FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

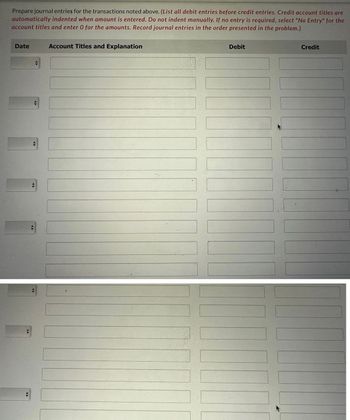

Transcribed Image Text:Prepare journal entries for the transactions noted above. (List all debit entries before credit entries. Credit account titles are

automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts. Record journal entries in the order presented in the problem.)

Date

◄►

►

◄►

Account Titles and Explanation

Debit

Credit

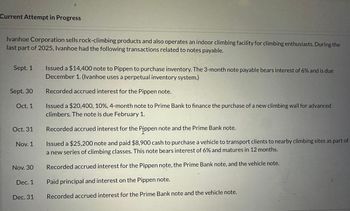

Transcribed Image Text:Current Attempt in Progress

Ivanhoe Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the

last part of 2025, Ivanhoe had the following transactions related to notes payable.

Sept. 1

Sept. 30

Oct. 1

Oct. 31

Nov. 1

Nov. 30

Dec. 1

Dec. 31

Issued a $14,400 note to Pippen to purchase inventory. The 3-month note payable bears interest of 6% and is due

December 1. (Ivanhoe uses a perpetual inventory system.)

Recorded accrued interest for the Pippen note.

Issued a $20,400, 10%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced

climbers. The note is due February 1.

Recorded accrued interest for the Pippen note and the Prime Bank note.

Issued a $25,200 note and paid $8,900 cash to purchase a vehicle to transport clients to nearby climbing sites as part of

a new series of climbing classes. This note bears interest of 6% and matures in 12 months.

Recorded accrued interest for the Pippen note, the Prime Bank note, and the vehicle note.

Paid principal and interest on the Pippen note.

Recorded accrued interest for the Prime Bank note and the vehicle note.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lewis Company had the following transactions involving notes payable. July 01, 2022 ... Borrows $50,000 from First Bank signing a 9-month, 8% note. Nov 01, 2022 ... Borrows $60,000 from Lyon Bank signing a 3-month, 6% note. Dec 31, 2022 ... Prepares annual adjusting entries. Feb 01, 2023... Pays principal and interest to Lyon Bank. Apr 01, 2023... Pays principal and interest to First National Bank. July 01 2022 Nov 01 2022 Dec 31 2022 Feb 01 2023 Apr 01 2023 On day note is created - is there interest exp? Or just the principal? DR 8% int $ DR 6% int $ CR Total $ 2 diff entries! A single CR to for each entry. Each entry pays note principal (can't be more), PLUS interest (and any publ from adj). Interest calc: Principal x Interest % = a full years int exp. BUT, notes often less than a full year. "Term" (length) of the note tells how many of the 12 months (or 365 days) apply. Eliminate any Int Pobl if ADJ were needed cuz some INT EXP is 2022, and some is 2023.arrow_forwardOn September 1, 2021, Allied Moving Corp. borrows $110,000 cash from First National Bank. Allied signs a six-month, 5% note payable. Interest is payable at maturity. Allied's year-end is December 31. 1., 2. & 3. Record the following transactions for the note payable by Allied Moving Corp. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your answers to nearest dollar amount.) View transaction list Journal entry worksheet < 1. 2 Record the issuance of notes payable. Date Sep 01, 2021 3 Note: Enter debits before credits. Record entry General Journal Clear entry Debit Credit View general jourarrow_forwardThe following selected transactions for notes receivable are for Marx Limited. May 1 Received a six-month, 5%, $15,120 note on account from Blackstone Limited. Interest is due at maturity. June 30 Accrued interest on the Blackstone note on this date, which is Marx's year end. July 1 Lent $13,200 cash to an employee, Noreen Wong, issuing a three-month, 7% note. Interest is due at the beginning of each month, starting August 1. Aug. 1 Received the interest due from Ms. Wong. Sept. 1 Received the interest due from Ms. Wong. Oct. 1 Received payment in full for the employee note from Ms. Wong. Nov. 1 Wrote off the Blackstone note because Blackstone defaulted. Future payment is not expected. Record the above transactions for Marx Limited. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually if no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record entries in…arrow_forward

