ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

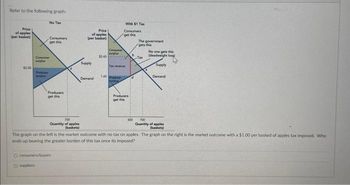

Transcribed Image Text:Refer to the following graph:

Price

of apples

(per basket

No Tax

Consumers

get this

suppliers

Consumer

sepha

Producers

get this

700

Quantity of apples

baskets)

O consumers/buyers

Price

of apples

(per basket)

Supply

Demand

$2.65

145

Tax

With $1 Tax

Consumers

get this

Producers

get this

b

d

500

The government

gets this

Tax

No one gets this

(deadweight losg)

Supply

Demand

The graph on the left is the market outcome with no tax on apples. The graph on the right is the market outcome with a $1.00 per basked of apples tax imposed. Who i

ends up bearing the greater burden of this tax once its imposed?

700

Quantity of apples

(baskets)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A. 31: $19 B. 31:$19 C. 15:$6 D 15:$16arrow_forwardAnswer to image?arrow_forwardNext question at The graph shows the demand curve for wallets and the market price of a wallet. Price (dollars per wallet) 18.00- 16.00- Draw a point that shows the value of the 30th wallet. Label it 1. 14.00- Draw a point that shows the willingness to pay for the 45th wallet. Label it 2. 12.00- Draw an arrow that shows the consumer surplus on the 45th wallet. Label it CS. 10.00- 8.00- What is the consumer surplus on the 45th wallet? 6.00- Market The consumer surplus on the 45th wallet is $. price 4.00- >>> Answer to 2 decimal places. 2.00 em 0.00 15 30 45 60 75 90 105 As Quantity (wallets per day) >>> Draw only the objects specified in the question. Ass O Time Remaining: 00:53:47 Next ced se (ECON202 s2022 online) is based on Bade/Parkin: Foundations of Microeconomics, 9earrow_forward

- To answer Questions #1-3, refer to the following diagram, which shows the monthly cigarette market in Wake County, North Carolina and the demand for, and supply of, cigarettes before and after the imposition of a $5.00-dollar per unit excise tax. Exam 2, Figure1-The Wake County Market for Cigarettes Per Pack Price Supply with tax 20.00 Supply before tax 18.00 16.00 Demand 10.00 Quantity Per Year (Milions of Packs) Ceteris paribus, how much will the government collect in annual tax revenue from this tax? Select one: a. $5 million b. $10 million C. $15 million d. $20 millionarrow_forward2. Taxes and welfare Consider the market for electric scooters. The following graph shows the demand and supply for electric scooters before the government imposes any taxes. First, use the black point (plus symbol) to indicate the equilibrium price and quantity of electric scooters in the absence of a tax. Then use the green point (triangle symbol) to shade the area representing total consumer surplus (CS) at the equilibrium price. Next, use the purple point (diamond symbol) to shade the area representing total producer surplus (PS) at the equilibrium price. PRICE (Dollars per scooter) 100 90 Demand 80 70 60 50 40 28 84 8 30 Supply 20 10 0 0 160 320 480 Before Tax 640 800 960 1120 1280 1440 1600 QUANTITY (Scooters) Equilibrium A Consumer Surplus Producer Surplusarrow_forwardThe graph shows the market for game consoles. Suppose 1 million game consoles a year are being produced Draw the deadweight loss on game consoles. Suppose the quantity of game consoles produced is 1 million and the price is the equilibrium price Price (dollars per game console) 600- 500- 400- 300 300- Calculate the consumer surplus, producer surplus, and deadweight loss 200- The consumer surplus is $million 100- The producer surplus is $ million The deadweight loss is $million 3 Quantity (millions of game consoles per year) >>> Draw only the objects specified in the questionarrow_forward

- 1. Here is the demand for coconuts: P 3 4 5 6 7 8 9 11 13 16 20 QD 1100 1000 900 800 700 600 500 400 300 200 100 And here is supply P 3 4 5 6 7 8 9 10 11 12 13 QS 100 200 300 400 500 600 700 800 900 1000 1100 Identify the equilibrium price, quantity, consumer and producer surplus and show them on a graph. The graph should be pretty simple here, the main issue is finding the numbers for consumer and producer surplus.arrow_forwardThe following graph shows the weekly market for handbags in some hypothetical economy. Suppose the government levies a tax of $23.20 per bag. The tax places a wedge between the price buyers pay and the price sellers receive. PRICE (Dollars per bag) 100 90 00 R 70 8 50 40 R20 10 0 10 Tax Wedge Supply Demand 20 30 40 50 00 70 QUANTITY (Bags of handbags) 00 00 100 C Darrow_forwardThe following graph shows the market for the long-distance bus rides. In the absence of taxes, the equilibrium price of a ride is $5 and the equilibrium quantity is 10 million rides. Suppose that regulator levies an excise tax on bus service providers. The amount of excise tax equals $2 per ride. How many rides will be demanded after the introduction of the excise tax? 7 million 10 million 8 million 9 millionarrow_forward

- Identify at least one positive externality from running a donut shop. Identify at least one negative externality from running a donut shop. Explain how these positive and negative externalities could impact the donut shop’s profits. (Hint: think subsidy for positive externality and tax for negative externality.) Draw two graphs that show the price of donuts before and after the positive and negative externality impacted the price of your donuts.arrow_forwardThe current market price of bananas is $1 per pound. Use a graph and words to show the effect of a ten cent tax on each pound of bananas. Insert your own numbers into your graph. Be sure to indicate the new price paid by consumers, the new price received by sellers, and the new quantity sold.arrow_forwardUse the figure below to answer the following question. Price A B E LL F S St S K K Quantity D What area represents society's total surplus after the government imposes the excise tax on the market?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education