FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

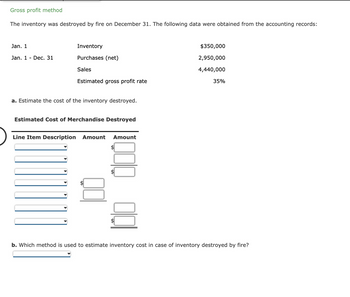

7. The inventory was destroyed by fire on December 31. The following data were obtained from the accounting records:

Transcribed Image Text:Gross profit method

The inventory was destroyed by fire on December 31. The following data were obtained from the accounting records:

Jan. 1

Jan. 1 Dec. 31

Inventory

Purchases (net)

Sales

Estimated gross profit rate

a. Estimate the cost of the inventory destroyed.

Estimated Cost of Merchandise Destroyed

Line Item Description Amount Amount

$

$350,000

2,950,000

4,440,000

35%

b. Which method is used to estimate inventory cost in case of inventory destroyed by fire?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- 2. Compute the July 31 balances of the inventory accounts.arrow_forwardWildhorse Company took a physical inventory on December 31 and determined that goods costing $676,000 were on hand. Not included in the physical count were $9,000 of goods purchased from Sandhill Corporation, f.o.b. shipping point, and $29,000 of goods sold to Ro-Ro Company for $37,000, f.o.b. destination. Both the Sandhill purchase and the Ro-Ro sale were in transit at year-end. What amount should Wildhorse report as its December 31 inventory? December 31 Inventory $ %24arrow_forwardAssume that on September 30, immediately after this balance sheet was prepared, a tornado completely destroyed one of the barns. This barn had a cost of $14,000 and was not insured against this type of disaster. Explain what changes would be required in your September 30 balance sheet to reflect the loss of this barn.arrow_forward

- Exercise 2-25 3 Adjusting and Closing Entries and Post-Closing Trial Balance Below is the trial balance for Boudreaux Company as of December 31. Cash Accounts Receivable. Inventory Prepaid Expenses . Land Plant and Equipment.. Other Assets Accounts Payable. Wages, Interest, and Taxes Payable Unearned Revenue.. Long-Term Debt Other Liabilities Common Stock Retained Earnings.. Dividends. Sales.. Interest Revenue. Cost of Goods Sold.. Selling, General, and Administrative Expenses Interest Expense. Income Tax Expense Totals. Debit $ 72,000 365,000 52,000 36,000 70,000 1,254,000 1,275,000 211,000 1,565,000 615,000 82,000 205,000 $5,802,000 Credit $ 154,000 218,000 42,000 1,190,000 297,000 195,000 915,000 2,762,000 29,000 $5,802,000arrow_forwardLarkspur is trying to determine value of its ending inventory as of Feb 28, 2017, company's year end. Accountant counted everything on the warehouse on Feb 28, ending inventory valuation of 46400. However, they didn't know how to treat the following transactions so they aren't recorded. First column asks, should it be included? Yes or no. Second column the amountarrow_forward(i)The inventory costing $ 150,000 being ordered by customers before the year end was excluded from the ending inventory balance as they are set aside for delivery after year end. The ending balance of inventory as on the statement of financial position was $ 600,000. (ii) Inventory list shows 40 boxes of rice but only 38 boxes were found in the warehouse. (iii) The inventory has a cost of $600,000 and realizable value of $540,000 as the items are outdated. The ending balance of inventory as on the statement of financial position was $ 600,000. Q) For each misstatement above, explain which of the above assertions is violated. (Each assertion can only be used once.) Also, give the relevant audit objective the auditor should focus on when detecting the misstatement if the assertion is "Valuation and Allocation "arrow_forward

- During the taking of its physical inventory on December 31, 20Y4, Barry's Bike Shop incorrectly counted its inventory as $225,870 instead of the correct amount of $179,251. The effect on the balance sheet and income statement would be a. assets overstated by $46,619; retained earnings understated by $46,619; and net income statement understated by $46,619 b. assets overstated by $46,619; retained earnings understated by $46,619; and no effect on the income statement c. assets, retained earnings, and net income all overstated by $46,619 d. assets and retained earnings overstated by $46,619; and net income understated by $46,619arrow_forwardAudit Procedures 1. Select a sample of inventory items in the factory warehouse and trace each item to the inventory count sheets to determine whether it has been included and whether the quantity and description are correct. 2. Trace selected quantities from the inventory list to the physical inventory to make sure that it exists and the quantities are the same. 3. Compare the quantities on hand and unit prices on this year's inventory count sheets with those in the preceding year as a test for large differences. 4. Read the footnote disclosures related to the company's accounting policies for valu- ing inventory to make sure the information provided correctly reflects the method used to value inventory. 5. Test the extension of unit prices times quantity on the inventory list for a sample of inventory items, test foot the list, and compare the total to the general ledger. that 6. Send letters directly to third parties who hold the client's inventory, and request they respond directly…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education