ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

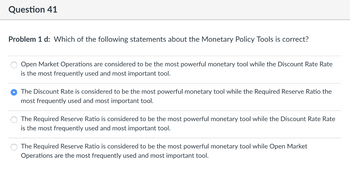

Transcribed Image Text:**Question 41**

**Problem 1 d:** Which of the following statements about the Monetary Policy Tools is correct?

- ○ Open Market Operations are considered to be the most powerful monetary tool while the Discount Rate Rate is the most frequently used and most important tool.

- ● The Discount Rate is considered to be the most powerful monetary tool while the Required Reserve Ratio the most frequently used and most important tool.

- ○ The Required Reserve Ratio is considered to be the most powerful monetary tool while the Discount Rate Rate is the most frequently used and most important tool.

- ○ The Required Reserve Ratio is considered to be the most powerful monetary tool while Open Market Operations are the most frequently used and most important tool.

**Explanation:**

The question presents multiple-choice options regarding which monetary policy tool is considered most powerful and most frequently used. The second option, which is selected, states that the Discount Rate is considered the most powerful tool, with the Required Reserve Ratio being the most frequently used and important.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Board of Governors of the Federal Reserve is in charge of setting and overseeing monetary policy and is headed by the ___________(PRESIDENT OF THE BANK OF NEW YORK / CHAIRMAN OF THE FEDERAL RESERVE / SPEAKER OF THE HOUSE / PRESIDENT OF FEDERAL OP[EN MARKET COMMITTEE). . Monetary policy is supposed to be____________(COORDINATED WITH/ INDEPENDENT OF) Congress and the president. This goal is hindered by the fact that the chairman is_______________(APPOINTED BY THE PRESIDENT / PUBLICLY ELECTED). Because Congress initially intended to create a decentralized banking system, there are also smaller branches of the Federal Reserve known as district banks. All presidents of the district banks take turns serving as members of the Federal Open Market Committee (FOMC) except for the president of the Federal Reserve Bank of __________(SAN FRANCISCO, NEW YORK, WASHINGTON DC), who is a permanent member. NOTE- This is one question but divided into the parts please answer with an…arrow_forwardFederal Reserve is the central bank of the United States. She conducts monetary policy with various tools.a. Many central banks share similar policy objectives. What are the objectives of the Federal Reserve? b. Suppose the Federal Reserve announces a “loose” monetary policy.What has to be done, traditionally, with an open market operation? Explain with reference to the money creation processarrow_forwardMonetary Policy is one the important drivers in growth & development of an economy. Illustrate at least four instruments/tools which are used universally in implementation of monetary policy.arrow_forward

- EconomyRead the following premise carefully and answer the questions specifically and in detail. "Faced with instability in economic growth due to a recession or accelerated inflation, the Fed uses the open market operation to increase or decrease the available reserves of commercial banks which, in turn, will affect the amount of money available in the economy. economy In addition to open market operation, the Fed has other tools available to promote the growth, sustainment and economic stability of a country.These tools have been used historically; "A good example was the mortgage debt crisis of 2008." 1. Explain in detail monetary policy, its function and its effects on short- and long-term economic fluctuations. Use the aggregate demand and supply model presented in the course. 2. Explain each of the tools that exist in expansionary monetary policy and contractionary monetary policy.arrow_forward2) When would the Federal Reserve want to carry out a monetary policy to decrease aggregate demand?arrow_forward6arrow_forward

- 10. According to the European Central Bank website, the treaty establishing the European Community "makes clear that ensuring price stability is the most important contribution that monetary policy can make to achieve a favourable economic environment and a high level of employment." If price stability is the only goal of monetary policy, explain how monetary policy would be conducted during recessions. Analyze both the case of a recession that is the result of a demand shock and the case of a recession that is the result of a supply shock.arrow_forwardQuestion 3 Which of the following is the most likely reason for a monetary policy that decreases the money supply A to increase total spending to encourage production to reduce unemployment to control inflation ©2021Illuminate EducationTM, Inc.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education