- Flounder, Inc. issued a $115,000, 4-year, 12% note at face value to Flint Hills Bank on January 1, 2025, and received $115,000 cash. The note requires annual interest payments each December 31. Prepare Flounder's journal entries to record (a) the issuance of the note and (b) the December 31 interest payment.arrow_forwardQuestion. Jamaica Corporation carried out the following transactions involving note payable. During the fiscal year ended December 31, 2020. Aug 6 Borrowed $ 15,200 from Tony Stark, issuing to him a 45 da, 14% note payable. Sept. 16 Purchased office equipment from Ikea Company. The invoice amount was $18,800 and Ikea Company agreed to accept as full payment a 3-month, 15% note for the invoice amount. Sept. 20 Paid Tony Stark note plus accrued interest. Nov.1 Borrowed $ 2,35,000 from Nation Commercial Bank at an interest rate of 12% per annum; signed a 90-days note payable for $ 2,42,256, which included a $7,056 interest charge in the face amount. Dec.1 Purchased merchandise in the amount of $13,000 from Stephens & Co. Gave in settlement a 60-day note nearing interest at 15% (Perpetual inventory system is deployed). Dec. 16 The $18,800 note payable to Ikea Company matured today. Paid the interest accrued and issued new 30-days, 12% note to replace the maturing…arrow_forwardWest County Bank agrees to lend Wildhorse Co. $472000 on January 1. Wildhorse Co. signs a $472000, 6%, 6-month note. What entry will Wildhorse Co. make to pay off the note and interest at maturity assuming that interest has been accrued to June 30? Notes Payable 486160 Cash 486160 Interest Payable 7080 Notes Payable 472000 Interest Expense 7080 Cash 486160 Notes Payable 472000 Interest Payable 14160 Cash 486160 Interest Expense 14160 Notes Payable 472000 Cash 486160arrow_forward

- Presley Supply Co. has the following transaction related to notes receivable during the last 2 months of 2020. Nov. 1 Loaned $30,000 cash to Logan Ransey on a 1-year, 10% note. Dec. 11 Sold goods to be Joe Noland, Inc., receiving a $9,000, 90-day, 8% note. 16 Received a $4,000, 6-month, 9% note in exchange for Jane Brock's outstanding accounts receivable. 31 Accrued interest revenue on all notes receivable. (a) Your Answer Correct Answer (Used) Your answer is partially correct. Journalize the above transactions for Presley Supply Co. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round interest to the nearest dollar.) (b) Date Account Titles and Explanation Nov. 1 Notes Receivable Cash Dec. 11 Notes Receivable Sales Revenue 16 Notes Receivable Accounts Receivable 31 Interest Receivable Interest Revenue eTextbook and Media Solution List of Accounts Debit 30000 9000 4000 667 Credit 30000 9000 4000 667 Attempts: 3 of 3 used Record the…arrow_forwardSelkirk Company obtained a $24,000 note receivable from a customer on January 1, 2021. The note, along with interest at 8%, is due on July 1, 2021. On February 28, 2021, Selkirk discounted the note at Unionville Bank. The bank's discount rate is 10%. Required: Prepare the journal entries required on February 28, 2021, to accrue interest and to record the discounting for Selkirk. Assume that the discounting is accounted for as a sale. (do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.). Tab 1) Record the accrued interest earned. Tab 2) Record the discounting of note receivable. Date General Journal Debit Credit February 28, 2021 ____________________________ ___________ ____________ _____________________________ ____________ ____________…arrow_forwardSarasota Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2017, Sarasota had the following transactions related to notes payable. Sept. 1 Issued a $16,800 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Sarasota uses a perpetual inventory system.) Sept. 30 Recorded accrued interest for the Pippen note. Oct. 1 Issued a $22,800, 10%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Oct. 31 Recorded accrued interest for the Pippen note and the Prime Bank note. Nov. 1 Issued a $27,600 note and paid $8,100 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Nov. 30 Recorded accrued interest for the Pippen note, the Prime Bank…arrow_forward

- Arvan Patel is a customer of Bank's Hardware Store. For Mr. Patel's latest purchase on January 1, 2018, Bank's Hardware issues a note with a principal amount of $560,000, 13% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Bank’s Hardware Store for the following transactions. If an amount box does not require an entry, leave it blank. A. Note issuance. B. Subsequent interest entry on December 31, 2018. C. Honored note entry at maturity on December 31, 2019.arrow_forwardEvergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2024, the following transactions related to receivables occurred: February 28 Sold merchandise to Lennox, Incorporated, for $24,000 and accepted a 8%, 7-month note. 8% is an appropriate rate for this type of note. March 31 Sold merchandise to Maddox Company that had a fair value of $20, 240, and accepted a noninterest-bearing note for which S 22,000 payment is due on March 31, 2025. April 3 Sold merchandise to Carr Company for $20,000 with terms 210/, n30/. Evergreen uses the gross method to account for cash discounts. April 11 Collected the entire amount due from Carr Company April 17 A customer returned merchandise costing $4,500. Evergreen reduced the customer's receivable balance by $6,300, the sales price of the merchandise. Sales retums are recorded by the company as they occur. April 30 Transferred receivables of $63,000 to a factor without recourse. The factor…arrow_forwardBramble Supply Co. has the following transactions related to notes receivable during the last 2 months of 2020. The company does not make entries to accrue interest except at December 31. How would I enter these into a journal? Nov. 1 Loaned $ 13,200 cash to Manny Lopez on a 12-month, 10% note. Dec. 11 Sold goods to Ralph Kremer, Inc., receiving a $ 24,750, 90-day, 8% note. 16 Received a $ 29,100, 180 day, 8% note in exchange for Joe Fernetti’s outstanding accounts receivable. 31 Accrued interest revenue on all notes receivable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education