Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

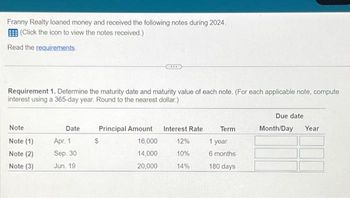

Franny Realty loaned money and received the following notes during 2024. (Click the icon to view the notes received.) Read the requirements. Requirement 1. Determine the maturity date and maturity value of each note. (For each applicable note, compute interest using a 365-day year. Round to the nearest dollar.) Note Note (1) Note (2) Note (3) Date Apr. 1 Sep. 30 Jun. 19 $ Principal Amount 16,000 14,000 20,000 Interest Rate 12% 10% 14% Term 1 year 6 months 180 days Due date Month/Day Year

Transcribed Image Text:Franny Realty loaned money and received the following notes during 2024.

(Click the icon to view the notes received.)

Read the requirements.

Requirement 1. Determine the maturity date and maturity value of each note. (For each applicable note, compute

interest using a 365-day year. Round to the nearest dollar.)

Note

Note (1)

Note (2)

Note (3)

Date

Apr. 1

Sep. 30

Jun. 19

***

Principal Amount

16,000

14,000

20,000

Interest Rate

12%

10%

14%

Term

1 year

6 months

180 days

Due date

Month/Day Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- C.S.Sunland Company had the following transactions involving notes payable. July 1, 2025 Nov. 1, 2025 Dec. 31, 2025 Feb. 1, 2026 Apr. 1, 2026 Borrows $55,950 from First National Bank by signing a 9-month, 8% note. Borrows $59,000 from Lyon County State Bank by signing a 3-month, 6% note. Prepares adjusting entries. Pays principal and interest to Lyon County State Bank. Pays principal and interest to First National Bank. Prepare journal entries for each of the transactions. (List all debit entries before credit entries. Credit accarrow_forwardharrow_forwardHelp me selecting the right answer. Thank youarrow_forward

- please help me dont give answer in image formatarrow_forwardPlease help me with show all calculation thankuarrow_forwardAnalyzing Interest-Bearing and Noninterest-Bearing Notes Consider the following three separate scenarios for a one-year, $250,000 note payable issued on September 1, 2020. Complete the table, using the straight-line method to amortize any discount on note payable. Note: Round your answers to the nearest whole dollar. Cash received upon note issuance Cash paid at maturity date Total interest paid (cash) Interest expense in fiscal year 2020 Interest expense in fiscal year 2021 Amount of liabilities reported on FYE 2020 balance sheet: Note payable (net) Interest payable *FYE: Fiscal year-end $250,000 Note payable 12% Interest due at maturity 12% market rate Borrower's FYE*: Dec. 31 250,000 $ $250,000 Note payable 10% interest due at maturity 10% market rate Borrower's FYE: Nov. 30 $ $250,000 Note payable Noninterest-bearing 12% market rate Borrower's FYE: Dec. 31 $arrow_forward

- 1. Compute the amount of interest during 2021, 2022, and 2023 for the following note receivable: On May 31, 2021, Washington State Bank loaned $260,000 to Paul Mara on a two-year, 12% note. 2. Which party has a(n): (a) note receivable? (b) note payable? (c) interest revenue? (d) interest expense? 3. How much in total would Washington State Bank collect if Paul Mara paid off the note early on November 30, 2021? 1. Compute the amount of interest during 2021, 2022, and 2023 for the following note receivable: On May 31, 2021, Washington State Bank loaned $260,000 to Paul Mara on a two-year, 12% note. (Round the interest amounts to the nearest whole dollar.) Year 2021 2022 2023 Amount of interestarrow_forward1. a) the amt of interest pd in cash every payment period, 1. b) the amt of amorization to be recorded at each interest payment date.(use the straight -line methodarrow_forwardWaterway Company has the following two notes receivable at May 31, 2024, its fiscal year end: 1. 2. $32,400 six-month, 6% note issued January 1, 2024. $12,000 three-month, 4% note issued April 30, 2024. Interest is payable at maturity for both notes. (a) Calculate the accrued interest on both notes at May 31, 2024. (Round answers to the nearest whole dollar, e.g. 5,275.) Note 1: Note 2: Total accrued interest $arrow_forward

- Example 4 (Notes Receivable): On November 30, 2020, James Co. lent money to Scott Co. and issued a 5-month, $120,000, 8% note receivable. Scott paid James the full amount of interest and principal on April 30, 2021. What is the journal entry for James Co. to record the issuance of the note receivable? What is the end-of-year adjusting journal entry for James Co. to record interest revenue earned as of December 31?arrow_forwardRequired information [The following information applies to the questions displayed below.] On August 1, 2019, Colombo Co.'s treasurer signed a note promising to pay $121,200 on December 31, 2019. The proceeds of the note were $115,800. Required: a. Calculate the discount rate used by the lender. (Enter your answer as a percentage rounded to 1 decimal place (l.e., 32.1).) Discount rate %arrow_forwardLewis Company had the following transactions involving notes payable. July 01, 2022 ... Borrows $50,000 from First Bank signing a 9-month, 8% note. Nov 01, 2022 ... Borrows $60,000 from Lyon Bank signing a 3-month, 6% note. Dec 31, 2022 ... Prepares annual adjusting entries. Feb 01, 2023... Pays principal and interest to Lyon Bank. Apr 01, 2023... Pays principal and interest to First National Bank. July 01 2022 Nov 01 2022 Dec 31 2022 Feb 01 2023 Apr 01 2023 On day note is created - is there interest exp? Or just the principal? DR 8% int $ DR 6% int $ CR Total $ 2 diff entries! A single CR to for each entry. Each entry pays note principal (can't be more), PLUS interest (and any publ from adj). Interest calc: Principal x Interest % = a full years int exp. BUT, notes often less than a full year. "Term" (length) of the note tells how many of the 12 months (or 365 days) apply. Eliminate any Int Pobl if ADJ were needed cuz some INT EXP is 2022, and some is 2023.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education