FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:View Policies

Show Attempt History

Current Attempt in Progress

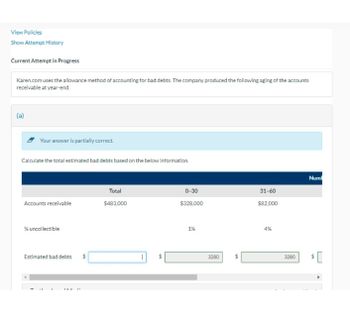

Karen.com uses the allowance method of accounting for bad debts. The company produced the following aging of the accounts

receivable at year-end.

(a)

Your answer is partially correct.

Calculate the total estimated bad debts based on the below information.

Num

Total

0-30

31-60

Accounts receivable

$483,000

$328,000

$82,000

% uncollectible

Estimated bad debts

"

$

A

1%

3280

SA

4%

3280

19

$

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Need Help please provide Solutionsarrow_forwardAn analysis and aging of the accounts receivable of Carla Vista Marine Service Company at December 31 reveal these data: Accounts receivable 12/31/X1 Bad Debt Expense for Year X1 $3,290,000 69,000 Allowance for doubtful accounts ENDING BALANCE 12/31/X1. Credit Balance 459,000 What is the cash realizable value of the accounts receivable at December 31 after adjustment?arrow_forwardDo not give solution in imagearrow_forward

- Saved Help Save E6-14 (Algo) Recording and Reporting a Bad Debt Estimate Using Aging Analysis LO6-2 Casilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $51,600; (2) up to 180 days past due, $15,300; and (3) more than 180 days past due, $4,200. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 3 percent, (2) 12 percent, and (3) 32 percent, respectively. At December 31, the end of the current year, the Allowance for Doubtful Accounts balance is $300 (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year. 2. Show how the various accounts related to accounts receivable should be shown on the December 31, current year, balance sheet. Complete this question by entering…arrow_forwardBeginning balances: Allowance for Doubtful Accounts - $45,000 Accounts Receivable - $3,000,000 Bad Debt percent of credit sales – 1.5% Total Credit Sales – $38,000,000 1) Estimate bad debt expense using percent of sales method 2) Record transaction. 3) Show new adjusted allowance account 4) In January the next year, $48,000 is determined to be uncollectible. Show the entry and adjust accounts.arrow_forwardhelparrow_forward

- Entry for bad debt expensesarrow_forwardweat subject-Accountingarrow_forwardnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $565,000, Allowance for Doubtful Accounts has a credit balance of $5,000, and sales for the year total $2,540,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $26,000. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5arrow_forward

- Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $440,000, Allowance for Doubtful Accounts has a debit balance of $4,000, and sales for the year total $1,980,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $18,400. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5 Answer with all workarrow_forwardMr. and Mrs. FB, a retired couple, decided to open a family restaurant. During March and April, they incurred the following expenses. Prepaid rent on commercial real estate ($2,100 per month from April through December) $ 18,900 Prepaid rent on restaurant equipment ($990 per month from April through December) 8,910 Advertising of upcoming Grand Opening 900 Staff hiring and training 11,500 TOTAL $ 40,210 Mr. and Mrs. FB served their first meal to a customer on May 1. Determine the tax treatment of the above expenses on their tax return.arrow_forwardi will upvote. thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education