FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

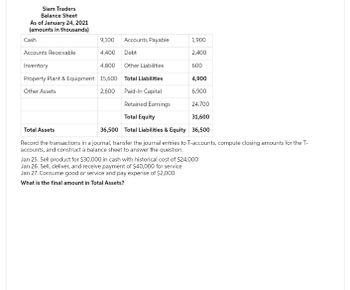

Transcribed Image Text:Siam Traders

Balance Sheet

As of January 24, 2021

(amounts in thousands)

9,100 Accounts Payable

4,400

Debt

4,800 Other Liabilities

Total Liabilities

4,900

Paid-In Capital

6,900

Retained Earnings

24,700

Total Equity

31,600

Total Assets

36,500

Total Liabilities & Equity 36,500

Record the transactions in a journal, transfer the journal entries to T-accounts, compute closing amounts for the T-

accounts, and construct a balance sheet to answer the question.

Cash

Accounts Receivable

Inventory

Property Plant & Equipment 15,600

Other Assets

2,600

1,900

2,400

600

Jan 25. Sell product for $30,000 in cash with historical cost of $24,000

Jan 26. Sell, deliver, and receive payment of $40,000 for service

Jan 27. Consume good or service and pay expense of $2,000

What is the final amount in Total Assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Based on the Trial Balance below, prepare the COGS for Sanchez Marketing.arrow_forwardRemaining TIme! Question Completion Status: QUESTION 1 Q7. Receiving cash in advance for services will be provided next month. This will have the following effects on the components of the basic accounting equation: increase assets and decrease owner's equity. increase liabilities and increase owner's equity. Ob. increase assets and increase owner's equity. Oc. increase assets and increase liabilities. Od. QUESTION 2 Posting: transfers journal entries to ledger accounts. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers LGarrow_forwardABC Company has the following T Account at the end of the year: Post to T-Acct (aka Ledger) Asset Cash Liability + C/ stock - Dividend + Acct Payable Commonstah Dividend Revenue 30,000 1,000 500 Common stah Dividend Service Revenue 30,000 480 Expense Rent expense 41000 500 15,000 4,000 5,000 15,000 480 Travel expense 1,000 Insurance expense 5,000arrow_forward

- how to write general journal for bringing van costing Rm 3000 and cash amount Rm 9000 into the businessarrow_forwardUse the Adjusted Trial Balance Lion Consulting. (Note: I am including the Adjusted Trial Balance below in this question to use for questions 18-23 and 40-46, but it would be easier if you refer to the separate file I provided.)On the Income Statement, what would the Gross Profit be for Lion Consulting? Lion Consulting Adjusted Trial Balance June 30, 2019 Debit Balances Credit Balances Cash 92,000 Accounts Receivable 450,000 Merchandise Inventory 370,000 Estimated Returns Inventory 5,000 Office Supplies 10,000 Prepaid Insurance 12,000 Office Equipment 220,000 Accumulated Depreciation - Office Equip. 58,000 Store Equipment 650,000 Accumulated Depreciation - Store Equip. 87,500 Accounts Payable 38,500 Customer Refunds Payable 10,000 Salaries Payable 4,000 Note Payable (final payment due 2029)* *140,000 M.T.…arrow_forward*Required: Record the transactions using a general journal. Create your own account titles that will appropriately describe the exchanges of values. Post in T-accounts and compute the total assets, liabilities, and equity.arrow_forward

- Purchased equitment with $6,000 cash. What accounts does this go into in the journal?arrow_forwardWhich of the following journal entries will increase the total balance of the debit accounts in the ledger by $4,500? Select answer from the options below: A debit to Supplies for $4,500; a credit to Cash for $500; and a credit to Accounts Payable for $5,000. A debit to Supplies Expense for $4,500; a credit to Cash for $500; and a credit to Accounts Payable for $4,000. A debit to Accounts Payable for $4,500; and a credit to Cash for $4,500. A debit to Supplies Expense for $5,000; a credit to Cash for $500; and a credit to Accounts Payable for $4,500.arrow_forwardWhat's the journal entry for sold services for $41,400 in cash and $4,600 on credit?arrow_forward

- I need answers in the right format thank you so much.arrow_forwardRecord all transactions in appropriate T-accounts (costs by nature), close all accounts and prepare an Income Statement.a) The company recorded an invoice for rubbish disposal in the current month; value 400.b) The company recorded bank fees; value 50.c) The company sold goods worth 2 000 for 3 500 on deferred payment.d) Goods were delivered to a customer – transport cost 500 and additional insurance cost of 200, both paid by bank money transfer..arrow_forwardWritten Work. Problem Solving. Show your solutions. At September 28, the balance sheet accounts for Hayao's Restaurant were as follows: Accounts Payable Land Accounts Receivable Building Cash Furniture P3,800 1,600 68,000 10,000 18,700 Hayao, Capital Notes Payable Supplies Instructions: Prepare an SFP on September 30, 2020. P33,000 ? 48,000 6,600 The following transactions occurred during the next two days: Hayao invested an additional P22,000 cash in the business. The accounts payable were paid in full. (No payment was made on the notes payable.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education