FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

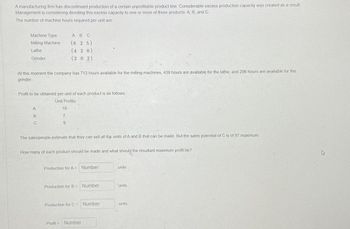

Transcribed Image Text:A manufacturing firm has discontinued production of a certain unprofitable product line. Considerable excess production capacity was created as a result.

Management is considering devoting this excess capacity to one or more of three products: A, B, and C.

The number of machine hours required per unit are

Machine Type

Milling Machine

Lathe

Grinder

At this moment the company has 713 hours available for the milling machines, 439 hours are available for the lathe, and 296 hours are available for the

grinder.

A B C

(625)

(420)

(202)

Profit to be obtained per unit of each product is as follows,

Unit Profits

A

B

C

19

7

9

The salespeople estimate that they can sell all the units of A and B that can be made. But the sales potential of C is of 97 maximum.

How many of each product should be made and what should the resultant maximum profit be?

Production for A = Number

Production for B = Number

Production for C = Number

Profit Number

units

units

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that each year a company normally produces and sells 80,000 units of its only product for $40 per unit. The company's average unit costs at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit $ 9.50 10.00 2.80 5.00 1.70 4.50 $ 33.50 One of the company's raw material suppliers is experiencing a shortage that will last for three months. The company can respond to this shortage in one of two ways over the next three months. It has enough raw materials on hand to enable it to continue operating at 25% of normal output. The second option is to close down the plant for three months. Under this option, the company could avoid 40% of the fixed manufacturing overhead costs that it would ordinarily incur during this three-month period. Furthermore, its fixed selling expenses would continue at 30% of their normal levels during the three-month…arrow_forwardhow can I solve this problem? Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for the month: Direct materials $ 70,000 Direct labor $ 35,500 Variable manufacturing overhead $ 15,400 Fixed manufacturing overhead 28,300 Total manufacturing overhead $ 43,700 Variable selling expense $ 12,200 Fixed selling expense 18,400 Total selling expense $ 30,600 Variable administrative expense $ 4,100 Fixed administrative expense 25,200 Total administrative expense $ 29,300 Required: 1. With respect to cost classifications for preparing financial statements: a. What is the total product cost? b. What is the total period cost? 2. With respect to cost classifications for assigning costs to cost objects: a. What is total direct manufacturing cost? b. What is the total indirect manufacturing…arrow_forwardKilmer Company's customer demand for its only product exceeds its manufacturing capacity. The company provided the following information for the machine whose limited capacity is prohibiting the company from producing and selling additional units: Actual run time this week Machine time available per week Actual run rate this week Ideal run rate Defect-free output this week Total output this week (including defects) 1-a. Utilization rate 1-b. Efficiency rate. 1-c. Quality rate 1-d. Overall equipment effectiveness 13,370 minutes 19, 100 minutes 2-a. Utilization loss in units 2-b. Efficiency loss in units 2-c. Quality loss in units 8.00 units per minute 10 units per minute. Required: 1. and 2. With respect to the company's overall equipment effectiveness, calculate the following: Note: Do not round intermediate calculations. Round final answers to 2 decimal places and "Units" answers to the nearest whole number. 64,176 units 106,960 unitsarrow_forward

- Assigning Costs to Activities, Resource Drivers The receiving department has three activities: unloading, counting goods, and inspecting. Unloading uses a forklift that is leased for $15,000 per year. The forklift is used only for unloading. The fuel for the forklift is $3,600 per year. Other operating costs (maintenance) for the forklift total $1,500 per year. Inspection uses some special testing equipment that has depreciation of $1,200 per year and an operating cost of $750. Receiving has three employees who have an average salary of $50,000 per year. The work distribution matrix for the receiving personnel is as follows: Activity Percentage of Time on Each Activity Unloading 40% Counting 25 Inspecting 35 No other resources are used for these activities. Required: 1. Calculate the cost of each activity. Unloading $fill in the blank 1 Counting $fill in the blank 2 Inspecting $fill in the blank 3 2. Explain the two methods used to assign costs to activities.arrow_forwardThe management of Bonga Corporation is considering dropping product D74F. Data from the company's accounting system for this product for last year appear below: Sales $936,000 Variable expenses $412,000 Fixed manufacturing expenses $350,000 Fixed selling and administrative expenses $257,000 All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $214,000 of the fixed manufacturing expenses and $125,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued. What would be the financial advantage (disadvantage) from dropping product D74F?arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 60,000 units per year is: Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expense Fixed selling and administrative expense The normal selling price is $21 per unit. The company's capacity is 75,000 units per year. An order has been received from a mail-order house for 15,000 units at a special price of $14.00 per unit. This order would not affect regular sales or total fixed costs. $ 5.10 $ 3.80 $ 1.00 $ 4.20 $ 1.50 $ 2.40 Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior…arrow_forwardI need help with this one please thank youarrow_forwardDelta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 105,600 units per year is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses The normal selling price is $19.00 per unit. The company's capacity is 123,600 units per year. An order has been received from a mail- order house for 1,500 units at a special price of $16.00 per unit. This order would not affect regular sales or the company's total fixed costs. $ 1.80 $3.00 $ 0.60 $4.25 $ 1.80 $2.00 Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this product that were produced last year and that are inferior to the current model. The units must be sold through regular channels…arrow_forward

- Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 60,000 units per year is: Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expense Fixed selling and administrative expense The normal selling price is $21 per unit. The company's capacity is 75,000 units per year. An order has been received from a mail-order house for 15,000 units at a special price of $14.00 per unit. This order would not affect regular sales or total fixed costs. $ 5.10 $ 3.80 $ 1.00 $ 4.20 $ 1.50 $ 2.40 Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior…arrow_forward[The following information applies to the questions displayed below.] Burchard Company sold 40,000 units of its only product for $17.00 per unit this year. Manufacturing and selling the product required $310,000 of fixed costs. Its per unit variable costs follow. Direct materials Direct labor Variable overhead costs i Variable selling and administrative costs $4.50 3.50 0.45 0.25 For the next year, management will use a new material, which will reduce direct materials costs to $2.25 per unit and reduce direct labor costs to $1.75 per unit. Sales, total fixed costs, variable overhead costs per unit, and variable selling and administrative costs per unit will not change. Management is also considering raising its selling price to $20.40 per unit, which would decrease unit sales volume to 38,000 units. Problem 21-5A (Algo) Part 1. Required: 1. Compute the contribution margin per unit from (a) using the new material and (b) using the new material and increasing the selling price. (Round…arrow_forwardNakuru Manufacturing limited operates at normal capacity. It manufactures 800,000units of a product per year. The unit cost manufacturing at normal capacity is as follows:Kshs.Direct materials 20.00Direct labour 7.00Variable overheads 5.00Fixed overheads 10.00Selling price 50.00During the next three months. only 40,000 units can be produced and sold. Managementplans to shut down the factory, estimating that the manufacturing overhead can bereduced to Kshs.296,000 for the quarter when the factory is not operating; the fixedoverhead costs are incurred at uniform rate throughout the year. Additional costs offactory shutdown for 3 months are estimates at Kshs.56,OOO.Examine if the factory should shut down for 3 months with relevant calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education