Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

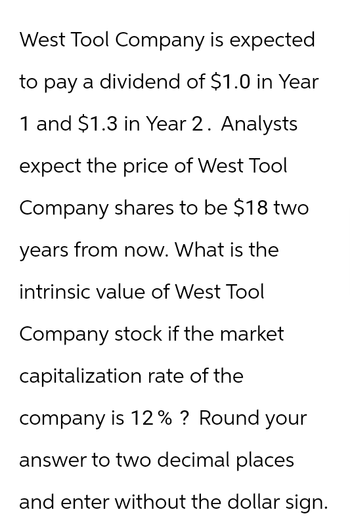

Transcribed Image Text:West Tool Company is expected

to pay a dividend of $1.0 in Year

1 and $1.3 in Year 2. Analysts

expect the price of West Tool

Company shares to be $18 two

years from now. What is the

intrinsic value of West Tool

Company stock if the market

capitalization rate of the

company is 12% ? Round your

answer to two decimal places

and enter without the dollar sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Anle Corporation has a current price of $13, is expected to pay a dividend of $2 in one year, and its expected price right after paying that dividend is $22. What is Anle's expected dividend yield? (Round to two decimalplaces.) What is Anle's expected capital gain rate? (Round to two decimalplaces.) What is Anle's equity cost of capital? (Round to two decimalplaces.)arrow_forwardThe Wei Corporation expects next year's net income to be $10 million. The firm is currently financed with 35% debt. Wei has $12 million of profitable investment opportunities, and it wishes to maintain its existing debt ratio. According to the residual distribution model (assuming all payments are in the form of dividends), how large should Wei's dividend payout ratio be next year? Round your answer to two decimal places .arrow_forwardAssume that you are on the financial staff of Vanderheiden Inc., and you have collected the following data: The yield on the company’s outstanding bonds is 7.75%, its tax rate is 25%, the next expected dividend is $0.65 a share, the dividend is expected to grow at a constant rate of 6.00% a year, the price of the stock is $14.00 per share, the flotation cost for selling new shares is F = 10%, and the target capital structure is 45% debt and 55% common equity. What is the firm's WACC, assuming it must issue new stock to finance its capital budget? 9.96% 7.98% 10.12% 8.75% 8.23%arrow_forward

- Procter and Gamble (PG) paid an annual dividend of $2.79 in 2018. You expect PG to increase its dividends by 7.9% per year for the next five years (through 2023), and thereafter by 2.7% per year. If the appropriate equity cost of capital for Procter and Gamble is 8.9% per year, use the dividend-discount model to estimate its value per share at the end of 2018.arrow_forwardArts and Crafts, Inc., will pay a dividend of $ 3.97 per share in 1 year. It sells at $ 90.00 a share, and has an expected return of 14.24 percent. What must be the expected growth rate of the company's dividends?arrow_forwardWhite Lion Homebuilders has a current stock price of $27 per share, and is expected to pay a per-share dividend of $4.60 at the end of next year. The company’s earnings and dividends growth rate are expected to grow at a constant rate of 5.10% into the foreseeable future. If Alpha Moose expects to incur flotation costs of 3.90% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common stock (rounded to two decimal places) should be _____? (22.83%, 21.69%, 18.26%, or 26.25%) Please answer fast I give you like.arrow_forward

- Abl ltd. Paid a dividend of $250000 this year. The current return to shareholders of the companies in the same industry an Abl ltd. is 12%, although it is expected that an additional risk premium of 2% will be applicable to Abl ltd., being a smaller and unquoted company. Compute the expected valuation of Abl ltd., if : 1. The current level of dividend is expected to continue into the foreseeable future 2. The dividend is expected to grow at a rate of 4%pa into the foreseeable future 3. The dividend is expected to grow at a 3% rate for three years and 2% afterwardsarrow_forwardBBB plc plans to pay a dividend next year of 41.2p per share and has a cost of equity of 9% per year. BBB plc has a dividend payout ratio of 50% and its EPS (earnings per share) is 80p. What is the ex-div share price of the company?arrow_forwardCapital Budgeting Problem What are some of the difficulties that might come up in actual applications of the various criteria we discussed in this chapter? Which one would be the easiest to implement in actual applications? The most difficult?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education