FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

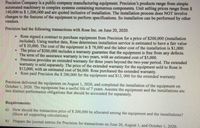

Transcribed Image Text:Precision Company is a public company manufacturing equipment, Precision's products range from simple

automated machinery to complex systems containing numerous components. Unit selling prices range from $

140,000 to $ 1,200,000 and are quoted inclusive of installation. The installation process does NOT involve

changes to the features of the equipment to perform specifications. So installation can be performed by other

vendors.

Precision had the following transactions with Rose Inc. on June 20, 2020.

• Rose signed a contract to purchase equipment from Precision for a price of $200,000 (installation

included). Using market data, Rose determines installation service is estimated to have a fair value

of $ 20,000. The cost of the equipment is $ 78,000 and the labor cost of the installation is $1,000.

• The price of $200,000 includes a warranty guarantee that the equipment is free from any defects.

The term of the assurance warranty is two years, with an estimated cost of $3,000.

• Precision provides an extended warranty for three years beyond the two-year period. The extended

warranty is sold separately. The price of the extended warranty for the equipment sold to Rose is

$12,000, with an estimated cost of $6,000. Rose purchased the extended warranty.

• Rose paid Precision the $ 200,000 for the equipment and $12, 000 for the extended warranty.

Precision delivered the equipment on August 1, 2020, and completed the installation of the equipment on

October 1, 2020. The equipment has a useful life of 7 years. Assume the equipment and the installations are

two distinct performance obligations that should be accounted for separately.

Requirements:

a) How should the transaction price of $ 200,000 be allocated among the equipment and the installations?

(Show all supporting calculations)

b) Prepare the journal entries for Precision for transactions on June 20, August 1, and October 1, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dengerarrow_forward3. Paris paid Cherry $333,333 on 12/31/2020 for the exclusive right to market a particular product using the Cherry Co name and logo in promotional material. The franchise follows the rules of Going Concern. Paris also spent $600,000 on 12/31/2020 in developing a new manufacturing process. Its application for a patent is submitted. Paris believes it will be successful In January of 2021 Paris application for a patent was granted. Legal and registrations costs incurred were $ 210,000. The patent runs for 20 years. But the manufacturing process will only be useful to Paris for 10 years What is the impact on net income related to the $210,000 of costs for the patent?arrow_forwardMeyer & Smith is a full-service technology company. They provide equipment, installation services as well as training. Customers can purchase any product or service separately or as a bundled package. Sunland Corporation purchased computer equipment, installation and training for a total cost of $ 135405 on March 15, 2021. Estimated standalone fair values of the equipment, installation and training are $ 88500, $ 44400 and $ 26400 respectively. The journal entry to record the transaction on March 15, 2021 will include a O credit to Sales Revenue for $ 135405. O credit to Unearned Service Revenue of $ 22440. O debit to Unearned Service Revenue of $ 26400. O credit to Service Revenue of $ 44400.arrow_forward

- Furtastic manufactures imitation fur garments. On June 1, 2024, Furtastic made a sale to Willett's Department Store under terms that require Willett to pay $220,000 to Furtastic on June 30, 2024. In a separate transaction on June 15, 2024, Furtastic purchased brand advertising services from Willett for $26,000. The fair value of those advertising services is $12,000. Furtastic expects that 3% of all sales will prove uncollectible. Required: 1. Prepare the journal entry to record Furtastic's sale on June 1, 2024. 2. Prepare the journal entry to record Furtastic's purchase of advertising services from Willett on June 15, 2024. Assume all of the advertising services are delivered on June 15, 2024. 3. Prepare the journal entry to record Furtastic's receipt of $220,000 from Willett on June 30, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forwardRhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2024, Rhone-Metro leased equipment to Western Soya Company for a noncancelable stated lease term of four years ending December 31, 2028, at which time possession of the leased asset will revert back to Rhone-Metro. ● ● ● The equipment cost $390,000 to manufacture and has an expected useful life of six years. Its normal sales price is $445,205. The expected residual value of $26,000 on December 31, 2028, is not guaranteed. The first payment was made on December 31, 2024. Western Soya's incremental borrowing rate is 10%. Western Soya knows the interest rate implicit in the lease payments is 9%. Both companies use straight-line depreciation or amortization. [Hint: A lease term ends for accounting purposes when an option becomes exercisable if it's expected to be exercised (i.e., a BPO).] Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of…arrow_forwardCanseco Company has been having difficulty obtaining key raw materials for its manufacturing process. The company, therefore, signed a long-term noncancelable purchase commitment with its largest supplier of this raw material on November 30, 2021, at an agreed price of $100,000. On December 31, 2021, the raw material had declined in price to $85,000. Required What entry, if any, would you make on December 31, 2021, to recognize these facts?arrow_forward

- 3....new. //// Metlock Inc. was incorporated in 2019 to operate as a computer software service firm, with an accounting fiscal year ending August 31. Metlock’s primary product is a sophisticated online inventory-control system; its customers pay a fixed fee plus a usage charge for using the system.Metlock has leased a large, Alpha-3 computer system from the manufacturer. The lease calls for a monthly rental of $44,000 for the 144 months (12 years) of the lease term. The estimated useful life of the computer is 15 years.All rentals are payable on the first day of the month beginning with August 1, 2020, the date the computer was installed and the lease agreement was signed. The lease is non-cancelable for its 12-year term, and it is secured only by the manufacturer’s chattel lien on the Alpha-3 system.This lease is to be accounted for as a finance lease by Metlock, and it will be amortized by the straight-line method. Borrowed funds for this type of transaction would cost…arrow_forward14.Kandon Enterprises, Inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. Both divisions are considered separate components as defined by generally accepted accounting principles. The horse division has been unprofitable, and, on November 15, 2021, Kandon adopted a formal plan to sell the division. The sale was completed on April 30, 2022. At December 31, 2021, the component was considered held for sale. On December 31, 2021, the company’s fiscal year-end, the book value of the assets of the horse division was $372,000. On that date, the fair value of the assets, less costs to sell, was $320,000. The before-tax loss from operations of the division for the year was $260,000. The company’s effective tax rate is 25%. The after-tax income from continuing operations for 2021 was $520,000. Required: Prepare a partial income statement for 2021 beginning with income from continuing operations. Ignore EPS disclosures. Prepare a partial…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education