ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

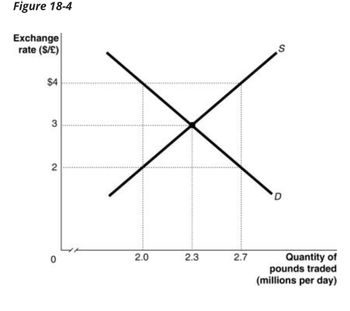

Transcribed Image Text:Figure 18-4

Exchange

rate (S/E)

$4

3

2

0

x

D

2.0

2.3

2.7

S

Quantity of

pounds traded

(millions per day)

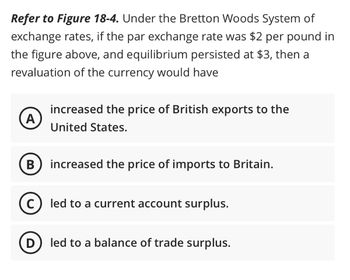

Transcribed Image Text:Refer to Figure 18-4. Under the Bretton Woods System of

exchange rates, if the par exchange rate was $2 per pound in

the figure above, and equilibrium persisted at $3, then a

revaluation of the currency would have

A

B

increased the price of British exports to the

United States.

increased the price of imports to Britain.

C) led to a current account surplus.

D) led to a balance of trade surplus.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1 Suppose that two countries, Indonesia and Vietnam, produce coffee. The currency unit used in Indonesia is the Rupiah (IDR). The currency unit used in Vietnam is the Dong (VND). In Vietnam, coffee sells for 4,500 dong (VND) per pound. The exchange rate is 1.57 VND per 1 IDR, EVND/IDR = 1.57. 2 If the law of one price holds, what is the price of coffee in Indonesia, measured in Rupiah (assume we are talking about the same type of coffee)? Please round your answer to the nearest whole number. Assume the price of coffee in Indonesia is actually 3000 IDR per pound. Compute the relative price of coffee in Indonesia versus Vietnam (round your answer to 2 decimal places). Where will coffee traders buy coffee? Where will they sell coffee in this case? How will these transactions affect the price of coffee in Vietnam? In Indonesia?arrow_forwardQUESTION 3 As trade distortions such as tariffs and quotas in a small country are removed, dead weight losses will decrease, hence increasing national welfare. deadweight losses will increase, hence decreasing national welfare. government tariff revenue will increase, hence increasing national welfare. government tariff revenue will decrease, hence decreasing national welfare. QUESTION 4 If the exchange rate for the US dollars and the Swiss francs (SF) is SF1.5 = $1 and then goes to SF1.52 = $1: The dollar depreciates and the franc appreciates. The dollar appreciates and the franc stays the same. The dollar appreciates and the franc depreciates. The dollar stays the same and the franc appreciates.arrow_forwardGiven a system of market determined (floating) exchange rates, if interest rates rise in the United Kingdom relative to the United States, then this event is most likely to cause the British pound to Group of answer choices appreciate and the U.S. dollar to depreciate. appreciate and the U.S. dollar to appreciate. depreciate and the U.S. dollar to depreciate. depreciate and the U.S. dollar to appreciate.arrow_forward

- In a setting of flexible exchange rates, suppose that the U.S. citizens decrease their import purchases from the United Kingdom at the same time that British citizens increase their purchases of stocks and bonds in the United States. The first action (the U.S. imports) by itself would lead to __________ of the dollar against the pound; the second action by itself would __________ of the dollar against the pound. A. an appreciation; lead to a depreciation B. an appreciation; also lead to an appreciation C. a depreciation; also lead to a depreciation D. a depreciation; lead to an appreciatioarrow_forwardConsider a small open economy producing a good which is an imperfect substitute for a foreign good. There are five categories of agents: firms, households, commercial banks, the central bank, and the government. The world price of the foreign good is taken as exogenous and normalized to unity. The nominal exchange rate, E, is flexible. The supply of the domestic good is given by (1) ys* y* (po)* Where Pº is the price of the domestic good and Y³=dY²³ /d PD > 0 Investment, I, is financed by bank loans and is defined as (2) 1=() Where is the loan rate and I' 0 is a constant coefficient. The demand for foreign deposits depends on the domestic and foreign interest rates: (5) ED* /F" =h(*). Where Fo" is the predetermined component of household financial wealth, Esthe nominal exchange rate at the beginning of the period, the interest rate on domestic deposits, į" the interest rate on foreign deposits, and he is a share function with partial derivatives ah/ai0. Household consumption spending,…arrow_forwardview picturearrow_forward

- Presently, the dollar is worth 140 Japanese yen in the spot market. The interest rate in Japan on 90-day government securities is 4 percent; it is 8 percent in the United States. a. If the interest-rate parity theorem holds, what is the implied 90-day forward exchange rate in yen per dollar? b. What would be implied if the U.S. interest rate were 6 percent?arrow_forwardAn economy with a strong export sector has been accumulating large surpluses in its current account. While this indicates a competitive export sector, it also leads to appreciation of the domestic currency, making exports more expensive and imports cheaper. This situation could potentially harm domestic industries and create economic imbalances. The government is contemplating measures to manage the current account surplus and maintain economic stability. The question is: In this scenario, the government's intervention should primarily focus on: A) Continuously increasing the current account surplus B) Managing the current account surplus to prevent economic imbalances C) Restricting all forms of imports D) Devaluing the domestic currencyarrow_forwardplease solvearrow_forward

- If a "Big Mac costs $4.00 in the United States and 200 yen in Japan, then the implied "purchasing-power-parity" exchange rate using the "Big Mac" is __________. If the actual exchange rate in the market is 120 yen = $1, then an economist would say that the actual Japanese yen is __________ in comparison with its "purchasing-power-parity" rate.arrow_forwardIf to ship any amount of gold between New York If to ship any amount of gold between New York and London costs 1 percent of the value of the gold shipped, define the U.S. gold export point or upper limit in the exchange rate between the dollar and the pound (R = $/£). Why is this so? If to ship any amount of gold between New Yorkarrow_forwardDraw the exchange market where dollars trade for British Pounds, with the equilibrium exchange rate at $1.18 and the equilibrium total amount of Pounds traded at 10 million. a> Assume that people in Britain become pessimistic about visiting, buying from, or investing in the United States. How will this market be affected? (i.e., which curve(s) will shift, and in which direction?) b> What will happen to the equilibrium quantity of Pounds traded after the event in part a? What will happen to the equilibrium exchange rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education