Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

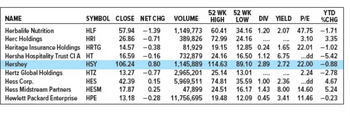

Refer to Figure and look at the listing for Hewlett Packard Enterprise.

a. How many shares could you buy for $10,000?b. What would be your annual dividend income from those shares?

c. What must be Hewlett Packard Enterprise's earnings per share?

d. What was the firm's closing price on the day before the listing?

Transcribed Image Text:NAME

Herbalife Nutrition

Herc Holdings

Heritage Insurance Holdings

Hersha Hospitality Trust CIA

Hershey

Hertz Global Holdings

Hess Corp.

Hess Midstream Partners

Hewlett Packard Enterprise

SYMBOL CLOSE NET CHG

57.94 -1.39

26.86 -0.71

14.57

-0.38

106.24

16.59 -0.16

0.80

13.27 -0.77

HLF

HRI

HRTG

HT

HSY

HTZ

HES

HESM

HPE

42.39 0.15

17.87 0.25

13.18 -0.28

YTD

%CHG

52 WK 52 WK

VOLUME

HIGH LOW DIV YIELD P/E

1,149,773 60.41 34.16 1.20 2.07 47.75

389,826 72.99 24.16

3.10

81,929 19.15

1.65 22.01

-1.02

12.85 0.24

16.50 1.12 6.75 ...dd -5.42

732,879 24.16

1,145,889 114.63

22.00 -0.88

2.24 -2.78

89.10 2.89 2.72

2,965,201 25.14 13.01

5,969,511 74.81 35.59 1.00 2.36

47,899 24.51 16.17 1.43 8.00 14.60 5.24

19.48 12.09 0.45 3.41 11.46 -0.23

...dd

4.67

11,756,695

-1.71

3.35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose Acap Corporation will pay a dividend of $2.89 per share at the end of this year and $2.93 per share next year. You expect Acap's stock price to be $52.48 in two years. Assume that Acap's equity cost of capital is 11.3%. a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? c. Given your answer in (b), what price would you be willing to pay for a share of Acap stock today if you planned to hold the stock for one year? How does this compare to your answer in (a)?arrow_forwardAssume that an investor buys 100 shares of stock at $37 per share, putting up a 65% margin. a. What is the debit balance in this transaction? b. How much equity funds must the investor provide to make this margin transaction? c. If the stock rises to $59 per share, what is the investor's new margin position? a. The debit balance in this transaction is $ *** (Round to the nearest dollar.)arrow_forwardAt the beginning of the year, you purchased a share of stock for $51.64. Over the year the dividends paid on the stock were $3.26 per share. Calculate the return if the price of the stock at the end of the year is $50.24. (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places. (e.g., 32.16))arrow_forward

- Using the data from the following table,calculate the return for investing in this stock from January 1 to December 31. Prices are after the dividend has been paid. Stock Price Dividend Jan 1 $50.18 Mar 31 $51.11 $0.58 Jun 30 $49.56 $0.58 Sep 30 $51.93 $0.75 Dec 31 $52.53 $0.75 The return from January 1 to March 31 is enter your response here. (Round to five decimal places.) Part 2 The return from March 31 to June 30 is enter your response here. (Round to five decimal places.) Part 3 The return from June 30 to September 30 is enter your response here. (Round to five decimal places.) Part 4 The return from September 30 to December 31 is enter your response here. (Round to five decimal places.) Part 5 enter your response here%. (Round to two decimal places.)arrow_forwardWhat is the answers and the workingarrow_forwardAssume you own shares in Walmart and that the company currently earns $6.80 per share and pays annual dividend payments that total $5.55 a share each year. Calculate the dividend payout for Walmart. Note: Enter your answer as a percent rounded to 2 decimal places. Dividend payout %arrow_forward

- Iron Manufacturers made two announcements concerning its common stock today. First, the company announced that the next annual dividend will be $2.10 a share. Secondly, all dividends after that will increase by 2.5 percent annually. What is the maximum amount you should pay to purchase a share of this stock today if you require a 10 percent rate of return? Solve using Excelarrow_forwardReturn for the entire period is (Round to two decimal places.)arrow_forwardThe Dahlia Flower Company has earnings of $1.48 per share. a. If the benchmark PE for the company is 15, how much will you pay for the stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. If the benchmark PE for the company is 18, how much will you pay for the stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. Stock price b. Stock pricearrow_forward

- Want accurateanswerarrow_forwardPlease give me answerarrow_forwardGo to Yahoo.com’s financial website and enter Apple, Inc.’s stock symbol, AAPL. Answer the following questions concerning Apple, Inc. At what price did Apple’s stock last trade? What is the 52-week range of Apple’s stock? When was the last time Apple’s stock hit a 52-week high? What is the annual dividend of Apple’s stock? How many current broker recommendations are strong buy, buy, hold, sell, or strong sell? What is the average of the broker recommendations? What is the price-earnings ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education