Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

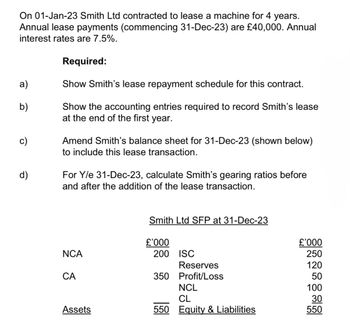

Transcribed Image Text:On 01-Jan-23 Smith Ltd contracted to lease a machine for 4 years.

Annual lease payments (commencing 31-Dec-23) are £40,000. Annual

interest rates are 7.5%.

a)

b)

c)

d)

Required:

Show Smith's lease repayment schedule for this contract.

Show the accounting entries required to record Smith's lease

at the end of the first year.

Amend Smith's balance sheet for 31-Dec-23 (shown below)

to include this lease transaction.

For Y/e 31-Dec-23, calculate Smith's gearing ratios before

and after the addition of the lease transaction.

Smith Ltd SFP at 31-Dec-23

£'000

£'000

NCA

200

ISC

250

Reserves

120

CA

350 Profit/Loss

50

NCL

CL

100

30

Assets

550 Equity & Liabilities

550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a operating lease. The lease requires three $18,000 lease payments (the first at the beginning of the lease and the remaining two at December 31 of Year 1 and Year 2) The present value of the three annual lease payments is $51,000, using a 6.003% interest rate. The lease payment schedule follows. Date January 1, Year 1 December 31, Year 1 December 31, Year 2 Required 1 No 1 (A) Beginning (B) Debit Balance of 2 Lease Liability $ 51,000 33,000 16,981 Required 2 3 Interest on Lease Liability 6.003% X (A) Complete this question by entering your answers in the tabs below. Required: 1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability. 2. Prepare the January 1 journal entry to record the first $18,000 cash lease payment. 3. Prepare the December 31 journal entry to record amortization at the end of (a) Year 1, (b) Year 2, and (c) Year 3. 4. Prepare the…arrow_forwardplease and thank youarrow_forwardMWANJOMBE Limited entered into a four year lease on 1 January 2022 for a machine. Rentals are TZS 20,000,000 p.a payable in advance. MWANJOMBE Limited incurs initial direct costs of TZS 5,000,000. The rate of interest implicit in the lease is 10%. Machine has a useful life of five years. REQUIRED Prepare extracts from financial statements for the year ended 31st December 2022 - 2025arrow_forward

- In your audit of Entity A, you noted that the Rent expense account has an ending balance of $1,100,000 at December 31, 2021. $100,000 of this pertains to the maintenance costs paid by the Lessor on behalf of Entity A, which was later paid by Entity A. The lease commenced on January 1, 2021. The following are the terms of agreement. Terms of the Lease Agreement Lease term 8 years Useful life 10 years Annual rental payments due at the end of the year $1,000,000 Residual value at the end of useful life $500,000 Bargain purchase option 200,000 Maintenance costs reimbursed to lessor 100,000 8% Implicit rate Note: There is reasonable certainty that the purchase option will be exercised by Entity A at the end of the lease term Required: 1. Compute for the (a) initial lease liability and the cost of the right-of-use asset, (b) Depreciable amount to be used and depreciation expense (c) Carrying amount of the lease liability and the right- of-use asset at the end of the year. 2. Show adjusting…arrow_forwardFigy Co entered into a 4-year lease agreement on 1 January 20X5. The agreement meets the definition of a lease in accordance with IFRS 16. An initial payment of $160,000 was made on 1 January 20X5 followed by three annual payments on 1 January of $150,000 each. The rate implicit in the lease is 10%. Figy Co incurred initial direct costs of X2 to set up the lease. Required: 1. Give your own X2 then calculate the cost of the right-of-use asset as at 1 January 20X5? 2. What is the carrying amount of the lease liability at 31 December 20X6? 3. What amount will be charged to the statement of profit or loss in respect of this asset for the year ended at 31 December 20X6? 4. Prepare necessary accounting entries related to this lease agreement for the year ended at 31 December 20X5.arrow_forward19 On September 30, 2024, Truckee Garbage leased equipment from a supplier and agreed to pay $125,000 annually for 15 years beginning September 30, 2025. Generally accepted accounting principles require that a liability be recorded for this lease agreement for the present value of scheduled payments. Accordingly, at inception of the lease, Truckee recorded a $1,214,031 lease liability. Determine the interest rate implicit in the lease agreement. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forward

- On July 1, 2020, Shroff Company leased a warehouse building under a 10-year lease agreement. The lease requires quarterly lease payments of $4,500. The first lease payment is due on September 30, 2020. The lease was reported as a finance lease using an 8% annual interest rate. a. Prepare the journal entry to record the commencement of the lease on July 1, 2020. b. Prepare the journal entries that would be necessary on September 30 and December 31, 2020. c. Post the entries from parts a and b in their appropriate T-accounts. d. Prepare a financial statement effects template to show the effects template to show the effects of the entries from parts a and b on the balance sheet and income statement.arrow_forwardSur Food Corp., leased machine from Al-Urami Corp. the lease agreement for the O.R 750,000 (fair and present value of the lease payment) machine specified five equal payments at the end of each year. The implicit interest rate was 9% Required: 1. Prepare the journal entry for Al-Urami Corp. at the inception of the lease on January 1, 2019. 2. Prepare an amortization schedule for the three-year term of the lease Note: Present value of an ordinary annuity of $1.n=5,1%39% is 3.88965arrow_forwardAt the beginning of the year, Cazenovia, Inc. Entered into a five-year lease for equipment that was valued at $95,000. The company will be required to make annual lease payments of $22,000 for five years at year-end. The implicit interest rate is 5% and the company classified the lease as a finance lease. Required What is the balance sheet value of the lease asset and the lease liability? Why was the lease categorized as a finance lease? How much is interest expense in the first year? What is the reduction in the lease liability in the first year? What is the total expense if straight-line amortization is used for the leased asset?arrow_forward

- On January 1, Mason Co. entered into a three-year lease on a building. The current value of the three lease payments is $60,000. Required Prepare entries for Mason to record (a) the lease asset and obligation at January 1 and (b) the $20,000 straight-line amortization at December 31 of the first year.arrow_forwardPrepare all the journal entries for Scuppermong for Years 1 and 2.arrow_forwardProvide a journal of the lease expense for the period ended 31 December 2022 The lease commenced on 1 May 2020 and 31 December is the year end. The lease payment is R1200 per month for the first year and R1450 per month for the second year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education