FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

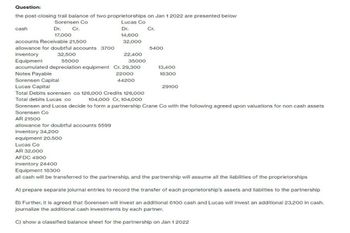

Transcribed Image Text:Question:

the post-closing trail balance of two proprietorships on Jan 1 2022 are presented below

Sorensen Co

Lucas Co

cash

Dr.

17,000

Cr.

Dr.

Cr.

14,600

accounts Receivable 21,500

32,000

allowance for doubtful accounts 3700

5400

inventory

32,500

22,400

Equipment

55000

35000

accumulated depreciation equipment Cr. 29,300

Notes Payable

Sorensen Capital

Lucas Capital

Total debits Lucas co

22000

44200

13,400

18300

29100

Total Debits sorensen co 126,000 Credits 126,000

104,000 Cr, 104,000

Sorensen and Lucss decide to form a partnership Crane Co with the following agreed upon valuations for non cash assets

Sorensen Co

AR 21500

allowance for doubtful accounts 5599

inventory 34,200

equipment 20.500

Lucas Co

AR 32,000

AFDC 4900

inventory 24400

Equipment 18300

all cash will be transferred to the partnership, and the partnership will assume all the liabilities of the proprietorships

A) prepare separate joiurnal entries to record the transfer of each proprietorship's assets and liabilties to the partnership

B) Further, it is agreed that Sorensen will invest an additional 6100 cash and Lucas will invest an additional 23,200 in cash.

journalize the additional cash investments by each partner.

C) show a classified balance sheet for the partnership on Jan 1 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compute RNOA with Disaggregation Refer to the balance sheet information below for Home Depot. $ millions Feb. 3, 2019 Jan. 28, 2018 Operating assets $9,940 $9,636 Nonoperating assets 419 846 Total assets $10,359 $10,482 Operating liabilities $3,926 $3,777 Nonoperating liabilities 6,874 6,362 Total liabilities $10,800 $10,139 Net sales $25,471 Operating expense before tax 21,815 Net operating profit before tax (NOPBT) 3,656 Other expense 229 Income before tax 3,427 Tax expense 809 Net income $2,618 a. Compute return on net operating assets (RNOA). Assume a statutory tax rate of 22%. Note: 1. Select the appropriate numerator and denominator used to compute RNOA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute 2018 RNOA. Numerator Denominator RNOA Answer Answer Answer Answer b. Disaggregate RNOA into components of profitability (NOPM) and productivity (NOAT). Assume a…arrow_forwardPlease Introduction and explanation please sir urgently answer please without plagiarism pleasearrow_forwardSubject/Course: Financial Accounting.arrow_forward

- Solve all questions otherwise leave itarrow_forwardPlease do not give solution in image format thankuarrow_forwardSelected accounts from Han Corporation’s trial balance are as follows. Prepare a partial balance sheet listing only the Fixed Assets section. Han Corporation Abbreviated Trial Balance December 31, 2020 Account Name (Acct. #) Debit Balances Credit Balances Cash 150,000 Short-term Marketable Securities 145,000 Accounts Receivable 26,000 Inventories 90,000 Other Current Assets 10,000 Land 350,000 Buildings 300,000 Accumulated Depreciation: Buildings 40,000 Equipment 145,000 Accumulated Depreciation: Equipment 150,000 Goodwill 40,000 Other Intangible Assets 20,000arrow_forward

- What is the income before the income statement? Cheyenne Corp's unadjusted trial balance at December 1, 2022, is presented below. Cash $20,100 Accounts Receivable 38,600 Notes Receivable 11,000 Interest Receivable 0 Inventory 34,700 Prepaid Insurance 3,600 Land 20,900 Buildings 141,000 Equipment 59,000 Patent 9,900 Allowance for Doubtful Accounts $500 Accumulated Depreciation-Buildings 47,000 Accumulated Depreciation-Equipment 23,600 Accounts Payable 25,300 Salaries and Wages Payable 0 Notes Payable (due April 30, 2023) 10,500 Income Taxes Payable 0 Interest Payable 0 Notes Payable (due in 2028) 32,100 Common Stock 49,000 Retained Earnings 92,700 Dividends 12,000 Sales Revenue 919,000 Interest Revenue 0 Gain on Disposal of Plant Assets 0 Bad Debt Expense 0 Cost of Goods Sold 674,000 Depreciation Expense 0 Income Tax Expense 0 Insurance Expense 0 Interest Expense 0 Other Operating Expenses 65,900 Amortization Expense 0 Salaries and Wages Expense…arrow_forwardThe balance sheet data of Pina Company at the end of 2025 and 2024 follow. 2025 2024 Cash $29,900 $35,300 Accounts receivable (net) 54,900 45,300 Inventory 64,400 45,400 Prepaid expenses 15,000 25,100 Equipment 90,900 75,200 Accumulated depreciatich-equipment (18,180) (8,100) Land 70,600 40,200 $307,520 $258,400 Accounts payable $65,000 $52,200 Accrued expenses 14,800 17,800 Notes payable-bank, long-term -0- 22,700 Bonds payable 30,200 -0- Common stock, $10 par 187,900 157,500 Retained earnings 9,620 8,200 $307,520 $258,400 Land was acquired for $30,400 in exchange for common stock, par $30,400, during the year; all equipment purchased was for cash. Equipment costing $13,000 was sold for $3,100; book value of the equipment was $6,000. Cash dividends of $10,000 were declared and paid during the year. Compute net cash provided (used) by: (Show amounts that decrease cash flow with either a - sign e.g. -12,000 or in parenthesis e.g. (12,000).) a. Net Cash by operating activities. $ b. Net…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education