Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

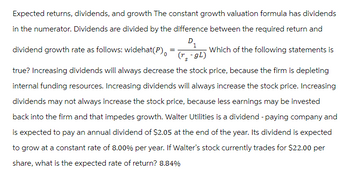

Transcribed Image Text:Expected returns, dividends, and growth The constant growth valuation formula has dividends

in the numerator. Dividends are divided by the difference between the required return and

D₁

1

Which of the following statements is

(r-gL)

dividend growth rate as follows: widehat(P)

true? Increasing dividends will always decrease the stock price, because the firm is depleting

internal funding resources. Increasing dividends will always increase the stock price. Increasing

dividends may not always increase the stock price, because less earnings may be invested

back into the firm and that impedes growth. Walter Utilities is a dividend - paying company and

is expected to pay an annual dividend of $2.05 at the end of the year. Its dividend is expected

to grow at a constant rate of 8.00% per year. If Walter's stock currently trades for $22.00 per

share, what is the expected rate of return? 8.84%

=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Attempts Keep the Highest / 3 6. Expected returns, dividends, and growth The constant growth valuation formula has dividends in the numerator. Dividends are divided by the difference between the required return and dividend growth rate as follows: Po = D₁ (Tx-g) Which of the following statements is true? Increasing dividends will always increase the stock price. ○ Increasing dividends will always decrease the stock price, because the firm is depleting internal funding resources. Increasing dividends may not always increase the stock price, because less earnings may be invested back into the firm and that impedes growth. Walter Utilities is a dividend-paying company and is expected to pay an annual dividend of $2.85 at the end of the year. Its dividend is expected to grow at a constant rate of 7.00% per year. If Walter's stock currently trades for $25.00 per share, what is the expected rate of return? 1,420.00% 710.65% 18.40% 791.20% Which of the following statements will always hold…arrow_forwardWhich statement is NOT correct? Multiple Choice O O O As the payout ratio goes up, the stock price also goes up. DDM can be used to calculate the terminal value. According to DDM, the discount rate should be greater than the growth rate of dividends. According to DDM formula, there is a one period lag between the times of stock price and the dividend payment. If the payout ratio is fixed, the growth rates of earnings and dividends are same.arrow_forwardAccording to the constant dividend growth model, what is the required return on a stock (RE) if the growth rate (g) is zero? Multiple choice question. RE = D1 / P0 RE = D1 – P0 RE = D0 / P0 RE = D1 + P0arrow_forward

- 5. Expected returns, dividends, and growth The constant growth valuation formula is as follows: Po D Is-g Which of the following statements is true? O Increasing dividends will always decrease the stock price, because the firm is depleting internal funding resources. Increasing dividends may not always increase the stock price, because less earnings may be invested back into the firm and that impedes growth. Increasing dividends will always increase the stock price. Walter Utilities is a dividend-paying company and is expected to pay an annual dividend of $0.85 at the end of the year. Its dividend is expected to grow at a constant rate of 9.50% per year. If Walter's stock currently trades for $29.50 per share, then the expected rate of return on the stock is Walter's dividend is expected to grow at a constant growth rate of 9.50% per year. What do you expect to happen to Walter's expected dividend yield in the future? It will increase. It will stay the same. O It will decrease.arrow_forwardWhich of the following statements is true about the constant dividend growth model? Group of answer choices 1. When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to no change in the value of the stock 2. When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to a decreased value of the stock 3. When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to a increased value of the stockarrow_forwardWhich of the following statements is CORRECT? a. The constant growth model takes into consideration the capital gains investors expect to earn on a stock. b. Two firms with the same expected dividend and growth rate must also have the same stock price. c. It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant. d. If a stock has a required rate of return rs = 12%, and if its dividend is expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%. e. The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate. provide an explanation for the choice.arrow_forward

- the dividend growth model may be use to value a stock v=Do(1+g) k-g a. what is the value of a stock if: Do=$2 k==10% g=6% b. what is the value of this stock if the dividend is increased to $3 and the other variables remain constant? c. what is the value os this stock if the required return decline to 7.5 percent and the other variables remain constant? d. what is the value of this stock if the growth rate declines to 4 percent and the other variables remin constant? e. what is the value of this stock if the dividend is increased to $2.30, the growth rate declines to 4 percent, and the required return remains 10 percent?arrow_forwardThe dividend yield (i.e. D1/P0) is a good measure of the expected return on a common stock under which of the following circumstances? g = 0 g > 0 g < 0 g is expected to remain constant over time under no circumstancesarrow_forwardWhich of the following assumptions would cause the constant growth stock valuation model to be invalid? The constant growth model is given below: P0 = D0(1+g)/rs - g Select one: a. The growth rate is more than the required rate of return b. The growth rate is negative c. The growth rate is zero d. None of the assumptions would invalidate the model e. The growth rate is less than the required rate of returnarrow_forward

- Infinite growth is a problem with the dividend discount model because: Seleccione una: a. Dividend growth rates eventually become very small b. The statement is incorrect as infinite growth is not a problem with the dividend discount model because at reasonably high discount rates, such as 12 percent, dividends received in the distant future are worth very little today c. The expected stream of dividends is infinite d. At reasonably high discount rates, such as 12 percent, dividends received in the distant future (40 or 50 years from now) are worth very little todayarrow_forwardplease respond to both. Which of the following is true about stocks? A. the dividend yield must always be positive B. the capital gains yield can never be negative. C. the capital gains yield can never be zero D. the dividend yield can never be negative According to the constant dividend growth model, which of the following is true? A. the constant growth rate is the same as the dividend yield B. The price growth rate is the same as the dividend yield C. the capital gains yield is the same as the constant dividend growth rate D. the dividend yield is the same as the capital gains yieldarrow_forwardThe dividend growth model: a. is only as reliable as the estimated rate of growth. b. can only be used if historical dividend information is available. C. considers the risk that future dividends may vary from their estimated values. d. applies only when a firm is currently paying dividends. e. uses beta to measure the systematic risk of a firm.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning