FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:E6-23

LO6-2

Recording, Reporting, and Evaluating a Bad Debt Estimate Using Aging Analysis

Brown Cow Dairy uses the aging approach to estimate bad debt expense. The ending balance of each account receivable

is aged on the basis of three time periods as follows: (1) not yet due, $14,000; (2) up to 120 days past due, $4,500; and

(3) more than 120 days past due, $2,500. Experience has shown that for each age group, the average loss rate on the

amount of the receivables at year-end due to uncollectibility is (1) 2 percent, (2) 12 percent, and (3) 30 percent,

respectively. At December 31 (end of the current year), the Allowance for Doubtful Accounts balance is $800 (credit)

before the end-of-period adjusting entry is made.

Data during the current year follow:

Required:

1. Give the required journal entries for the two items listed above.

DATUM

2. Show how the amounts related to Accounts Receivable and Bad Debt Expense would be reported on the income

statement and balance sheet for the current year. Disregard income tax considerations.

7. During December, an Account Receivable (Patty's Bake Shop) of $750 from a prior sale was determined to be

uncollectible; therefore, it was written off immediately as a bad debt.

5. On December 31, the appropriate adjusting entry for the year was recorded.

3. On the basis of the data available, does the estimate resulting from the aging analysis appear to be reasonable?

Explain.

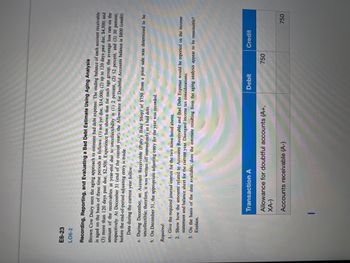

Transaction A

Arghh run

Allowance for doubtful accounts (A+,

XA-)

Accounts receivable (A-)

Debit

750

Credit

750

Expert Solution

arrow_forward

Step 1

1) Journal entry

| No | General Journal | Debit | Credit |

| a | Allowance for doubtful accounts | 750 | |

| Account receivable | 750 | ||

| b | Bad debt expense (1570-50) | 1520 | |

| Allowance for doubtful accounts | 1520 |

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- solve this pleasearrow_forwardQuestion: Young and Old Corporation (YOC) uses two aging categories to estimate uncollectible accounts. Accounts less than 60 days are considered young and have a 4% uncollectible rate. Accounts more than 60 days are considered old and have a 35% uncollectible rate old If YOC has $107,000 of young accounts and $470,000 of accounts, how much should reported in the Allowance for Doubtful Accounts? Amount to reported? be bearrow_forwardTammany Professional Engineers uses the Percentage of Receivables method to account for bad debt. The following is a summary of Tammany’s Accounts Receivable Aging Report. Cash Sales $42,000 Credit Sales $21,000 Allowance for Uncollectible Accounts December 31, 2020 $4,375 Current > 30 >60 >90 $115,000 $98,000 $75,000 $15,000 Estimated Uncollectible 1% 2% 4% 5% Required: Prepare the total estimate of uncollectible accounts and give the amount of the required adjustment. Do not prepare a journal entry. Please show your work if possible. In addition to submitting your answer here, you should also write it down so you an use it for the next problem.arrow_forward

- Determine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. a. Credit balance of $350 in Allowance for Doubtful Accounts just prior to adjustment. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $7,220. Amount added Ending balance b. Credit balance of $350 in Allowance for Doubtful Accounts just prior to adjustment. Bad debt expense is estimated at 2% of credit sales, which totaled $980,000 for the year. Amount added Ending balance MacBook Proarrow_forwardvin.3arrow_forwardCasilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $51,300; (2) up to 180 days past due, $14,800; and (3) more than 180 days past due, $5,000. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 4 percent, (2) 13 percent, and (3) 31 percent, respectively. At December 31, the end of the current year, the Allowance for Doubtful Accounts balance is $100 (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year. 2. Show how the various accounts related to accounts receivable should be shown on the December 31, current year, balance sheet. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Show how the various accounts related to accounts…arrow_forward

- Haresharrow_forwardi need the answer quicklyarrow_forwardCompare Two Methods of Accounting for Uncollectible Receivables Call Systems Company, a telephone service and supply company, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increases in sales volume and the amount of uncollectible accounts, the company is considering changing to the allowance method. Information is requested as to the effect that an annual provision of 2% of sales would have had on the amount of bad debt expense reported for each of the past four years. It is also considered desirable to know what the balance of Allowance for Doubtful Accounts would have been at the end of each year. The following data have been obtained from the accounts: Year of Origin of Accounts Receivable Written Off as Uncollectible Uncollectible Accounts Year Sales 1st 2nd 3rd 4th Written Off 1st $1,200,000 $1,100 $1,100 2nd 1,720,000 2,900 1,350 $1,550 3rd 2,690,000 11,700…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education