FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

No work shown required

Transcribed Image Text:Assume that Oslo Corp. acquires 30% of Celdon Corp. for $360,000 on January 1, 2021. The journal entry on Oslo's books assuming Celdon's

net income for 2021 was $600,000 would include a debit to

А.

Cash for $600,000.

B. Cash for $180,000.

C. Investments for $180,000.

D.

No entry is necessary.

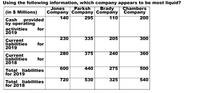

Transcribed Image Text:Using the following information, which company appears to be most liquid?

Parksh

Company Company Company

295

(in $ Millions)

Jones

Brady

Chambers

Company

140

110

200

Cash

by operåting

activities

2019

provided

for

230

335

205

300

Current

liabilities

2019

for

280

375

240

360

Current

liabilities

2018

for

600

440

275

500

Total liabilities

for 2019

720

530

325

540

Total liabilities

for 2018

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following is an example of a contra account: Select one: Equipment Equipment expense Accounts payable Accumulated depreciationarrow_forwardWhat are the steps in determining whether or not to compute impairment for PP&E?arrow_forwardAll of the following statements regarding asset impairments are true EXCEPT which one? O After recording the impairment loss, the reduced carrying amount of the asset held for use becomes its new cost basis O An impaired asset held for disposal may not be written up O An impairment loss for an asset held for use may not be restored. An impaired asset held for disposal is treated like inventory, and therefore should be reported at the lower-of-cost or net-reaalizable value.arrow_forward

- Under the completed-contract method, Question 16 options: a revenue, cost, and gross profit are recognized at the time the contract is completed. b revenue and cost are recognized during the production cycle, but gross profit recognition is deferred until the contract is completed. c revenue, cost, and gross profit are recognized during the production cycle. d None of these answers are correct.arrow_forwardExplain the process of ‘impairment of an asset’ and its definition? Explain how to account for an impairment of an item of property, plant and equipment bearrow_forwardDescribe how the recognition and measurement requirements for Intangible Assets under AASB 138 differ from the recognition and measurement principles outlined for assets under the (revised) Conceptual Framework and explain the reasons why these differences may exist. Refer to AASB 138 and Conceptual Framework where appropriate (max. 250 words).arrow_forward

- 1. Find the proper FASB ASC citation that provides guidance on the measurement of an impairment loss for a long-lived asset. (The citation must follow xxx-xx-xx-xx or xxx-xx-xx-x format)arrow_forwardWhich of the following costs is not relevant whenconsidering the closure of a department within afactory?direct materialsfixed overheadsvariable overheadsdirect labourarrow_forwardIdentify the control document for materials flow when a materials requisition slip is not used.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education