Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Solution to both Question

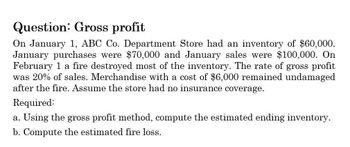

Transcribed Image Text:Question: Gross profit

On January 1, ABC Co. Department Store had an inventory of $60,000.

January purchases were $70,000 and January sales were $100,000. On

February 1 a fire destroyed most of the inventory. The rate of gross profit

was 20% of sales. Merchandise with a cost of $6,000 remained undamaged

after the fire. Assume the store had no insurance coverage.

Required:

a. Using the gross profit method, compute the estimated ending inventory.

b. Compute the estimated fire loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The merchandise inventory was destroyed by fire on December 13. The following data were obtained from the accounting records: Merchandise inventory $ 350,000 Jan. 1 Jan. 1-Dec. 31 Purchases (net) 2,950,000 Sales 4,440,000 Estimated gross profit rate 35% a. Estimate the cost of the merchandise destroyed. b. Briefly describe the situations in which the gross profit method is useful.arrow_forwardOn April 15 of the current year, a fire destroyed the entire uninsured inventory of a retail store. The following data are available: Sales, January 1 through April 15 $600,000 Inventory, January 1 100,000 Purchases, January 1 through April 15 500,000 Markup on cost 25% The amount of the inventory loss is estimated to be O a. $120,000. O b. $100,000. O C. $150,000. O d. $60,000. Quitar mi elección ere to search 近arrow_forwardOn April 15 of the current year, a fire destroyed the entire uninsured inventory of a retail store. The following data are available: Sales, January 1 through April 15 $573000 Inventory, January 1 91000 Purchases, January 1 through April 15 477500 20% Markup on cost The amount of the inventory loss is estimated to be • $91000. O $109200. O $95500. O $45500.arrow_forward

- What amount of inventory was lost in the fire?arrow_forwardThe following information is available for October for Norton Company. Beginning inventory Net purchases Net sales 4,00,000 12,00,000 24,00,000 66.67% Percentage markup on cost A fire destroyed Norton's October 31 inventory leaving undamaged inventory with a cost of 24,000. Using the gross profit method the estimated ending inventory destroyed by fire isarrow_forwardNonearrow_forward

- Do not give image formatarrow_forwardHelparrow_forwardEstimating Inventory Loss Using Gross Profit Method On November 15, a fire destroyed Youngstown Inc.'s warehouse where inventory is stored. It is estimated that $12,000 can be realized from sale of usable but damaged inventory. The accounting records concerning inventory reveal the following. Gross profit averaged 35% of net sales. Inventory at Nov. 1 Purchases from Nov. 1 to Nov. 15 Net sales from Nov. 1 to Nov. 15 $144,000 168,000 240,000 Required a. Calculate the estimated loss of inventory using the gross profit method. $ 144,000 b. Assume instead that the markup is 25% of cost. Estimate the loss of inventory using the gross profit method. $ 120,000 Xarrow_forward

- 7. The inventory was destroyed by fire on December 31. The following data were obtained from the accounting records:arrow_forwardPlease provide correct answer financial Accountingarrow_forwardjournalize entries for the following related transactions of greenville heating & air company: a. purchased $33,000 of merchandise from foster co., on account terms 2/10, n 30 b. paid the amount owed on the invoice within the discount period. c. Discovered that $6,600 of the purchased in (a) was defective and returned items, receiving credit for $6,468 ($6,600-($6,600 x2%) ).d. purchased $5,400 of merchandise from foster co., on account, terms n/30. e. received a refund from foster co., in (c) less the purchase in d.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College