FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ps://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Flms.mheducati... A

☆

Homework Problems i

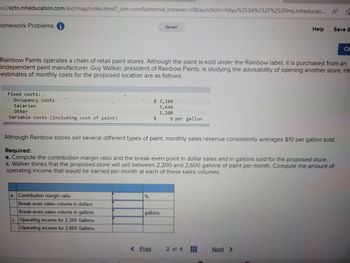

Fixed costs:

Occupancy costs

Salaries

Other

Variable costs (including cost of paint)

Rainbow Paints operates a chain of retail paint stores. Although the paint is sold under the Rainbow label, it is purchased from an

independent paint manufacturer. Guy Walker, president of Rainbow Paints, is studying the advisability of opening another store. His

estimates of monthly costs for the proposed location are as follows.

a. Contribution margin ratio

Break-even sales volume in dollars

Break-even sales volume in gallons

c. Operating income for 2,200 Gallons

Operating income for 2,600 Gallons

%

Saved

$ 3,160

3,640

1,200

$

< Prev.

gallons

Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold.

Required:

a. Compute the contribution margin ratio and the break-even point in dollar sales and in gallons sold for the proposed store.

c. Walker thinks that the proposed store will sell between 2,200 and 2,600 gallons of paint per month. Compute the amount of

operating income that would be earned per month at each of these sales volumes.

6 per gallon

Help

2 of 4

Save &

Next >

Ch

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Deli's Fudge Factory currently makes fudge for retail and mail order customers. It also offers a variety of roasted nuts. Fudge sales have increased over the past year, so Deli is considering outsourcing the roasted nuts and using the roasting space to make additional fudge. A reliable supplier has quoted a price of £0.85 per pound for the roasted nuts. The following amounts reflect the in-house manufacturing costs per pound for the roasted nuts: Direct materials Direct labour Unit-related support costs Batch-related support costs Product-sustaining support costs Facility-sustaining support costs Total cost per pound £0.50 0.06 0.10 0.04 0.05 0.15 £0.90 Required: Should Deli's Fudge Factory outsource the roasted nuts? Why or why not? Discuss all items that should be considered. a.arrow_forwardMesa Verde manufactures unpainted furniture for the do-it-yourself (DIY) market. It currently sells a table for $75. Production costs per unit are $40 variable and $10 fixed. Mesa Verde is considering staining and sealing the table to sell it for $100. Unit variable costs to finish each table are expected to be an additional $19 per table, and fixed costs are expected to be an additional $3 per table.Prepare an analysis showing whether Mesa Verde should sell stained or finished tables. Please solve this if any more information is needed let me know.arrow_forwardDiamond Boot Factory normally sells its specialty boots for $34 a pair. An offer to buy 85 boots for $30 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost Determine the differential income or loss per pair of boots from selling to the organization. Should Diamond Boot Factory accept or reject the special offer?arrow_forward

- Annie's Homemade currently owns one push cart along with a branded tent to facilitate off-site sales. The company is considering buying a second push cart and tent for $4,500 to expand its off-site sales opportunities. Because the company's cargo trailer has the capacity to transport two push carts, there is no need to buy an additional trailer at this time. Annie's provided the following estimates to assist with analyzing the investment in an additional push cart: Additional sales events per month (in June, July, August, and September) Average number of servings sold per event Selling price per serving Ingredients and packaging cost per serving Average time for manager to make one batch of 100 servings of ice cream Average time for employees to pre-package one serving of ice cream Pickup truck diesel fuel, oil, and diesel exhaust fluid expenses Average duration of each event (including drive time) Average number of employees working at each event Hourly wage rate for managers Hourly…arrow_forwardYardwork Tools Corp manufactures garden tools in a factory in Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather than consumer use. Management needs to make a good decision about whether to produce this line in their existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan. Data concerning the decision are as follows: Expected annual sales of tools (in units) 660,000 Average selling price of tools $11 Price quoted by Taiwanese company, in New Taiwanese Dollars (NTD) 27,300 Current exchange rate 9,100 NTD = $1 Variable manufacturing costs $2.85 per unit Incremental annual fixed manufacturing costs associated with the new product line $310,000 Variable selling and distribution costsª $0.50 per unit Annual fixed selling and distribution costsª $250,000 ªSelling and distribution costs are the same regardless of whether the tools…arrow_forwardTupper Inc. and Victory Inc. are two small clothing companies that are considering leasing a dyeing machine together. The companies estimated that in order to meet production, Tupper needs the machine for 950 hours and Victory needs it for 700 hours. If each company rents the machine on its own, the fee will be $85 per hour of usage. If they rent the machine together, the fee will decrease to $80 per hour of usage. Read the requirements. Requirements 1. Calculate Tupper's and Victory's respective share of fees under the stand-alone cost-allocation method. 2. Calculate Tupper's and Victory's respective share of fees using the incremental cost-allocation method assuming (a) Tupper ranked as the primary party and (b) Victory ranked as the primary party. 3. Calculate Tupper's and Victory's respective share of fees using the Shapley value method. 4. Which method would you recommend Tupper and Victory use to share the fees? - Xarrow_forward

- Hannah Ortega is considering expanding her business. She plans to hire a salesperson to cover trade shows. Because of compensation, travel expenses, and booth rental, fixed costs for a trade show are expected to be $10,660. The booth will be open 26 hours during the trade show. Ms. Ortega also plans to add a new product line, ProOffice, which will cost $190 per package. She will continue to sell the existing product, EZRecords, which costs $103 per package. Ms. Ortega believes that the salesperson will spend approximately 16 hours selling EZRecords and 10 hours marketing ProOffice. Required a. Determine the estimated total cost and cost per unit of each product, assuming that the salesperson is able to sell 73 units of EZRecords and 59 units of ProOffice.arrow_forwardPlease help me to solve this problemarrow_forwardWhitmore Glassware makes a variety of drinking glasses and mugs. The company's designers have discovered a market for a 16 ounce mug with college logos. Market research indicates that a mug like this would sell well in the market priced at $26.65. Whitmore only introduces a product if they can an operating profit of 30 percent of costs. Required: What is the highest acceptable manufacturing cost for which Whitmore would be willing to produce the mugs? (Round your answer to 2 decimal places.) Highest acceptable manufacturing costsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education