Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

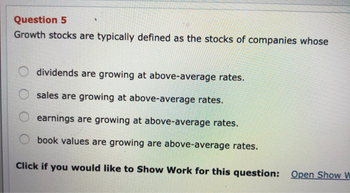

Transcribed Image Text:Question 5

Growth stocks are typically defined as the stocks of companies whose

dividends are growing at above-average rates.

sales are growing at above-average rates.

earnings are growing at above-average rates.

book values are growing are above-average rates.

Click if you would like to Show Work for this question: Open Show W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 18arrow_forwardUsing the constant dividend growth model, determine the percentage price change in a share when the required rate of return decreases from 19 to 17 per cent combined with a decrease in the dividend growth rate from 11 to 9 per cent. Select one: A. fall less than 2% B. rise more than 2%. C. rise less than 3% D. fall more than 2%arrow_forwardPlease provide a step-by-step solution with an explanation.arrow_forward

- If you were an investor considering purchasing the stock of a company and you were concerned about the company's ability to produce income or operating success for a given period of time, which of the following trends would worry you most? O a decreasing inventory turnover ratio an increasing return on common stockholders' equity ratio O a decreasing return on assets ratio an increasing current ratioarrow_forwardA higher growth rate (g) will affect the P/E ratio as follows Question 9 options: 1) Increase the earnings multiplier (P/E ratio) 2) Decrease the earnings multiplier 3) It depends upon the growth rate of the required return of the stock 4) None of the abovearrow_forwardclassified stock founders’ shares American depository receipts (ADRs) Euro stock Yankee stock market price (value), intrinsic (theoretical) value, growth rate, g required rate of return, dividend yield capital gains yield expected rate of return, constant growth model nonconstant growth P/E ratio economic value added (EVA) Define All Wordsarrow_forward

- USE EXCEL and show cell references.arrow_forwardIntro You've estimated the following expected returns for a stock, depending on the strength of the economy: State (s) Probability Expected return Recession -0.02 Normal 0.09 Expansion 0.14 Part 1 What is the expected return for the stock? 3+ decimals Submit 0.2 0.5 0.3 Part 2 What is the standard deviation of returns for the stock? 3+ decimals Submitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education