FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

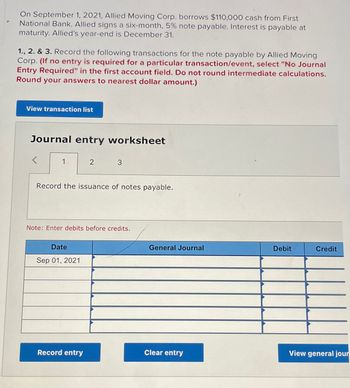

Transcribed Image Text:On September 1, 2021, Allied Moving Corp. borrows $110,000 cash from First

National Bank. Allied signs a six-month, 5% note payable. Interest is payable at

maturity. Allied's year-end is December 31.

1., 2. & 3. Record the following transactions for the note payable by Allied Moving

Corp. (If no entry is required for a particular transaction/event, select "No Journal

Entry Required" in the first account field. Do not round intermediate calculations.

Round your answers to nearest dollar amount.)

View transaction list

Journal entry worksheet

<

1.

2

Record the issuance of notes payable.

Date

Sep 01, 2021

3

Note: Enter debits before credits.

Record entry

General Journal

Clear entry

Debit

Credit

View general jour

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Record the following transactions for Sheridan Company in the general journal. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) .2020 May 1 Dec. 31 Dec. 31 2021 May Received a $27,450, 12-months, 8% note in exchange for Mark Chamber's outstanding accounts receivable. Date Accrued interest on the Chamber note. Closed the interest revenue account. 1 Received principal plus interest on the Chamber note. (No interest has been accrued in 2021.) V > Account Titles and Explanation (To record accrued interest on note.) (To close the interest revenue account.) Debit Credit Iarrow_forwardhello, I need help pleasearrow_forwardRequired Information [The following information applies to the questions displayed below.] Agrico Incorporated accepted a 10-month, 11% (annual rate), $5,650 note from one of its customers on July 15, 2022; Interest is payable with the principal at maturity. b-2. Prepare the journal entry to record collection of the note and Interest at maturity. Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account fleld. Do not round your Intermediate calculation. Round your answers to 2 decimal places. View transaction list View journal entry worksheet No A Event 1 Cash Interest payable Interest revenue Note receivable General Journal Debit Credit Ⓒarrow_forward

- Sarasota Company borrowed $34,800 on November 1, 2025, by signing a $34,800, 9%, 3-month note. Prepare Sarasota's November 1, 2025, entry; the December 31, 2025, annual adjusting entry; and the February 1, 2026, entry. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardOn November 1, 2023, Tommy Tunes accepted a $15,200, 6-month, 4% note from customer Tammy Notune. Required: Prepare the journal entry for the receipt of the note receivable in 2023. Prepare the necessary year-end adjusting journal entry (assume a December 31 year end). Prepare collection of the note receivable at maturity in 2024.arrow_forwardArvan Patel is a customer of Bank's Hardware Store. For Mr. Patel's latest purchase on January 1, 2018, Bank's Hardware issues a note with a principal amount of $490,000, 11% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Bank’s Hardware Store for the following transactions. If an amount box does not require an entry, leave it blank. A. Note issuance. B. Subsequent interest entry on December 31, 2018. C. Honored note entry at maturity on December 31, 2019.arrow_forward

- On October 1, 2020, Ayayai, Inc. assigns $1,263,100 of its accounts receivable to Pina National Bank as collateral for a $718,300 note. The bank assesses a finance charge of 3% of the receivables assigned and interest on the note of 9%.Prepare the October 1 journal entries for both Ayayai and Pina. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)arrow_forwardon november 1, 2018, Downtown Jewelers accepted a 3-month, 15% note for $6,000 in sttlement of an averdue account receivable. the account period ends on december 31. prepare the journal entry to record the accrued interest at the year end.arrow_forwardDanali Corporation borrowed $400,000 on October 1. The note carried a 13 percent interest rate with the principal and interest payable on May 1 of next year. Prepare the following journal entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forward

- 26 )arrow_forwardOn October 1, Dutta Incorporated borrowed $82 million and issued a nine-month promissory note. Interest was discounted at issuance at a 13% discount rate. Prepare the journal entry for the issuance of the note and the appropriate adjusting entry for the note at December 31, the end of the reporting period. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.arrow_forwardLewis Company had the following transactions involving notes payable. July 01, 2022 ... Borrows $50,000 from First Bank signing a 9-month, 8% note. Nov 01, 2022 ... Borrows $60,000 from Lyon Bank signing a 3-month, 6% note. Dec 31, 2022 ... Prepares annual adjusting entries. Feb 01, 2023... Pays principal and interest to Lyon Bank. Apr 01, 2023... Pays principal and interest to First National Bank. July 01 2022 Nov 01 2022 Dec 31 2022 Feb 01 2023 Apr 01 2023 On day note is created - is there interest exp? Or just the principal? DR 8% int $ DR 6% int $ CR Total $ 2 diff entries! A single CR to for each entry. Each entry pays note principal (can't be more), PLUS interest (and any publ from adj). Interest calc: Principal x Interest % = a full years int exp. BUT, notes often less than a full year. "Term" (length) of the note tells how many of the 12 months (or 365 days) apply. Eliminate any Int Pobl if ADJ were needed cuz some INT EXP is 2022, and some is 2023.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education