FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

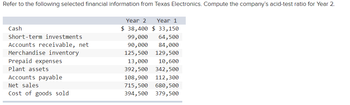

Transcribed Image Text:Refer to the following selected financial information from Texas Electronics. Compute the company's acid-test ratio for Year 2.

Year 2

$ 38,400

Year 1

$ 33,150

64,500

99,000

90,000

84,000

125,500

129,500

13,000 10,600

392,500 342,500

108,900 112,300

715,500 680,500

394,500 379,500

Cash

Short-term investments.

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets

Accounts payable

Net sales.

Cost of goods sold

Transcribed Image Text:Multiple Choice

O

C

O

O

2.45.

2.21.

3.36.

2.09.

3.24.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- COMPANY B Balance Sheets December 31, Year 2 and Year 1 Year 2 Year 1 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land $ 217,600 58,000 85,000 3,000 $ 110,000 82,000 70,000 1,000 380,000 690,000 (328,000) $1,105,600 380,000 570,000 (168,000) $1,045,000 Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings $ 89,000 $4 5,000 7,000 75,000 11,000 4,000 120,000 240,000 600,000 284,600 $1,105,600 $1,045,000 600,000 115,000 Total liabilities and stockholders' equity Additional information for Year 2: 1. Net income is $169,600. 2. Sales on account are $1,183,000. 3. Cost of goods sold is $953,250. Required: 1. Calculate the following profitability ratios for Year 2: (Round vour answers to 1 decimal place.)arrow_forwardDelta Company reports the following year-end balance sheet data. The company's acid-test ratio equals: Cash Accounts receivable Inventory Equipment Total assets Multiple Choice о о 0.60 1.39 2.22 0.38 0.63 $ 55,000 Current liabilities 70,000 Long-term liabilities 75,000 Common stock 160,000 Retained earnings $360,000 Total liabilities and equity $ 90,000 45,000 115,000 110,000 $ 360,000arrow_forwardRefer to the following selected financial information from Texas Electronics. Compute the company's accounts receivable turnover for Year 2. Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 $ 39,100 106,000 93,500 129,000 13,700 396,000 105,400 719,000 398,000 Year 1 $ 33,850 68,000 87,500 133,000 11,300 346,000 115,800 684,000 383,000arrow_forward

- Refer to the following selected financial information from a company. Compute the company’s debt-to-equity ratio for Year 2. Year 2 Year 1 Net sales $ 484,500 $ 427,450 Cost of goods sold 277,500 251,320 Interest expense 10,900 11,900 Net income before tax 68,450 53,880 Net income after tax 47,250 41,100 Total assets 319,500 295,200 Total liabilities 175,400 168,500 Total equity 144,100 126,700 Answer: A. 1.22. B. 1.82. C. 3.36. D. 0.82. E. 2.22.arrow_forwardPFA Screenshot. Please answer a, b, c, d sections correctly with calculatiosn.arrow_forwardRefer to the following selected financial information from Gomez Electronics. Compute the company's profit margin for Year 2. Year 2 Year 1 $ 488,000 $ 428,150 278,200 252,020 11,600 12,600 Net income before tax 69,150 54,580 Net income after tax 47,950 41,800 Total assets 320,900 299,400 Total liabilities 171,900 169,200 Total equity 149,000 130,200 Net sales Cost of goods sold Interest expense 12.2%. 17.2%. 9.8%. 14.2%. 32.2%.arrow_forward

- Refer to the following selected financial information from a company. Compute the company’s return on total assets for Year 2. Year 2 Year 1 Net sales $ 483,000 $ 427,150 Cost of goods sold 277,200 251,020 Interest expense 10,600 11,600 Net income before tax 68,150 53,580 Net income after tax 46,950 40,800 Total assets 318,900 293,400 Total liabilities 176,900 168,200 Total equity 142,000 125,200 Answer: A. 22.3% B. 14.7% C. 9.7% D. 2.7% E. 15.3%arrow_forwardUse the information in the table below to calculate the following ratios for Windswept Woodworks for year 1 and year 2. Windswept Woodworks, Incorporated Input Data (millions of dollars) Year 2 Year 1 Accounts payable 602 534 Accounts receivable 1,446 980 Accumulated depreciation 6,912 6,782 Cash & equivalents 390 278 Common stock 1,350 1,270 Cost of goods sold 1,570 n.a. Depreciation expense ? n.a. Common stock dividends paid ? n.a. Interest expense 210 n.a. Inventory 1,180 1,176 Addition to retained earnings 602 n.a. Long-term debt 978 886 Notes payable 300 450 Gross plant & equipment 10,540 10,280 Retained earnings 3,228 2,626 Sales 3,088 n.a. Other current liabilities 186 166 Tax rate 21% n.a. Market price per share – year end $ 25.80 $ 23.50 Number of shares outstanding 500 million 500 million (For all requirements, round your answers to 2…arrow_forwardThe following percentages apply to Zachary Company for Year 3 and Year 4: Sales Cost of goods sold Gross margin Selling and administrative expense Interest expense Total expenses Income before taxes Income tax expense Net income ZACHARY COMPANY Income Statements Sales Cost of goods sold Gross margin Selling and administrative expenses Interest expense Total expenses Income before taxes Income tax expense Net income Required Assuming that sales were $515,000 in Year 3 and $585,000 in Year 4, prepare income statements for the two years. $ Year 4 100.0 % 61.1 38.9 26.5 2.7 29.2 9.7 5.5 4.2 % Year 4 0 0 0 $ Year 3 100.0 % 63.9 36.1 20.3 1.9 Year 3 22.2 13.9 7.2 6.7 % 0 0 0arrow_forward

- Complete the balance sheet and sales information using the following financial data: Total assets turnover: 1.1x Days sales outstanding: 73.0 daysa Inventory turnover ratio: 4x Fixed assets turnover: 3.0x Current ratio: 2.5x Gross profit margin on sales: (Sales - Cost of goods sold)/Sales = 20% aCalculation is based on a 365-day year. Do not round intermediate calculations. Round your answers to the nearest dollar. Cash Accounts receivable Inventories Fixed assets Total assets Sales $ $ Balance Sheet $270,000 Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Cost of goods sold $ $ $ 54,000 67,500arrow_forwardi. Use the information available in Income and Financial position statementin Part A and calculate the following ratios for DavidCompetitors Average• Net profit margin 28%• Gross profit margin 65%• Current ratio 2.10x• Acid test ratio 1.50x• Accounts receivable collection period 47 days• Accounts payable payment period 65 days Net Profit Margin = Net Income/ Sales = 350/2300 = 15.22% Gross Profit = Sales Revenue + Ending Inventory - Purchases less purchase returns = 2300 + 250 - 1100 = 1450 Gross Profit Margin = Gross Profit/ Sales = 1450/2300 = 63.04% Current Ratio = Current Assets/ Current Liabilities Current Assets = Cash + Bank + Accounts Receivable + Inventory = 4050 + 17100 + 400 + 250 = 21800 Current Liabilities = Accounts Payable = 700 Current Ratio = 21800/700 = 31.14:1 please answer this QUESTION :ii. Assuming David’s competitor’s ratio averages are as stated above:Analyse his performance with reference to each of the ratios calculatedin comparison to those of her…arrow_forwardCalculate the accounts receivable period, accounts payable period, inventory period, and cash conversion cycle for the following firm: Income statement data: Sales 5,000 Cost of goods sold 4,200 Balance Sheet Data: Beginning of Year End of Year Inventory 500 600 Accounts Receivable 100 120 Accounts Payable 250 290arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education