FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

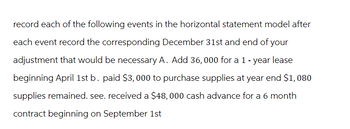

Transcribed Image Text:record each of the following events in the horizontal statement model after

each event record the corresponding December 31st and end of your

adjustment that would be necessary A. Add 36,000 for a 1 - year lease

beginning April 1st b. paid $3,000 to purchase supplies at year end $1,080

supplies remained. see. received a $48,000 cash advance for a 6 month

contract beginning on September 1st

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please i need both parts correct and only handwritten will upvotearrow_forwardA 1,000-square-foot office space is leased at $15.00 per square foot during the first year with $2.00 step-up provisions each of the following years. The lease is gross with an expense stop set at $6.65 per square foot, and yearly expenses per square foot are as follows: $6.00, $6.65, and $7.05. The lease provides for two months of free rent at the end of the lease term. If the lease term is three years and the discount rate is 10 percent, what is the effective rent per square foot?arrow_forwardOn July 1, 2020, Shroff Company leased a warehouse building under a 10-year lease agreement. The lease requires quarterly lease payments of $4,500. The first lease payment is due on September 30, 2020. The lease was reported as a finance lease using an 8% annual interest rate. a. Prepare the journal entry to record the commencement of the lease on July 1, 2020. b. Prepare the journal entries that would be necessary on September 30 and December 31, 2020. c. Post the entries from parts a and b in their appropriate T-accounts. d. Prepare a financial statement effects template to show the effects template to show the effects of the entries from parts a and b on the balance sheet and income statement.arrow_forward

- Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank in the amount of $670,000. The terms of the loan are 3.8% annual interest rate and payable in 8 months. Interest is due in equal payments each month. A. Compute the interest expense due each month. If required, round final answer to two decimal places. B. Show the journal entry to recognize the interest payment on October 20, and the entry for payment of the short-term note and final interest payment on May 20. If required, round final answers to two decimal places. If an amount box does not require an entry, leave it blank. Oct. 20 May 20arrow_forwardjournal entries needed for march 31, sept 30, and dec 31arrow_forwardScrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank in the amount of $640,000. The terms of the loan are 3.1% annual interest rate and payable in 8 months. Interest is due in equal payments each month. A. Compute the interest expense due each month. If required, round final answer to two decimal places. 1,653.33 B. Show the journal entry to recognize the interest payment on October 20, and the entry for payment of the short-term note and final interest payment on May 20. If required, round final answers to two decimal places. If an amount box does not require an entry, leave it blank. 1,653.33 Oct. 20 Interest Expense Cash May 20 Cash 1,653.33 640,000 1,653.33 641,653.33arrow_forward

- Core Co. leased a piece of manufacturing equipment from E-So Co. with the following terms: Annual lease payment: $990,000 Term of lease: 5 years Interest rate: 4% Lease commences on January 1, 2023 Payments are made on December 31 of each year in the lease term For parts a and b: a. Prepare journal entries to show the effects for Core Co. for January 1, 2023-December 31, 2024, if the lease is classified as a finance lease. b. Prepare journal entries to show the effects for Core Co. for January 1, 2023-December 31, 2024, if the lease is classified as an operating lease. Operating Lease Finance Lease a. Finance lease: Date Jan. 1, 2023 Account To record the start of the finance lease. Dec. 31, 2023 To record the amortization of leased asset. Dec. 31, 2023 Dec. 31, 2024 Dec. 31, 2024 To record the lease payment. To record the amortization of leased asset. To record the lease payment. > > > > > > > > > > Debit Credit 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0arrow_forwardMonth-end payments of $1,410 are made to settle a loan of $119,660 in 8 years. What is the effective interest rate? % Round to two decimal places Question 3 of 10 hup SUBMIT QUESTION SUBMIT ASSIGNMENT 21°C Sunny ENG 1:17 PM 7/13/2022arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] On November 1, 2022, Gordon Company collected $9,660 in cash from its tenant as an advance rent payment on its store location. The six-month lease period ends on April 30, 2023, at which time the contract may be renewed. c. Suppose the advance collection received on November 1, 2022, covered an 24-month lease period at the same amount of rent per month. How should Gordon Company report the unearned rent amount on its December 31, 2022, balance sheet? Current liability? Noncurrent liability?arrow_forward

- In Intermediate Accounting by Whalen on Cengage, chapter 20, homework question 4, how do you calculate the selling price? Sale type lease for 8 years. Lease pmt due at the end of the year $32,000/yr. 14% interest. Cost of the equipment is $110,000 and estimate fair value at the end of the lease is $20,000.arrow_forwardPrepare all the journal entries for Scuppermong for Years 1 and 2.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education