Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

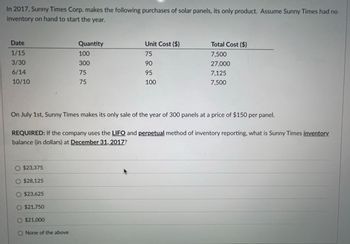

Transcribed Image Text:In 2017, Sunny Times Corp. makes the following purchases of solar panels, its only product. Assume Sunny Times had no

inventory on hand to start the year.

Date

Quantity

Unit Cost ($)

Total Cost ($)

1/15

100

75

7,500

3/30

300

90

27,000

6/14

75

10/10

75

95

100

7,125

7,500

On July 1st, Sunny Times makes its only sale of the year of 300 panels at a price of $150 per panel.

REQUIRED: If the company uses the LIFO and perpetual method of inventory reporting, what is Sunny Times inventory.

balance (in dollars) at December 31, 2017?

O $23,375

O $28,125

$23,625

$21,750

$21,000

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- [The following information applies to the questions displayed below.] The Shirt Shop had the following transactions for T-shirts for 2018, its first year of operations: Jan. 20 Purchased 400 units @ $ 8 = $ 3,200 Apr. 21 Purchased 200 units @ $ 10 = 2,000 July 25 Purchased 280 units @ $ 13 = 3,640 Sept. 19 Purchased 90 units @ $ 15 = 1,350 During the year, The Shirt Shop sold 810 T-shirts for $20 each. Requireda. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. (Round intermediate calculations to 2 decimal places and final answers to nearest whole dollar amount.) b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions.arrow_forwardSports Haven keeps an inventory of FITBIT Wearable Technology. Assume an inventory of 35 FitBits at the beginning of the year at a cost of $44.32 each. Additional FitBits were purchased as follows: 15 at $45.50 each on March 22, 30 at $45.80 each on May 2, 10 at $46.20 each on July 14, and 40 at $43.90 each on September 9. Use FIFO to determine the cost of the ending inventory. Assume 32 FitBits in inventory at the end of the year.arrow_forwardThe following data was obtained from the records of ABC Inc., for the current year. Sales during the year were 210 units. Jan 1, 2021 Beginning Inventory 80 units at $8 Jan 11, 2021 Purchases 65 units at $10 Jan 23, 2021 Purchases 55 units at $ 12 January 31 Purchases 53 units at $14 IF THE TAX RATE IS 30%, HOW MUCH IN TAXES WILL ABC SAVE IN THE CURRENT YEAR IF THEY CHOOSE TO USE LIFO INSTEAD OF FIFO?arrow_forward

- Sports Haven keeps an inventory of FITBIT Wearable Technology. Assume an inventory of 35 FitBits at the beginning of the year at a cost of $44.32 each. Additional FitBits were purchased as follows: 15 at $45.50 each on March 22, 30 at $45.80 each on May 2, 10 at $46.20 each on July 14, and 40 at $43.90 each on September 9. Use LIFO to determine the cost of the ending inventory. Assume 32 FitBits in inventory at the end of the year.arrow_forwardNathan's Grills, Inc., imports and sells premium-quality gas grills. The company had the following layers in its LIFO inventory at January 1, 2017, at which time the replacement cost of the inventory was $675 per unit. Year LIFO layer added: Units: Unit Cost: 2014 50 $450 2015 40 $500 2016 60 $600 The replacement cost of grills remained constant throughout 2017. Nathan's sold 275 units during 2017. The company established the selling price of each unit by doubling its replacement cost at the time of sale. Required: 1. Determine gross margin and the gross margin percentage for 2017 assuming that Nathan's Grills purchased 280 units during the year. 2. Determine gross margin and the gross margin percentage for 2017 assuming that Nathan's…arrow_forwardHelp me to solve this Question, please.arrow_forward

- Sports Haven keeps an inventory of FITBIT Wearable Technology. Assume an inventory of 35 FitBits at the beginning of the year at a cost of $44.32 each. Additional FitBits were purchased as follows: 15 at $45.50 each on March 22, 30 at $45.80 each on May 2, 10 at $46.20 each on July 14, and 40 at $43.90 each on September 9. Refer to the previous problem's answer. What was the Cost of Goods Sold (COGS)?arrow_forwardOn July 1st. Comfort Furnishings purchased all the remaining inventory of a competitor for $100,000 when their competitor, Lazy Days, went out of business. The products and their estimated selling price for each listed below. Estimated Selling Price Per Unit Sofas Recliners Tables Chairs Maku 200 600 100 Qty 150 $400 $220 $130 $85 1. What is the amount of Gross Profit that Comfort will realize if they sell half of the sofas (100 units) in July? 2. What should the chairs be valued at in Comfort's ending inventory as of 7/31 if 100 chairs were sold during July?arrow_forwardDream Big Pillow Co. pays 65% of its purchases in the month of purchase, 30% the month after the purchase, and 5% in the second month following the purchase. It made the following purchases at the end of 2017 and the beginning of 2018:arrow_forward

- Record the journal entry for each of the following transactions. Glow Industries purchases 750 strobe lights at $23 per light from a manufacturer on April 20. The terms of purchase are 10/15, n/40, invoice dated April 20. On April 22, Glow discovers 100 of the lights are the wrong model and is granted an allowance of $8 per light for the error. On April 30, Glow pays for the lights, less the allowance.arrow_forwardSky Probe sells state-of-the-art telescopes to individuals and organizations interested in studying the solar system. At December 31 last year, the company’s inventory amounted to $250,000. Dur-ing the first week of January this year, the company made only one purchase and one sale. These transactions were as follows:Jan. 2 Sold one telescope costing $90,000 to Central State University for cash, $117,000.Jan. 5 Purchased merchandise on account from Lunar Optics, $50,000. Terms, net 30 days.a. Prepare journal entries to record these transactions assuming that Sky Probe uses the perpetualinventory system. Use separate entries to record the sales revenue and the cost of goods soldfor the sale on January 2.b. Compute the balance of the Inventory account on January 7. c. Prepare journal entries to record the two transactions, assuming that Sky Probe uses the peri-odic inventory system. d. Compute the cost of goods sold for the first week of January assuming use of a periodic inven-tory…arrow_forwardDream Big Pillow Co., pays 65% of its purchases in the month of purchase, 30% the month after the purchase, and 5% in the second month following the purchase. It made the following purchases at the end of 2017 and the beginning of 2018: Nov. 2017 Dec. 2017 Jan. 2018 Feb. 2018 Mar. 2018 $61,000 $51,000 $37,000 $38,000 $46,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College