FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

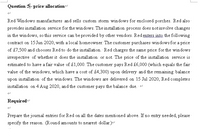

Transcribed Image Text:Question 5-price allocation

Red Windows manufactures and sells custom storm windows for enclosed porches. Red also-

provides installation service for the windows. The installation process does notinvolve changes

in the windows, so this service can be provided by other vendors. Red enters into the following

contract on 15 Jun 2020, with alocal homeowner. The customer purchases windows for a price

of £7,500 and chooses Red to do the installation. Red charges the same price for the windows

irrespective of whether it does the installation or not. The price of the installation service is

estimated to have a fair value of £1,000. The customer pays Red £6,000 (which equals the fair

value of the windows, which have a cost of £4,300) upon delivery and the remaining balance

upon installation of the windows. The windows are delivered on 15 Jul 2020, Red completes

installation on 4 Aug 2020, and the customer pays the balance due. e

Required

Prepare the journal entries for Red on all the dates mentioned above. If no entry needed, please

specify the reason. (Round amounts to nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Give me correct answer with explanation.jarrow_forwardNash Windows manufactures and sells custom storm windows for three-season porches. Nash also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other vendors. Nash enters into the following contract on July 1, 2020, with a local homeowner. The customer purchases windows for a price of $2,360 and chooses Nash to do the installation. Nash charges the same price for the windows irrespective of whether it does the installation or not. The customer pays Nash $1,920 (which equals the standalone selling price of the windows, which have a cost of $1,100) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September 1, 2020, Nash completes installation on October 15, 2020, and the customer pays the balance due. (a) Nash estimates the standalone selling price of the installation based on an estimated cost of $440 plus a margin of…arrow_forwardFreesure Company manufactures and sells commercial refrigerators. It is currently running a promotion in which it pays a $500 rebate to any customer that purchases a refrigeration unit from one of its participating dealers. The rebate must be returned within 90 days of purchase. Given its historical experience and the ease of obtaining a rebate, Freesure expects all qualifying customers to receive the rebate. Required: Prepare the journal entry to record the sale of a refrigerator to a participating dealer for $6,000.arrow_forward

- Furtastic manufactures imitation fur garments. On June 1, 2024, Furtastic made a sale to Willett's Department Store under terms that require Willett to pay $220,000 to Furtastic on June 30, 2024. In a separate transaction on June 15, 2024, Furtastic purchased brand advertising services from Willett for $26,000. The fair value of those advertising services is $12,000. Furtastic expects that 3% of all sales will prove uncollectible. Required: 1. Prepare the journal entry to record Furtastic's sale on June 1, 2024. 2. Prepare the journal entry to record Furtastic's purchase of advertising services from Willett on June 15, 2024. Assume all of the advertising services are delivered on June 15, 2024. 3. Prepare the journal entry to record Furtastic's receipt of $220,000 from Willett on June 30, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forwardPearl Windows manufactures and sells custom storm windows for three-season porches. Pearl also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other vendors. Pearl enters into the following contract on July 1, 2020, with a local homeowner. The customer purchases windows for a price of $2,360 and chooses Pearl to do the installation. Pearl charges the same price for the windows irrespective of whether it does the installation or not. The installation service is estimated to have a standalone selling price of $570. The customer pays Pearl $2,100 (which equals the standalone selling price of the windows, which have a cost of $1,110) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September 1, 2020, Pearl completes installation on October 15, 2020, and the customer pays the balance due.Prepare the journal entries for Pearl in 2020arrow_forwardPearl Windows manufactures and sells custom storm windows for three-season porches. Pearl also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other vendors. Pearl enters into the following contract on July 1, 2020, with a local homeowner. The customer purchases windows for a price of $2,360 and chooses Pearl to do the installation. Pearl charges the same price for the windows irrespective of whether it does the installation or not. The installation service is estimated to have a standalone selling price of $570. The customer pays Pearl $2,100 (which equals the standalone selling price of the windows, which have a cost of $1,110) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September 1, 2020, Pearl completes installation on October 15, 2020, and the customer pays the balance due.Prepare the journal entries for Pearl in 2020.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education