Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer step by step

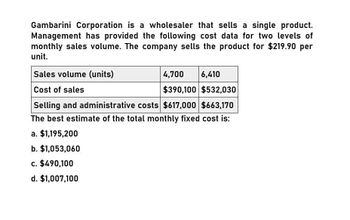

Transcribed Image Text:Gambarini Corporation is a wholesaler that sells a single product.

Management has provided the following cost data for two levels of

monthly sales volume. The company sells the product for $219.90 per

unit.

Sales volume (units)

Cost of sales

4,700 6,410

$390,100 $532,030

Selling and administrative costs $617,000 $663,170

The best estimate of the total monthly fixed cost is:

a. $1,195,200

b. $1,053,060

c. $490,100

d. $1,007,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Starling Co. manufactures one product with a selling price of 18 and variable cost of 12. Starlings total annual fixed costs are 38,400. If operating income last year was 28,800, what was the number of units Starling sold? a. 4,800 b. 6,400 c. 5,600 d. 11,200arrow_forwardWest Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forwardCadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.arrow_forward

- Lotts Company produces and sells one product. The selling price is 10, and the unit variable cost is 6. Total fixed cost is 10,000. Required: 1. Prepare a CVP graph with Units Sold as the horizontal axis and Dollars as the vertical axis. Label the break-even point on the horizontal axis. 2. Prepare CVP graphs for each of the following independent scenarios: (a) Fixed cost increases by 5,000, (b) Unit variable cost increases to 7, (c) Unit selling price increases to 12, and (d) Fixed cost increases by 5,000 and unit variable cost is 7.arrow_forwardlacob Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $153.00 per unit. Sales volume (units) Cost of sales Selling and administrative costs The best estimate of the total contribution margin when 13,360 units are sold is: Multiple Choice O O $755,310 $641,280 $338,770 $430,850 12,400 $ 954,800 $ 688,000 13,590 $ 1,046,430 $ 721,320arrow_forwardJenna Corporation sells a single product. Management has provided the following data for two levels of monthly sales volume. The company sells the product for $172.50 per unit. Sales Volume in Units 4,000 5,000 Cost of Sales (COS) $307,600 $384,500 Selling, General & Administrative Costs (SG&A) $321,200 $337,000 Selling Price Per Unit $173 Total costs for these cost categories and may include both Fixed and Variable costs. HINT: See high-low analysis. 1. Calculate the total contribution margin when 4,300 units are sold. 2. What is the breakeven point in Sales dollars if Advertising (a fixed SG&A cost) is increased by $40,000? Please show calculations.arrow_forward

- Bacob Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $103.40 per unit. Sales volume (units) Cost of sales Selling and administrative costs O $213,590 The best estimate of the total contribution margin when 5,300 units are sold is: O $41,340 O $133,560 5,000 $315,500 $ 162,500 $56,710 6,000 $378,600 $177,600arrow_forwardMienfoo Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume: Sales volume (units) 9,500 11,490 Cost of sales P 731,500 P 884,730 Selling and administrative costs P 696,000 P 739,780 The company sells the product for P134.00 per unit. The best estimate of the TOTAL CONTRIBUTION MARGIN when 10,070 units are sold is Parrow_forwardMisdrea Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume: Sales volume (units) 5,000 6,000 Cost of sales ₱ 315,500 ₱ 378,600 Selling and administrative costs ₱ 162,500 ₱ 177,600 The company sells the product for ₱103.40 per unit. The best estimate of the TOTAL VARIABLE COSTS when 5,300 units are sold is ₱________________arrow_forward

- Frymire Corporation produces and sells a single product. Data concerning that product appear below: Selling price per unit $240.00 Variable expense per unit $79.20 Fixed expense per month $1,019,472 Assume the company's monthly target profit is $46,000. The dollar sales to attain that target profit is closest to: a. $3,228,703 b. $1,961,477 c. $1,590,257 d. $1,065,472arrow_forwardMienfoo Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume: Sales volume (units) 9,500 11,490 Cost of sales ₱ 731,500 ₱ 884,730 Selling and administrative costs ₱ 696,000 ₱ 739,780 The company sells the product for ₱134.00 per unit. The best estimate of the TOTAL CONTRIBUTION MARGIN when 10,070 units are sold is ₱_________________arrow_forwardNorthenscold Company sells several products. Information of average revenue and costs are as follows: Selling price per unit $20.00 Variable costs per unit: Direct materials $4.00 Direct manufacturing labor $2.00 ABC cost per unit $0.50 Fixed MOH $0.40 Variable MOH $0.30 Selling costs $2.00 Annual fixed costs $96,000 Calculate the number of units Northenscold's must sell to yield a profit of $144,000. (round to nearest whole unit).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning