Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Return for the entire period is

(Round to two decimal places.)

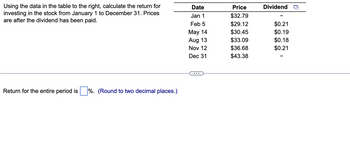

Transcribed Image Text:Using the data in the table to the right, calculate the return for

investing in the stock from January 1 to December 31. Prices

are after the dividend has been paid.

Return for the entire period is %. (Round to two decimal places.)

Date

Jan 1

Feb 5

May 14

Aug 13

Nov 12

Dec 31

Price

$32.79

$29.12

$30.45

$33.09

$36.68

$43.38

Dividend

$0.21

$0.19

$0.18

$0.21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the present value of $8,590 due 8 periods hence, discounted at 6%? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.)arrow_forward(c) 5%? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Amount to Pay $arrow_forwardUsing the simple interest formula I= Prt, compute the amount of interest earned on $1141.00 at 8.06% p.a. for 193 days. The interest eamed is $. (Round the final answer to the nearest cent as needed. Round all internadiate values to six decimal places as needed.) Enter your answer in the answer box.arrow_forward

- What is the forward rate in year 2? 1-year zero rate: 3% 2-year zero rate: 4% 3-year zero rate: 5% 4-year zero rate: 6% Please report your answer in percentage to two decimal places. For instance, 8.55% would be 8.55.arrow_forwardWhat is the nominal annual rate compounded daily equivalent to an effective rate of 4.55% ? Round the answer to NOM to four decimal places. (1year = 365 days)arrow_forwardHow long will it take $300 to accumulate to $800 at j12 = 7%? Assume that the practical method of accumulation is in effect. (Be sure to use linear interpolation.) Answer: 14 5 X years, 5 months and 29 Note: Carry four decimal places through all calculations. Your answers should be integers. X daysarrow_forward

- How long will it take $700 to double if it earns the following rates? Compounding occurs once a year. Round your answers to two decimal places. a. 8%. year(s) b. 10%. year(s) C. 16%. year(s) d. 100%. year(s)arrow_forwardDetermine the following (1–18) measures for 20Y2, rounding to one decimal place, except the dollar amount, which should be rounded to the nearest cent. Use the rounded answer to the requirement for subsequent requirements, if required. Assume 365 days a year. Show each formula and calculation on the worksheet. amount which should be rounded to the nearest cent. use the rounded answer to the requirment for subsequent requirements, if required. Assume 365 days a year. Formula Calculation and Answer 1 Working Capital Stargel Inc. 2 Current ratio Comparative Retained Earnings Statement 3 Quick ratio For the Years Ended December 31, 20Y2 and 20Y1 4 Accounts receivable turnover 20Y2 20Y1 5 Number of days' sales in receivables days Retained…arrow_forwardHow long will it take $800 to double if it earns the following rates? Compounding occurs once a year. Round your answers to two decimal places. 6%. year(s) 11%. year(s) 17%. year(s) 100%. year(s)arrow_forward

- Find the EAR in each of the following cases. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year. Number of Times Stated Rate (APR) Compounded Effective Rate (EAR) 9.75 % Quarterly % 16.25 % Monthly % 15.75 % Daily % 11.75 % Semiannually %arrow_forward(b) What is the present value of $30,700 to be received at the end of each of 5 periods, discounted at 10%? (Round answer to 2 decimal places, e.g. 25.25.)arrow_forwardUsing either logarithms or a graphing calculator, find the time required for the initial amount to be at least equal to the final amount. $7000, deposited at 7% compounded quarterly, to reach at least $8000 The time required is year(s). (Type an integer or decimal rounded up to the next quarter.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education