ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

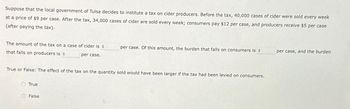

Transcribed Image Text:Suppose that the local government of Tulsa decides to institute a tax on cider producers. Before the tax, 40,000 cases of cider were sold every week

at a price of $9 per case. After the tax, 34,000 cases of cider are sold every week; consumers pay $12 per case, and producers receive $5 per case

(after paying the tax).

The amount of the tax on a case of cider is $

that falls on producers is $

per case.

True or False: The effect of the tax on the quantity sold would have been larger if the tax had been levied on consumers.

True

per case. Of this amount, the burden that falls on consumers is $

False

per case, and the burden

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- am. 163.arrow_forwardThe figure shows the pizza market. A) If the price of a slice of 4-point pizza is $3, what is the consumer surplus of the 50th slice? B) If the price of a slice of pizza is $3, what is the producer surplus for the 50th slice of pizza? C) What is the efficient quantity? What is the equilibrium quantity? What is the loss when the equilibrium quantity is produced?arrow_forwardIf the price of a hamburger falls from $2.00 to $1.50, the gain in consumer surplus to consumers who are persuaded to buy at the lower price (and who were not buying when the price was $2.00) is equal to:arrow_forward

- Assume that the monthly demand for Gala apple in the US is given by q=1200-300p and quantity is in million pounds. The monthly supply of Gala is q= -200+400p for p>$0.5. Now assume that the government has imposed a quantity tax equal to $0.14 on each pound of apple. What is the new equilibrium consumer price, producer price and quantity?arrow_forwardquestion 7arrow_forwardSuppose that the local government of Columbus decides to institute a tax on soda producers. Before the tax, 30 million liters of soda were sold every month at a price of $9 per liter. After the tax, 23 million liters of soda are sold every month; consumers pay $14 per liter, and producers receive $6 per liter (after paying the tax). The amount of the tax on a liter of soda is $ that falls on producers is $ per liter. True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on consumers. True per liter. Of this amount, the burden that falls on consumers is $ False per liter, and the burdenarrow_forward

- Suppose Rajiv is the only seller in the market for bottled water and Kevin is the only buyer. The following lists show the value Kevin places on a bottle of water and the cost Rajiv incurs to produce each bottle of water: Kevin's Value Value of first bottle: $10 Value of second bottle: $7 Value of third bottle: $3 Value of fourth bottle: $1 Price $1 or less $1 to $3 $3 to $7 $7 to $10 More than $10 The following table shows their respective supply and demand schedules: Quantity Demanded Quantity Supplied 4 3 2 1 0 0 1 2 3 Cost of first bottle: Cost of second bottle: $3 Cost of third bottle: $7 Cost of fourth bottle: $10 4 Rajiv's Costs $1 Use Rajiv's supply schedule and Kevin's demand schedule to find the quantity supplied and quantity demanded at prices of $2, $6, and $9. Enter these values in the following table.arrow_forward2. 3-5: Attaining Market Equilibrium *3* The Wall Street Journal of March 20, 2020, reported on the "large surplus of oil" as there is not enough storage capacity to hold the refined oil. Assuming the price of oil is set by competitive market forces, which of the following sequence of events accurately describes how the surplus of oil would be eliminated? As price decreases, the: Quantity demanded decreases, quantity supplied increases, and a new equilibrium will be reached. O Quantity demanded increases, quantity supplied increases, and a new equilibrium will be reached. O Demand decreases, supply increases, and a new equilibrium will be reached. O Demand increases, supply decreases, and a new equilibrium will be reached. O Quantity demanded increases, quantity supplied decreases, and a new equilibrium will be reached.arrow_forwardCurrently, the market price for a gallon of ice cream is $5. Now, suppose the federal government requires buyers of ice cream to pay a $2 tax on eachgallon of ice cream sold.arrow_forward

- Suppose that the local government of Santa Fe decides to institute a tax on soda consumers. Before the tax, 45,000 liters of soda were sold every week at a price of $10 per liter. After the tax, 38,000 liters of soda are sold every week; consumers pay $14 per liter (including the tax), and producers receive $8 per liter. The amount of the tax on a liter of soda is 3 that falls on producers is 5 per liter. True or False: The effect of the tax on the quantity sold would have been the same as if the tax had been levied on producers. True per liter. Of this amount, the burden that falls on consumers is 3 O False per liter, and the burdenarrow_forward11:51 OT = 2. A cash-starved town decides to impose a $6 excise tax on T-shirts sold. The following table shows the quantity demanded and the quantity supplied at various prices. Price per T- shirt ← $19 16 13 10 7 4 Quantity demanded 1 O 10 20 30 40 50 + Quantity supplied 3 60 50 40 b. What are the equilibrium quantity demanded 185 and quantity supplied after the tax is implemented? Determine the consumer and producer surplus after the tax. 30 20 10arrow_forwardThe graph shows the market for game consoles. Suppose 1 million game consoles a year are being produced Draw the deadweight loss on game consoles. Suppose the quantity of game consoles produced is 1 million and the price is the equilibrium price Price (dollars per game console) 600- 500- 400- 300 300- Calculate the consumer surplus, producer surplus, and deadweight loss 200- The consumer surplus is $million 100- The producer surplus is $ million The deadweight loss is $million 3 Quantity (millions of game consoles per year) >>> Draw only the objects specified in the questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education