Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

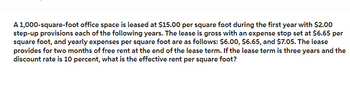

Transcribed Image Text:A 1,000-square-foot office space is leased at $15.00 per square foot during the first year with $2.00

step-up provisions each of the following years. The lease is gross with an expense stop set at $6.65 per

square foot, and yearly expenses per square foot are as follows: $6.00, $6.65, and $7.05. The lease

provides for two months of free rent at the end of the lease term. If the lease term is three years and the

discount rate is 10 percent, what is the effective rent per square foot?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Calculate the total rent paid over the lease term:

VIEW Step 2: Subtract the expense stop from the total expenses for each year to find the additional expenses

VIEW Step 3: Calculate the present value (PV) of each year's net cash flow:

VIEW Step 4: Add the present value of the two months of free rent:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- The following data is the planned rates by type of room: Room Type Rooms Rate Single 40 $ 70.00 Double 100 $ 100.00 The average room rate using a weighted average isarrow_forwardCarla Vista Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers. For the year 2022, management estimates the following revenues and costs. Sales Direct materials Direct labor Manufacturing overhead-variable Manufacturing overhead-fixed $2,000,000 550,000 400,000 420,000 190.000 Selling expenses-variable Selling expenses-fixed Administrative expenses-variable Administrative expenses-fixed $109,000 58,000 21,000 52.000arrow_forwardif dollar markup is $5.60 and percent markup is 101.82% on cost, what is cost and selling price?arrow_forward

- Use the following information (in thousands):a. ¥126,000 d. ¥63,000Answer:1Sales revenue¥300,000 Gain on sale of equipment90,000 Cost of goods sold164,000 Interest expense16,000 Selling & administrative expenses30,000 Income tax rate30%Determine the amount of net income.arrow_forward10. Current ratio is 1.4:1 with current liabilities aggregating to P50,000. Inventory and prepaid expenses amount to P35,000 and P5,000 respectively. The acid test ratio isarrow_forwardSales = $1,000; Cost of Goods Sold = $500; Depreciation Expense = $100; Administrative Expenses = $100; Interest Expense = $20; Marketing Expenses = $80; and Taxes = $100. The Co's net income is equal to A) $100. B) $150. C) $220. D) $200.arrow_forward

- 2 A storekeeper bought merchandise for $2940. If she sells the merchandise at 16% above cost, how much gross profit does she make? Her gross profit is $ (Type an integer or a decimal)arrow_forwardThe amount of markup on a store item is $11. Find the cost to the store if the markup is 20%.arrow_forwardSandhill Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 60 cents per 16-ounce bottle to retailers. For the year 2022, management estimates the following revenues and costs. Sales Direct materials Direct labor Manufacturing overhead-variable Manufacturing overhead-fixed $1,800,000 420,000 400,000 Selling Selling expenses-fixed expenses-variable Administrative expenses-variable 420,000 Administrative expenses-fixed 110,000 $87,000 61,000 23,000 99,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education