0.038)

- 0.749**

(0.069)

(5)

- 1.33**

(0.23)

- 0.116**

(0.035)

- 0.535**

(0.032)

Compute the R² for each of the regressions.

0.043

(0.059)

694.6**

681.7**

699.4**

701.6**

704.8**

Intercept

(10.8)

(8.3)

(5.6)

(6.7)

(5.2)

Summary Statistics and Joint Tests

SER

18.72

14.47

9.49

11.55

9.14

Ŕ²

0.044

0.492

0.751

0.644

0.763

n

450

450

450

450

450

These regressions were estimated using data on K-8 school districts in California. Heteroskedastic-robust

standard errors are given in parentheses under coefficients. The individual coefficient is statistically significant

at the *5% level or **1% significance level using a two-sided test.

1. The R² for the regression in column (1) is: 0.046

2. The R² for the regression in column (2) is: 0.494

3. The R² for the regression in column (3) is: 0.753

4. The R² for the regression in column (4) is: 0.646

5 The R²² for the regression in column (5) is: 0 765

Next

![4. The R* for the regression in column (4) is: 0.646|

5. The R² for the regression in column (5) is: 0.765

(Round your response to three decimal places)

Construct the homoskedasticity-only F-statistic for testing ẞ3 = ẞ4 = 0 in the regression shown in column (5).

The homoskedasticity-only F-statistic for the test is: 255.66

(Round your response to two decimal places)

Is the homoskedasticity-only F-statistic significant at the 5% level?

A. Yes.

B. No.

Test B3 B40 in the regression shown in column (5) using the Bonferroni test. Note that the 1% Bonferroni critical value is 2.807.

The t-statistic for ẞ3 in the regression in column (5) is:

Is the Bonferroni test significant at the 1% level?

A. Yes.

B. No.

(Round your response to three decimal places)

The t-statistic for ẞ4 in the regression in column (5) is:

(Round your response to three decimal places)

Construct a 99% confidence interval for B₁ for the regression in column (5).

The 99% confidence interval is: - 1.923

-0.737]

(Round your response to three decimal places)](https://content.bartleby.com/qna-images/question/79146392-6a88-41c3-83e8-75131ce910cd/fc6c9da1-414b-4c9b-9cda-998a0a3a8006/2sspnm_thumbnail.png)

Transcribed Image Text:4. The R* for the regression in column (4) is: 0.646|

5. The R² for the regression in column (5) is: 0.765

(Round your response to three decimal places)

Construct the homoskedasticity-only F-statistic for testing ẞ3 = ẞ4 = 0 in the regression shown in column (5).

The homoskedasticity-only F-statistic for the test is: 255.66

(Round your response to two decimal places)

Is the homoskedasticity-only F-statistic significant at the 5% level?

A. Yes.

B. No.

Test B3 B40 in the regression shown in column (5) using the Bonferroni test. Note that the 1% Bonferroni critical value is 2.807.

The t-statistic for ẞ3 in the regression in column (5) is:

Is the Bonferroni test significant at the 1% level?

A. Yes.

B. No.

(Round your response to three decimal places)

The t-statistic for ẞ4 in the regression in column (5) is:

(Round your response to three decimal places)

Construct a 99% confidence interval for B₁ for the regression in column (5).

The 99% confidence interval is: - 1.923

-0.737]

(Round your response to three decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Help to solve this?arrow_forwardect p.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/... * D B homework i Saved Help Save & Exit Submit Check my work Required information [The following information applies to the questions displayed below.] Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug.1 Inventory on hand–2,000 units; cost $5.30 each. 8 Purchased 8,000 units for $5.50 each. 14 Sold 6,000 units for $12.00 each. 18 Purchased 6,000 units for $5.60 each. 25 Sold 7,000 units for $11.00 each. 28 Purchased 4,000 units for $5.80 each. 31 Inventory on hand-7,000 units. Required: 1. Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 31, 2021, balance sheet and the cost of goods sold it would report in its August 2021 income statement using the FIFO method. Cost of Goods…arrow_forwardPlease avoid answers in image format thank youarrow_forward

- I have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardNot a previously submitted question. Thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education