ECON MACRO

5th Edition

ISBN: 9781337000529

Author: William A. McEachern

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

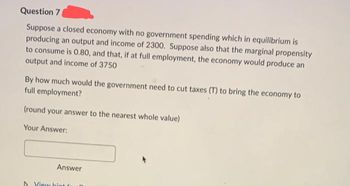

Transcribed Image Text:Question 7.

Suppose a closed economy with no government spending which in equilibrium is

producing an output and income of 2300. Suppose also that the marginal propensity

to consume is 0.80, and that, if at full employment, the economy would produce an

output and income of 3750

By how much would the government need to cut taxes (T) to bring the economy to

full employment?

(round your answer to the nearest whole value)

Your Answer:

Answer

View hint fr

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Under what general macroeconomic circumstances might a government use expansionary fiscal policy? When might it use contractionary fiscal policy?arrow_forwardWhat would happen if expansionary fiscal policy was implemented in a recession but, due to lag, did not actually take effect until after the economy was back to potential GDP?arrow_forwardFigure 8-23. The figure represents the relationship between the size of a tax and the tax revenue raised by that tax. 6 on4m21 3 Tax Revenue B Tax Size Refer to Figure 8-23. If the economy is at point A on the curve, then a small increase in the tax rate will O increase the deadweight loss of the tax and increase tax revenue. O increase the deadweight loss of the tax and decrease tax revenue. decrease the deadweight loss of the tax and increase tax revenue. O decrease the deadweight loss of the tax and decrease tax revenue.arrow_forward

- If the marginal propensity to consume is 0.75, byhow much would government spending have to rise toincrease output by $1,000 billion? By how muchwould taxes need to decrease to increase output by$1,000 billion?arrow_forwardSuppose a closed economy with no government spending which in equilibrium is producing an output and income of 2500. Suppose also that the marginal propensity to consume is 0.80, and that, if at full employment, the economy would produce an output and income of 3900 By how much would the government need to cut taxes (T) to bring the economy to full employment?arrow_forwardSuppose that due ot a fiscal stimulus, there is an increase in disposable incomes of $100 billion in the first round. Then, $33 billion was spent in consumption from this initial change of the disposable incomes. Following the same marginal propensity to consume, how much is the change in consumption spending in the next round from the $33 billion?arrow_forward

- Please see attachment Answer neatly Show all your work. Based on the above diagram: 1. Calculate MPC? 2. If Private Investment increases by 100, calculate the new level of NI. 3. If full-employment NI is at 3000, by how much should Government spending change? 4. What is the new NI, If 1/2 of those government expenditures are financed through taxes?arrow_forward. Suppose an economy is represented by the following equations.Consumption function C = 100 + 0.8YdPlanned investment I = 38Government spending G = 75Exports EX = 25Imports IM = 0.05YdAutonomous Taxes T = 40Planned aggregate expenditure AE = C + I + G + (EX - IM)a. By using the above information calculate the equilibrium level of income for thiseconomy. b. Calculate the value of expenditure multiplier. c. Suppose that government spending is increased by 5, what will happen to theequilibrium income level?arrow_forwardineim Suppose the government decide to use fiscal policy to close the output gap. The marginal propensity to consume is 0.6 and the output GDP is $150 million Çalculate the minimum change in government spending required to close this output GDParrow_forward

- uèstion 21 pounts The economy is in a recession. The government enacts a policy to increase the real GDP by $10 billion. The MPS is 0.2. Assuming that the agggregate supply curve is horizontal across the range of GDP being considered, by how much should the government change spending or taxes in order to achieve its objective? Show your calculations. e For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt A v x X, Re v 55 OWORDS POWERED 図 田 lili 用arrow_forwardThe marginal propensity to consume (MPC) for this econamy is . and the spending multiplier for this economy is Suppose the govemment in this economy decides to decrease govemment purchases by $250 bilion. The decrease in government purchases will lead to a decrease in income, generating an initial change in consumption equal to second change in consumption equal to This decreases income yet again, causing a The total change in demand resulting from the initial change in government spending is The following graph shows the aggregate demand curve (AD ) for this economy before the change in govemment spending. Use the green line (trangie symbol) to plot the new aggregate demand curve (AD:) after the multiplier effect takes place. For simplioity, assume that there is no "crowding out." Hint: Be sure that the new aggregate demand curve (AD) is paralel to the initial aggregate demand curve (AD). You can see the slope of AD by selecting t on the graph. 540 AD. AD, 130 100 OUTPUT (Tions of…arrow_forward2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning