ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

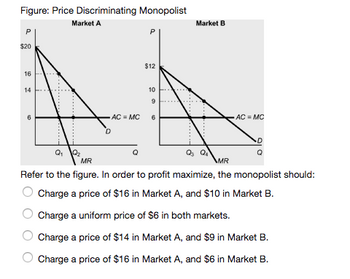

Transcribed Image Text:Figure: Price Discriminating Monopolist

Market A

P

$20

16

14

6

Q₁ Q₂

$12

10

9

-AC = MC 6

Market B

AC = MC

MR

MR

Refer to the figure. In order to profit maximize, the monopolist should:

Charge a price of $16 in Market A, and $10 in Market B.

Charge a uniform price of $6 in both markets.

Charge a price of $14 in Market A, and $9 in Market B.

O Charge a price of $16 in Market A, and $6 in Market B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please answer questions 4 through 7.arrow_forwardA monopolist produces at a constant $5 marginal and average cost. The demand the monopolist faces is shown below: $15 $10 $7.50 $5 MC = AC = $5 D 20 30 40 60 Quantity If the monopolist sells all units at the same price to all customers, she will earn profits of $ But if she perfectly price discriminates, she will | in profits. earn Pricearrow_forwardThe monopolist faces the following demand curve: Price $20 Quantity 15 $19.50 16 $19 17 $18.50 18 $18 19 $17.50 20 $17 21 $16.50 22 $16 23 If the monopolist has total fixed costs of $40 and a constant marginal cost of $10, how much profit can the firm earn at the profit-maximizing level of output?arrow_forward

- If a profit-maximizing monopolist is currently charging a price on the inelastic portion of its demand curve, what action should it take to maximize profits? It should reduce both output and price. It should raise the price and decrease output. It should raise the price and hold output constant. It should lower the price and increase output.arrow_forwardA monopolist has four distinct groups of customers: group A has an elasticity of demand of 0.2, group B has an elasticity of demand of 0.8, group C has an elasticity of demand of 1.0, and group D has an elasticity of demand of 2.0. The group paying the highest price for the product will be group: a) D. b) C. c) B. d) A.arrow_forwardIf the monopolist shown in the following figure could implement a two- part tariff, the entry fee would be: $0. $225. $450. $900. $1,200.arrow_forward

- Suppose a monopolist faces a market demand that is the first two columns in the table below. Also, in the short run, assume that Total Fixed Cost equals $100 and the monopolist has Total Variable Cost according to the table. Find Total Revenue for each price and quantity combination, and then Marginal Revenue as price falls and quantity increases. Fill in the rest of the costs in the table and find profit at each price and quantity combination as the difference between Total Revenue and Total Cost. If profit is less than zero that indicates a loss. What is the maximum profit you found in this table? At what quantity and price combination is profit maximized for this monopolist? Next, verify this result by using Marginal Analysis to find the profit maximizing price and quantity combination. For each quantity, ask yourself if Marginal Revenue exceeds Marginal Cost. If it does, then profits would be increased by producing that quantity. As you go down the table to higher quantities, stop…arrow_forwardThis is part 1 of a multi-part question. A monopolist faces the demand curve Q = 144 / P2, where Q is the quantity demanded and P is price. Its average variable cost is AVC = Q1/2 and its fixed cost is 25. 1. Find the monopolist's profit-maximizing quantity. (Round to at least 2 decimal places.)2. Find the monopolist's profit-maximizing pricearrow_forwardThe following table (see MS Word/PDF version of Take-Home Quiz #5 handout, page 1) shows a market demand a monopolist is facing. Use the table to answer questions #4 thru #6. Average Marginal Marginal Rev. Total Economic Quantity Price Total Rev. Rev. Cost Cost Profit (Q) (P) (TR) (AR) (MR) (MC) (TC) (II) === =====%3D ====== =====3= 1 35 35 11 11 24 64 32 29 11 22 42 3 29 11 4 17 11 23 11 11 6. 120 11 7 17 -1 11 -7 11 9 99 11 -13 11 10 80 8. 11 [Extra Credit 2 pts] Fill all blanks in the Table 1 on the Quiz #5 handout. You will receive extra credit if you submit the completed table via email. Q4. If the monopolist sells 8 units of its product, how much total revenue (TR) will it receive from the sale? 40 O 87 O 104 O 112 O 164arrow_forward

- Answer multiple choicearrow_forwardA monopolist serves a market with five potential buyers, each of whom would buy at most one piece of the monopolist's good. Anna would be willing to pay up to £80 for it, Bob up to £90, Chloe up to £100, Dave up to £110 and Elizabeth up to £120. The monopolist's variable cost function is given in below table. Quantity Variable Costs 1 3. 4. 40 90 150 220 300 Price Marg. Revenue a) Indicate in the table which price the monopolist would want to charge for each given quantity. b) Find the marginal revenue for each quantity. c) Find the monopolist's profit maximising price under the assumption that he wants to produce anything at all. d) How large can the monopolist's fixed costs be such that he still wants to start producing at 1. D Focus 9°C Sunarrow_forwardFind the economic profit of a monopolist using the following information: Demand: p = 130—3Q Total cost: TC = 100 + 30Qarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education