Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

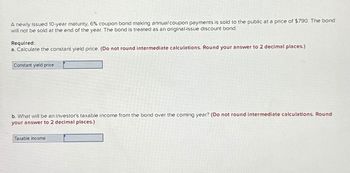

Transcribed Image Text:A newly issued 10-year maturity, 6% coupon bond making annual coupon payments is sold to the public at a price of $790. The bond

will not be sold at the end of the year. The bond is treated as an original-issue discount bond.

Required:

a. Calculate the constant yield price. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Constant yield price

b. What will be an investor's taxable income from the bond over the coming year? (Do not round intermediate calculations. Round

your answer to 2 decimal places.)

Taxable income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps with 2 images

Knowledge Booster

Similar questions

- You are considering a 10-year, $1,000 par value bond. Its coupon rate is 11%, and interest is paid semiannually. If you require an "effective" annual interest rate (not a nominal rate) of 7.1230%, how much should you be willing to pay for the bond? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardWhat is the market price of a $1,000, 8 percent bond if the market interest rates rise to 10 percent and the bond matures in 14 years? Round to the nearest cent. DO NOT INCLUDE COMMAS OR $. Type your response Submitarrow_forwardAssume you purchase (at par) one 12-year bond with a 6.10 percent coupon and a $1,000 face value. Suppose you are only able to reinvest the coupons at a rate of 4.10 percent. If you sell the bond after 7 years when the yield to maturity is 7.10 percent, what is your realized yield? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Answer is complete but not entirely correct. FV Selling price Realized yield $ 483.26 X $ 959.11 5.37 %arrow_forward

- A bond is issued with a coupon of 4% paid annually, a maturity of 39 years, and a yield to maturity of 7%. What rate of return will be earned by an investor who purchases the bond for $602.05 and holds it for 1 year if the bond's yield to maturity at the end of the year is 9% ? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount should be indicated by a minus sign.)arrow_forwardYou are considering a 30-year, $1,000 par value bond. Its coupon rate is 9%, and interest is paid semiannually. If you require an "effective" annual interest rate (not a nominal rate) of 7.1225%, how much should you be willing to pay for the bond? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardYou can invest in taxable bonds that are paying a yield of 9.7 percent or a municipal bond paying a yield of 7.95 percent. Assume your marginal tax rate is 21 percent. a. Calculate the after-tax rate of return on the taxable bond? (Round your answer to 2 decimal places. (e.g., 32.16))b. Which security bond should you buy?arrow_forward

- еВook Problem Walk-Through Last year Carson Industries issued a 10-year, 13% semiannual coupon bond at its par value of $1,000. Currently, the bond can be called in 6 years at a price of $1,065 and it sells for $1,200. a. What are the bond's nominal yield to maturity and its nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % Would an investor be more likely to earn the YTM or the YTC? -Select- -Select- ent yield and to Table 7.1) Round your answer to two decimal places. b. Since the YTM is above the YTC, the bond is likely to be called. Since the YTC is above the YTM, the bond is likely to be called. Since the YTM is above the YTC, the bond is not likely to be called. Since the YTC is above the YTM, the bond is not likely to be called. Since the coupon rate on the bond has declined, the bond is not likely to be called. I. If the bond is called, the capital gains yield will remain the same but the current yield will be…arrow_forwardCompute the price of a $ 9,349 par value, 13 percent coupon consol, or perpetual bond (i.e., coupon interest payment is a perpetuity), assuming that the yield to maturity on the bond is 8 percent. (Round your answer to 2 decimal places and record without dollar sign or commas). Your Answer: Compute the price of a $1,000 par value, 18 percent (semi-annual payment) coupon bond with 13 years remaining until maturity assuming that the bond's yield to maturity is 6 percent? (Round your answer to 2 decimal places and record your answer without dollar sign or commas). Your Answer:arrow_forwardA General Power bond carries a coupon rate of 9.2%, has 9 years until maturity, and sells at a yield to maturity of 8.2%. (Assume annual interest payments.) a. What interest payments do bondholders receive each year? b. At what price does the bond sell? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. c. What will happen to the bond price if the yield to maturity falls to 7.2%? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. A a. Interest payments b. Price c. Price will byarrow_forward

- An investor purchases a 13-year, 5.5% annual coupon payment bond at a price equal to par value, After the bond is purchased and before the first coupon is received, interest rates increase by 1.2%. The investor sells the bond after 5 years. Assume that interest rates remain unchanged at 5.5+1.2% over the 5-year holding period. Assuming that all coupons are reinvested over the holding period, what is the investor's 5 year horizon yield?arrow_forwardA newly issued 10-year maturity, 4% coupon bond making annual coupon payments is sold to the public at a price of $800. What will be an investor’s taxable income from the bond over the coming year? The bond will not be sold at the end of the year. The bond is treated as an original-issue discount bond.arrow_forwardAssume you purchase (at par) one 17-year bond with a 6.35 percent coupon and a $1,000 face value. Suppose you are only able to reinvest the coupons at a rate of 4.35 percent. If you sell the bond after 12 years when the yield to maturity is 7.35 percent, what is your realized yield? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Answer is complete but not entirely correct. FV Selling price Realized yield $ $ 973.52 959.38 5.65 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education