Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

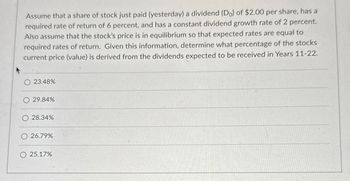

Transcribed Image Text:Assume that a share of stock just paid (yesterday) a dividend (Do) of $2.00 per share, has a

required rate of return of 6 percent, and has a constant dividend growth rate of 2 percent.

Also assume that the stock's price is in equilibrium so that expected rates are equal to

required rates of return. Given this information, determine what percentage of the stocks

current price (value) is derived from the dividends expected to be received in Years 11-22.

23.48%

29.84%

O 28.34%

26.79%

25.17%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Find the annualized holding rate of return and the average rate of return for a stock that returned -30% in year 1 and +30% in year 2. Annualized holding rate of return = -7.00% A. -9.00% B. -15.00% C. 0.00%arrow_forwardSuppose that the initial dividend on a stock is £1. The interest rate is 3 percent and the growth rate of dividends is constant at 2 percent. What Is the prics of the stock?arrow_forwardAn analyst gathered the following information for a stock and market parameters: stock beta = 1.23; expected return on the Market = 9.32%; expected return on T-bills = 4.75%; current stock Price = $9.08; expected stock price in one year = $13.1; expected dividend payment next year = $3.8. Calculate the expected return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forward

- ABC Inc. is expected to pay a dividend of $1.01 at the end of the year (year 1). The stock has a beta of 1.64. The risk-free rate is 2.9%. The expected return on the market is 7.2%. The stock's dividends are expected to grow at a constant rate. The stock price today is $30.66. If the market is in equilibrium what does the market believe the stock price will be in 3 years? ABC Inc has an outstanding preferred share. The preferred share just paid a dividend of $0.99. Dividends are paid quarterly. The price of stock today is $52.18. What is the effective annual rate of return?arrow_forwardA stock is selling today for $50 per share. At the end of the year, it pays a dividend of $3 per share and sells for $59. Required: a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain? c. Now suppose the year-end stock price after the dividend is paid is $44. What are the dividend yield and percentage capital gain in this case?arrow_forwardA stock just paid $2.7 dividend yesterday. The dividend is expected to grow at 3.4% per year thereafter. If the required rate of return of the stock is 10.5%, then using the dividend discount model, the stock price should be _______. (Round your answer to two decimal places, such as 12.34).arrow_forward

- You observed that the most recent price of a stock was $50. If the stock's dividends are expected to grow at a constant rate of 6% per year, what is the estimated stock price in year 1 (i.e., P₁)? O $47.17 O $53.00 O $42.65 O $58.25arrow_forwardA stock just paid a dividend of D0 = $1.50. The required rate of return is rs = 9.0%, and the constant growth rate is g = 4.0%. What is the current stock price? Select the correct answer. a. $31.20 b. $33.18 c. $30.21 d. $34.17 e. $32.19arrow_forward(a) Compute the expected book value per share at time 1. (b) Compute the expected earnings per share of DTI at time 2. (c) Compute the expected value of the ex-dividend stock price at time 2. (d) Compute the expected value of the ex-dividend stock price at time 0. (e) Compute the expected return (over a single-period) on the stock of DTI at time 0 (in %).arrow_forward

- A stock is expected to pay a dividend of $1.99 at the end of the year. The required rate of return is rs = 13.82%, and the expected constant growth rate is g = 8.0%. What is the stock's current price?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. A. $39.61 B. $29.71 C. $34.14 D. $42.68 E. $35.51arrow_forwardYou are investing in a stock that is expected to pay a dividend per share of $3.5 in year 1, $3.7 in year 2, $3.9 in year 3, and $4.0 in year 4. The required rate of return on the stock is 9.5%. Analysts expect earnings per share (EPS) of $13 and a P/E ratio of 36 at the end of year 4. What is the intrinsic value of the stock?arrow_forwardRussellCo (RCO) stock has the following forecasted dividend per share stream: $1.14 at the end of years 1 to 10, $1.80 at the end of year 11, after which dividends are expected to grow by 2% per year, forever and ever. Using a required return of 14%, calculate a fair price for RCO's stock today (b) Based on the forecasted dividend stream, calculate what RCO's stock price should be 16 years from todayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education