Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Provide answer

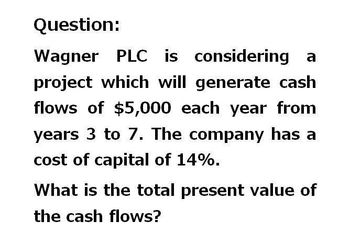

Transcribed Image Text:Question:

Wagner PLC is considering a

project which will generate cash

flows of $5,000 each year from

years 3 to 7. The company has a

cost of capital of 14%.

What is the total present value of

the cash flows?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The table below gives the expected cash inflows of a firm for a period of 9 years. Time 3 6 9 Cash inflow (£) 45000 90000 120000 Assume the present value of the cash outflows is £87000, and the applicable cost of capital is 13%. Calculate the (a) Future value of the cash inflows (b) Modified internal rate of return (MIRR)arrow_forwardFind the present value of the streams of cash flows shown in the following table. Assume that the firm's opportunity cost is 12%. A B C Year Cash Flow Year Cash Flow Year Cash Flow 1 -$2,000 1 $ 10,000 1-5 $ 10,000/yr 2345 5 2 3,000 2-5 5,000/yr 6-10 8,000/yr 4,000 6 7,000 6,000 8,000arrow_forwardFind the net present value (NPV) for the following series of future cash flows, assuming the company’s cost of capital is 10.19 percent. The initial outlay is $471,448. Year 1: 191,637 Year 2: 128,236 Year 3: 161,255 Year 4: 138,369 Year 5: 190,517 Round the answer to two decimal places in percentage form.arrow_forward

- Brans Co. is considering a $270,000 investment, which will provide net returns of $110,000, $140,000, and $220,000 in the second, third, and fourth yearS, respectively. The company has a payback rule of 3 years. Should the company undertake the investment? Use the following table: Cumulative Cash Flow Cash Cash Net Cash Year Outflow Inflow Flow a. No O b. Yesarrow_forwardFind teh present value of the streams of cash flows shown in the following table. Assume that the firms opportunity cost is 14% A: Year Cash Flow 1 -$2100 2 2900 3 4000 4 5900 5 8200 B: Year Cash Flow 1 $9000 2-5 $5000/yr 6 $7200 C: Year Cash Flow 1-5 $12000/yr 6-10 $8000/yr The presevent vaule of stream A, B, and Carrow_forwardThe free cash flows (in millions) shown below are forecast by Simmons Inc. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions? Year: 1 2 3 Free cash flow: −$20 $42 $45 $680 $648 $617 $586 $714arrow_forward

- The free cash flows (in millions) shown below are forecast by Simmons Inc. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions? Year: 1 Free Cash Flow: -$20, Year 2 Free Cash Flow: $44, Year 3 Free Cah Flow: $47.arrow_forwardConsider the following data (be careful there might be some "unnecessary" information). EBIT = 176 Interest expense = 10 Tax rate = 30% Depreciation = 38 Net working capital = 30 Increase in net working capital = 10 Beginning of period Net PP&E = 50 Capex = 16 What is the free cash flow of the firm that year?arrow_forwardThe free cash flows (in millions) shown below are forecast by Simmons Inc. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions? Years 1 2 3 Free cash flow: Year 1- $-20, Year 2- $42, Year 3- $45arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you