Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting Problem 3.4

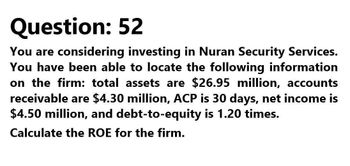

Transcribed Image Text:Question: 52

You are considering investing in Nuran Security Services.

You have been able to locate the following information

on the firm: total assets are $26.95 million, accounts

receivable are $4.30 million, ACP is 30 days, net income is

$4.50 million, and debt-to-equity is 1.20 times.

Calculate the ROE for the firm.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Entrepreneurshiparrow_forwardPlease solve complete in one hourarrow_forwardFill in the Blank Question If the interest rate is 8%, the expected growth rate of a firm for the foreseeable future is 6%, and the firm's current profits are $60 million, then the value of the firm on the ex-dividend date is $ million. (Enter a number in the blank.) 4 Need help? Review these concept resources. UZZIarrow_forward

- Suppose your company wants to place an investment with a private equity firm with an amount of Php 200,000 for 2021. Considering all the risks involved, the prevailing discount rate is 12% and with a revenue stream/dividends below. Should the company invest? Why or why not? Year Cash flow 2022 5,000.00 2023 6,000.00 2024 7,000.00 2025 8,000.00 2026 9,000.00 2027 10,000.00 2028 11,000.00 Determine the following: a. NPV for the period 2022 through 2028; b. Total NPV using manual computation; c. Total NPV using the Excel function; and d. IRR rate.arrow_forwardQ11arrow_forwardPls be as accurate as possible, use excel if you have to and show very clear working. Will upvote correct and accurate answers.arrow_forward

- You are a senior financial analyst of a firm based in Sydney. You have been assigned with the task of training interns who recently joined your firm on how to use the free cash flow model to estimate the value of a company. You have collected data on the following data: Year 2020 2021 2022 2023 2024 Long-term Debt ($M) 56000 57,000 57,000 58,000 60,000 Profits (SM, after tax) 22,000 28,000 26,000 32,000 35,000 Interest ($M, after tax) 1,900 1,950 2,050 2,150 2,275 Working Cap (SM) 20,000 19,000 22,000 30,000 28,000 Depreciation (SM) 36,000 37,000 38,000 38,000 40,000 Cap Spending ($M) 35,150 37,000 41,000 45,000 Cost of equity 0.10 0.11 0.09 0.11 WACC 0.12 0.13 0.13 0.12 Number of equity shares (Million) 3,000 Terminal growth rate 0.06 Using the information you have collected above, perform calculations to explain to interns as to how the following are calculated: i. Free cash flow to firm ii. Free cash to equity iii. method Value of the firm according to the free cash flow to firm…arrow_forwardHelp need, thank you for assistancearrow_forwardGive typing answer with explanation and conclusion 1. If the value of sustainable investing is $171.1 and the discount rate is 8% while the value of non-sustainable investing is $15.7 and the company has a 28.7% probability of being sustainable. What is the expected value today of the company given a 18 year horizon? (Answer to 2 decimal places in $).arrow_forward

- An investment advisor currently has two types of investments available for clients: a conservative investment A that pays 8% per year and investment B of higher risk that pays 14%. Clients may divide their investments between the two to achieve any total return desired between 8% and 14%. However, the higher the desired return, the higher the risk. How should each client listed in the table invest to achieve the desired return? Client 1 Client 2 Client 3 k $21000 $40000 $31000 k, Annual Return Desired $2460 $3860 $3740 k2 Total Investment How much money should Client 1 invest in each account to achieved the desired return? Amount in investment A: Amount in investment B: How much money should Client 2 invest in each account to achieved the desired return? Amount in investment A: Amount in investment B: How much money should Client 3 invest in each account to achieved the desired return? Amount in investment A: Amount in investment B:arrow_forwardYou have the following information about Burgundy Basins, a sink manufacturer. Equity shares outstanding Stock price per share Yield to maturity on debt Book value of interest-bearing debt Coupon interest rate on debt Market value of debt Book value of equity Cost of equity capital Tax rate a. What is the internal rate of return on the investment? Note: Round your answer to 2 decimal places. Internal rate of return 20 million Burgundy is contemplating what for the company is an average-risk investment costing $30 million and promising an annual ATCF of $4.5 million in perpetuity. % $ 35 7.5% $ 330 million 4.0% $225 million $370 million 11.0% 35%arrow_forwardHi, How do I solve these corporate finance problems? Without using Excel Thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning