redo to give me the accurate answer for b please in the first picture in addition redo thois problem by given me the accurate answer it is nit close to $24... Lohn Corporation is expected to pay the following dividends over the next four years: $9, $7, $3, and $1. Afterward, the company pledges to maintain a constant 4 percent growth rate in dividends forever. If the required return on the stock is 12 percent, what is the current share price?

redo to give me the accurate answer for b please in the first picture in addition redo thois problem by given me the accurate answer it is nit close to $24... Lohn Corporation is expected to pay the following dividends over the next four years: $9, $7, $3, and $1. Afterward, the company pledges to maintain a constant 4 percent growth rate in dividends forever. If the required return on the stock is 12 percent, what is the current share price?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 2MAD

Related questions

Question

redo to give me the accurate answer for b please in the first picture

in addition redo thois problem by given me the accurate answer it is nit close to $24...

|

Lohn Corporation is expected to pay the following dividends over the next four years: $9, $7, $3, and $1. Afterward, the company pledges to maintain a constant 4 percent growth rate in dividends forever. |

|

If the required return on the stock is 12 percent, what is the current share price? |

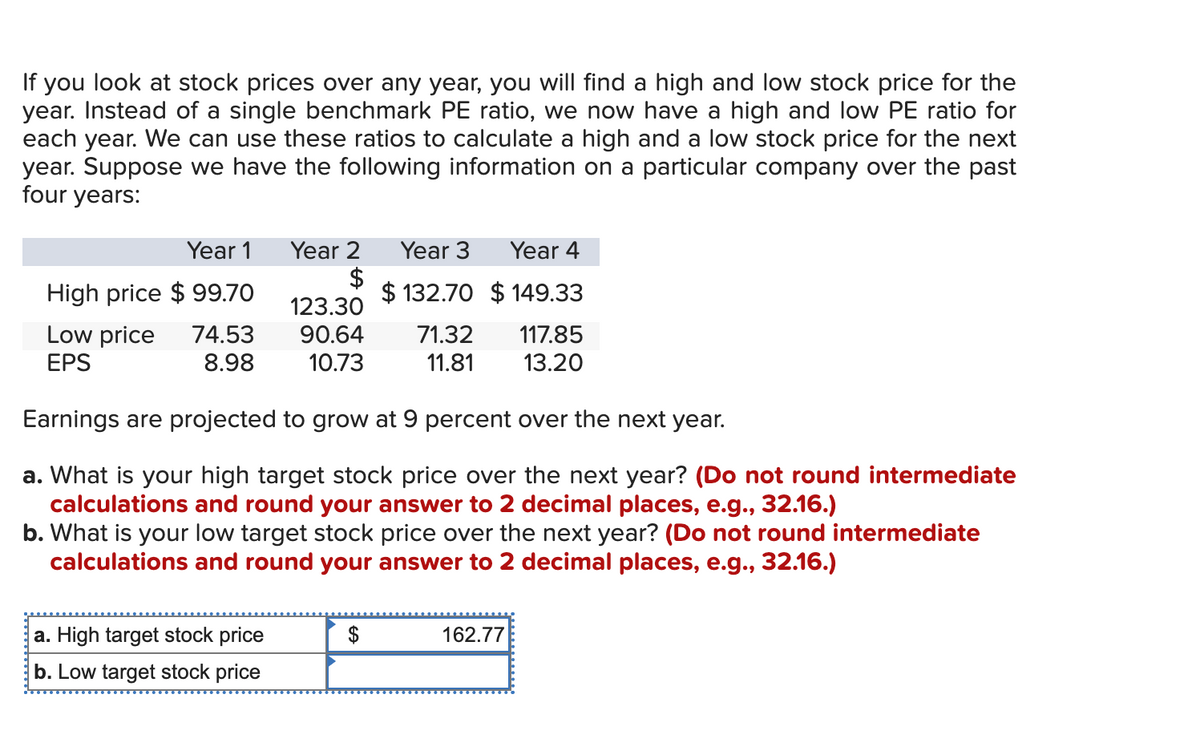

Transcribed Image Text:If you look at stock prices over any year, you will find a high and low stock price for the

year. Instead of a single benchmark PE ratio, we now have a high and low PE ratio for

each year. We can use these ratios to calculate a high and a low stock price for the next

year. Suppose we have the following information on a particular company over the past

four years:

Year 1

Year 2 Year 3

$

High price $99.70

Year 4

$132.70 $149.33

Low price

EPS

74.53

8.98

123.30

90.64

10.73

71.32 117.85

11.81

13.20

Earnings are projected to grow at 9 percent over the next year.

a. What is your high target stock price over the next year? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

b. What is your low target stock price over the next year? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

a. High target stock price

b. Low target stock price

162.77

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning