FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

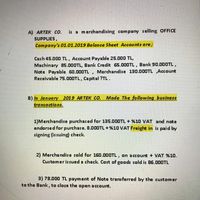

Transcribed Image Text:is a merchandising company selling OFFICE

A) ARTEK CO.

SUPPLIES,

Company's 01.01.2019 Balance Sheet Accounts are;

Cash 45.000 TL, Account Payable 25.000 TL,

Machinary 85.000TL, Bank Credit 65.000TL, Bank 90.00OTL,

Note Payable 60.000TL , Merchandise 130.000TL ,Account

Receivable 75.000TL, Capital ?TL.

B) In January 2019 ARTEK CO. Made The following business

trancactions.

1)Merchandise purchased for 135.000TL + %10 VAT and note

endorsed for purchase. 8.00OTL+%10 VAT Freight in is paid by

signing (issuing) check.

2) Mercha ndise sold for 160.000TL, on account + VAT %10.

Customer is sued a check Cost of goods sold is 86.000TL

3)78.000 TL payment of Note transferred by the customer

to the Bank, to close the open account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Create T-Account.arrow_forward42.The following data were available for ABC Company, which uses perpetual system, at Dec 31, 20X2:Accounts Payable, beg P15,000Accounts Payable, end P10,000Inventory, beg P17,000Inventory, end P9,000Cash payment to creditors(net of 2% discount) 294,000Purchase returns, P5,000How much were the credit purchases during the period? 285,000 294,000 300,000 315,000arrow_forwardSweet Company has the following account balances: \table [[Inventory, 556,000], [Prepaid Insurance, 12,000], [Cash, 360,000], [Accounts Receivable,260,000], [Supplies, 26, 000], [Allowance for Doubtful Accounts, 36,000]] When listing Accounts Receivable, what is the cash (net) realizable value to be presented on the statement of financial position? 620,000 260,000 296,000 224,000arrow_forward

- Q3: Salalah company’s recent financial statements showed the following information. Net Sales 250,000 OMR Accounts Receivables 180,000 OMR The management made two estimates for the uncollectible receivables It can be 4.5 % of net sales or It can be 3.2 % of accounts receivables Calculate and record journal entries in each case. If the company had already recognized an allowance amount of 8,000 OMR, make the journal entry. In this question, make the solution only for net sales casearrow_forwardThe Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. Assume that the credit card fee is recorded on the date of sale and that the credit card company charges a fee of 3% for handling a credit card transaction. Which of the following correctly shows the effects of the sale on July 7? Assets 600 A. B. 582 C. 582 D. 600 Multiple Choice O Balance Sheet Liabilities + 18 ΝΑ ΝΑ ΝΑ Option B Option D Option C Option A Stockholders' Equity 582 582 582 600 Revenue 582 600 600 600 Income Statement Expense = Net Income Statement of Cash Flows ΝΑ ΝΑ 18 582 0A 18 ΝΑ 582 582 582 600 ΝΑ ΝΑarrow_forwardBlossom Company has a balance in its Accounts Receivable control account of $11,300 on January 1, 2022. The subsidiary ledger contains three accounts: Bixler Company, balance $4,200: Cuddyer Company, balance $2,200, and Freeze Company. During January the following receivable-related transactions occurred. Bixler Company Cuddyer Company Freeze Company (a) Credit Sales Collections $9,000 $7,900 2.600 8.800 7.100 8.500 Returns $0 3.000 Balance in the Freeze Company subsidiary account S 0 What is the January 1 balance in the Freeze Company subsidiary account?arrow_forward

- Please answer following question Q5: Company Name Net Credit Sales Beginning Net Receivables Ending Net Receivables Brown $180,000 $ 5,000 $30,000 Pink $400,000 $52,000 $42,000 Yellow $ 75,000 $ 5,400 $ 5,800 (a)Which company is doing the best job of managing its accounts receivable? Why? Be sure to support your answer with computations. (b)What are your concerns about these companies? BR,arrow_forwarddon't give answer in image formatarrow_forwardTanger Company has three customers: E, F, and G. The beginning accounts receivable subsidiary ledger of customers F and G have $2,600 and $1,500, respectively. The beginning Accounts Receivable balance in the general ledger is $12,000. Calculate the ending amount in the accounts receivable subsidiary ledger account of customer E, if customer E also made a $3,900 payment. OA. $4,000 OB. $3,900 OC. $1,500 OD. $2,600arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education