FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

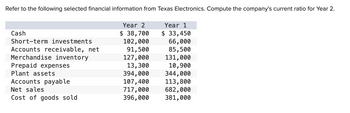

Transcribed Image Text:Refer to the following selected financial information from Texas Electronics. Compute the company's current ratio for Year 2.

Cash

Short-term investments

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets

Accounts payable

Net sales

Cost of goods sold

Year 2

$ 38,700

102,000

91,500

127,000

13,300

394,000

107,400

717,000

396,000

Year 1

$ 33,450

66,000

85,500

131,000

10,900

344,000

113,800

682,000

381,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comparative Balance SheetsConsider the following balance sheet data for Great Buy Co., Inc., an electronics and major appliance retailer (amounts in thousands): Current Year Previous Year Cash and Cash Equivalents $113,756 $12,848 Accounts Receivables 100,593 68,342 Merchandise Inventories 1,212,105 449,983 Other Current Assets 26,303 17,692 Total Current Assets 1,452,757 548,865 Property and Equipment (net) 328,175 227,596 Other Assets 28,804 13,993 Total Assets $1,809,736 $790,454 Current Liabilities $763,853 $334,809 Long-Term liabilities 454,141 127,537 Total Liabilities 1,217,994 462,346 Common Stock 3,965 2,068 Additional Paid-in-Capital 425,768 246,871 Retained Earnings 162,009 79,169 Total Stockholders' Equity 591,742 328,108 Total Liabilities and Stockholders' Equity $1,809,736 $790,454 Prepare a comparative balance sheet, showing increases in dollars and percentages. Note: Round "Percent Change" answers to one decimal place (ex:…arrow_forwardUsing the income statement for Times Mirror and Glass Co., compute the following ratios: TIMES MIRROR AND GLASS Co. Income Statement Sales Cost of goods sold Gross profit Selling and administrative expense Lease expense Operating profit* Interest expense Earnings before taxes Taxes (30%) Earnings after taxes *Equals income before interest and taxes. a.Compute the interest Interest coverage ge ratio. (Round yo times $ 223,000 130,000 $ 93,000 44,000 19,100 $ 29,900 10,600 times $ 19,300 7,720 $ 11,580 answer to 2 decimal places.) b.Compute the fixed charge coverage ratio. (Round your answer to 2 decimal places.) Fixed charge coveragearrow_forwardRequired information [The following information applies to the questions displayed below.) Income statements for the current year and one year ago, follow. Assume that all sales are on credit. For Year Ended December 31 Sales Cost of goods sold. Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share. Year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Inventory Prepaid rent Machinery, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock Retained earnings Total liabilities and equity Current Year $ 121,756 92,867 162,500 121,838 $ 498,961 $ 395,676 201,081 11,027 8,432 $ 648,649 Current Year 1 Year Ago 2 Years Ago $ 33,723 35, 135 $ 28,850 87,882 107,277 59,015 46,378 80,371 49,388 9,214 9,196 265,756 3,943 220,056 247,816 $ 498,961 $430,139 $ 354,900 $ 74,147 101,900 162,500 91,592 $430,139 616,216 $ 32,433 $ 2.00 $ 45,910 76,080 162,500 70,410 $ 354,900…arrow_forward

- EMM, Inc. has the following balance sheet: EMM, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $ 1,200 Accounts payable $ 4,900 Accounts receivable 8,900 Bank note payable 7,700 Inventory 6,100 Long-term assets 4,400 Equity 8,000 $ 20,600 $ 20,600 It has estimated the following relationships between sales and the various assets and liabilities that vary with the level of sales: Accounts receivable = $3,560 + 0.35 Sales, Inventory = $2,356 + 0.28 Sales, Accounts payable = $1,449 + 0.20 Sales. If the firm expects sales of $27,000, what are the forecasted levels of the balance sheet items above? Round your answers to the nearest dollar. Accounts receivable: $ Inventory: $ Accounts payable: $ Will the expansion in accounts payable cover the expansion in inventory and accounts receivable? Round your answers to the nearest dollar. The expansion in accounts payable of $ the total…arrow_forwardIncome statements for Franklin Company for Year 3 and Year 4 follow: FRANKLIN COMPANY Income Statements Year 4 Year 3 Sales $ 201,300 $181, 300 Cost of goods sold 143, 600 121,600 Selling expenses 20,100 18, 100 Administrative expenses 12,500 14,500 Interest expense 3, 900 5,900 Total expenses 180, 100 160, 100 Income before taxes 21, 200 21,200 Income taxes expense 6, 400 3,600 Net income $ 14,800 $ 17,600 Required Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year.arrow_forwardRefer to the following selected financial information from Gomez Electronics. Compute the company's profit margin for Year 2. Net sales Cost of goods sold Interest expense Net income before tax Net income after tax Total assets Total liabilities Total equity Year 2 Year 1 $485,000 $427,550 277,600 251,420 11,000 12,000 68,550 53,980 47,350 41, 200 319,700 295,800 174,900 144, 800 168, 600 127, 200arrow_forward

- Provide answer pleasearrow_forwardIncome statements for Fanning Company for Year 3 and Year 4 follow. FANNING COMPANY Income Statements. Sales Cost of goods sold. Selling expenses Administrative expenses. Interest expense Total expenses Income before taxes Income taxes expense Net income Year 4 $200,200 143,800 20,500 12,500 3,500 $180, 300 19,900 5,900 $14,000 Year 3 $180, 200 121,800 18,500 14,500 5,500 $160,300 19,900 3,100 $16,800 Required a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year.arrow_forwardhi, can you help me with Calculatingthe following ratios for Year 2: (a) profit margin ratio (b) gross margin ratio ( c) times interest earned. Silverlight Company Income Statements For Years Ended December 31, Year 2 Year 1 Net sales $ 720,000 $ 607,500 Cost of goods sold 450,000 382, 700 Gross profit $270,000 $224,800 Operating expense 168, 500 134, 900 Income from operations $ 101,500 $ 89,900 Interest expense 22, 300 11,200 Income before taxes $ 79,200 $ 78,700 Income taxes 28,000 27,000 Net income $ 51,200 $ 51,700arrow_forward

- Refer to the following selected financial information from Texas Electronics. Compute the company's accounts receivable turnover for Year 2. Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 Year 1 $ 38,300 $ 33,050 98,000 64,000 89,500 83,500 125,000 129,000 12,900 10,500 392,000 342,000 109,400 111,800 715,000 680,000 394,000 379,000arrow_forwardPlease solve this providearrow_forwardLong-Term Solvency Ratios Summary data from year-end financial statements of Palm Springs Company for the current year follow. Summary Income Statement Data Sales $10, 500, 600 Cost of goods sold 6, 050,000 Selling expenses 685,000 Administrative expenses 945,000 Interest expense 783, 500 Income tax expense 427,791 8,891,291 Net income $1,609,309 Summary Balance Sheet Data Cash $84, 700 Total liabilities $749,700 Noncash assets 885,500 Stockholders' equity 220, 500 Total assets $970, 200 Total liabilities and equity $970, 200 Round answers to one decimal place. a. Compute the ratio of times - interest - earned. Answer times b. Compute the debt-to-equity ratio. Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education