ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

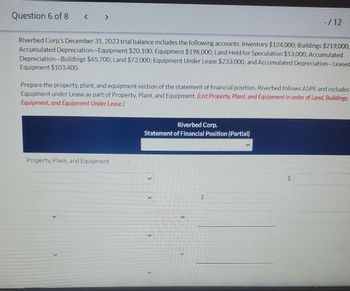

Transcribed Image Text:Question 6 of 8

Riverbed Corp's December 31, 2023 trial balance includes the following accounts: Inventory $124,000; Buildings $219,000;

Accumulated Depreciation Equipment $20,100; Equipment $198,000; Land Held for Speculation $53,000; Accumulated

Depreciation-Buildings $45,700; Land $72,000; Equipment Under Lease $233,000; and Accumulated Depreciation-Leased

Equipment $103,400.

Prepare the property, plant, and equipment section of the statement of financial position. Riverbed follows ASPE and includes

Equipment under Lease as part of Property, Plant, and Equipment. (List Property, Plant, and Equipment in order of Land, Buildings,

Equipment, and Equipment Under Lease.)

Property, Plant, and Equipment

-/12

Riverbed Corp.

Statement of Financial Position (Partial)

5

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Letang Tsipane started a business restaurant called Letang Coffee on 1 May 2023 The following balances and totals were in the General Ledger on 1 May 2023: Capital R 45 000 Trading stock R 38 744 Debtors control R 27 800 Bank R 2008 Sales R 30 586 Cost of sales R 20 389 The following balance occurred in the Debtors ledger on 1 May 2023: T. Jacobs P. Khumalo R 3 000 R 5700 REQUIRED: Record the given transactions in the following Journals: 1. Cash Receipts Journal, with Analysis columns for Analysis of receipts, Bank, Sale Cost of Sales, Debtors control and Sundry accounts; 2. Debtors Journal, with Analysis columns for Sales and Cost of sales 3. Post from the Journals to the following accounts in the General ledger: Capital, Bank, Trading Stock; Debtors Control; Sales, Cost of sales 4. Post to the applicable accounts in the Debtors ledger of Letang Coffee 5. Prepare the List of Debtors. TRANSACTION FOR MAY 2023: 1. Received EFT payment from the owner Letang Tladi for R250 000 as her…arrow_forwardYou are building guest huts at a holiday resort, and you need to choose whether to build your huts out of straw, wood, or brick. Straw is the cheapest but depreciates the most quickly; brick is the most expensive but depreciates least; wood is intermediate. Assume that all types of huts are equally picturesque/functional. They differ only in terms of durability. The cost (and depreciation rates) of the different hut types is: - Brick: £3,500 (10% depreciation) - Wood: £3,000 (15% depreciation) - Straw: £2,500 (20% depreciation) a) The interest rate is 5%, which type of hut should you buy? b) The interest rate is 20%, which type of hut should you buy? c) Intuitively, why were the answers for parts (a) and (b) different? Explain in words.arrow_forward10.16 An asset in the five-year MACRS property class costs $150,000 and has a zero estimated salvage value after six years of use. The asset will generate annual revenues of $320,000 and will require $80,000 in annual labor and $50,000 in annual material expenses. There are no other revenues and expenses. Assume a tax rate of 25%. a. Compute the after-tax cash flows over the project life. b. Compute the NPW at MARR=12%. Is the investment acceptable?arrow_forward

- We are evaluating a project that costs $2,190,000, has a 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 91,200 units per year. Price per unit is $38.97, variable cost per unit is $24.05, and fixed costs are $866,000 per year. The tax rate is 22 percent and we require a return of 11 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within \pm 10 percent. Calculate the best-case and worst -case NPV figures.arrow_forwardUrgent...arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- SGS Golf Academy is evaluating different golf practice equipment. The "Dimple-Max" equipment costs $149,000, has a 4-year life, and costs $9,300 per year to operate. The relevant discount rate is 14 percent. Assume that the straight-line depreciation method is used and that the equipment is fully depreciated to zero. Furthermore, assume the equipment has a salvage value of $21,500 at the end of the project’s life. The relevant tax rate is 22 percent. All cash flows occur at the end of the year. What is the EAC of this equipment? Note: Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardplease,don't provied handwriting solution.arrow_forwardGive the calculations regarding the sinking fund method of depreciation with an interest rate of 12% compounded annually. Find the book value until 10th year and create a table regarding to depreciation. FC= 100,000 SV= 20, 000 n= 8years i=12%arrow_forward

- The asset described below is to be depreciated using sum-of-years-digits depreciation. Determine the amount of depreciation in year four. B = asset cost basis = $15,000 N =6 years S = salvage value $3,000 %3D Choose an answer from one of the letters below: O $1854 O $1,666 O $1714 O $3,200 O $2023arrow_forwardConsider the following project Net cash flow e -225 Period Change in value (economic depreciation) Expected economic income 2 91.55 The internal rate of return is 17%. The NPV, assuming a 17% opportunity cost of capital, is exactly zero. Calculate the expected economic income and economic depreciation in each year. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) 3 253.25 1 Period 2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education