ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

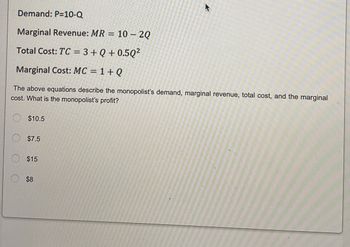

Transcribed Image Text:Demand: P=10-Q

Marginal Revenue: MR = 10 - 2Q

Total Cost: TC = 3 +Q+0.5Q²

Marginal Cost: MC = 1 + Q

The above equations describe the monopolist's demand, marginal revenue, total cost, and the marginal

cost. What is the monopolist's profit?

$10.5

$7.5

$15

$8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Serena is profit-maximizing monopolist selling of her own patented perfume, whose demand and marginal cost curves are as shown. 1. Serena is profit-maximizing monopolist selling of her own patented perfume, whose demand and marginal cost curves are as shown. Relative to the consumer surplus that would result at the perfectly competitive quantity and price, how much consumer surplus is lost from her selling at the monopolist's profit-maximizing quantity and price? $ per ounce 60 50 45 40 30 20 15 10 0 468 12 16 Ounces/day MC D 24 2. In the first problem, how much total surplus would Serena have made if she acted as a perfectly price-discriminating monopolist? Show your work. 3. Explain the difference between the demand curve faced by a perfectly competitive firm and the demand curve faced by a monopoly. Draw both curves and explain why they are different. How do these demand curves cause marginal revenue to differ across the two types of firm? 4. Explain the incentives created by…arrow_forward5. Use the following figure to answer the question: If the monopolist charges the same price to all consumers, what will be the deadweight loss at the monopolist’s profit maximizing level of output?arrow_forwardRuth’s Rubies is a single-price monopolist in the market for rubies. Suppose Ruth’s Rubies currently charges $200 for its rubies (i.e. sells 3 rubies). If it lowers the price to $100 (to sell 4 rubies), how large is: The quantity effect? The price effect? Price of a Ruby Quantity of Rubies Demanded Total Revenue Marginal Revenue $500 0 0 400 1 400 400 300 2 600 200 200 3 600 0 100 4 400 200 0 5 0 400arrow_forward

- QUESTION 6 Consider a monopolist with constant marginal cost of 10 and a demand given by D(p) = 250 - 5p where p is the monopolist's price. The monopolist's optimal quantity is 100 and the deadweight loss is 2000. True or False? O True O Falsearrow_forwardWhat is generally the case for a monopolist's average revenue? Select one: O a. It is equal to marginal revenue. O b. It is equal to the price of its product. O c. It is less than the price of its product. O d. It is greater than the price of its product.arrow_forwardSuppose the table below describes the relationship between price and quantity demanded for a monopolist. Quantity 1 2 3 4 5 6 7 8 O If the marginal cost of producing each unit of output is $5, then this monopolist maximizes its profit by charging __________ per unit. O $8 $5 $3 Price $10 $9 $8 $7 $6 $5 $4 $3 $6arrow_forward

- In which of the following situations would the quantity supplied to the market increase? A price ceiling O below the competitive equilibrium price in a competitive market. above the unregulated monopolist price, but above the fırm's average total cost for a natural monopoly. none of the other answers are correct. A price ceiling never increases the quantity supplied to a market. O below the unregulated monopolist price, but above the firm's average total cost for a natural monopoly. above the competitive equilibrium price in a competitive market.arrow_forwardPlease see the attached40arrow_forwardThe accompanying graph depicts the marginal revenue (MR), demand (D), and marginal cost (MC) curves for a monopoly a. Place point Pi at the profit maximizing price and quantitvy assuming that the monopolist can only charge a single price. 100 95 90 85 80 75 70 65 2 60 b. What are the profits of the firm if it charges a single price? 50 45 Suppose the monopolist able to successfully price discriminate between two groups by charging one group $60 and charging $35 to the other group. c. What are the firm's profits if it charges the two prices as mentioned above? 35 30 25 20 15 10 MR 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95100 Quantityarrow_forward

- A monopolist faces the demand curve illustrated below. 12 9 -1 -2 12 13 11 15 15 1 1s 19 20 21 22 23 24 Suppose the monopolist faces a marginal cost of $5, and that there are no fixed costs. Thus, the marginal cost is equal to the average total cost in this case. Given this, what is the monopolist's profit maximizing price if it is not able to price discriminate O $5 O $8.33 O $2 O $10 $7.50 N O087654321arrow_forwardIf the average total cost curve is always above the demand curve of a monopolist, what can we conclude about the monopolist's performance? The monopolist will earn an economic profit. O Entry will occur, forcing the monopolist to reduce price and expand output. The monopolist will suffer economic losses. O The monopolist must be producing inefficiently.arrow_forward2. Given the demand curve of the monopolist Q = 60 - 2P and the cost function of the monopolist TC = 50-4Q+ 0.5 Q^{2}, Then find: A. The inverse demand function, average revenue, the marginal revenue functions, marginal cost function? B. Find the level of output and price that maximizes the monopolist profit? C. The level of profit at equilibrium. D. Show graphically profit maximization level of output?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education