FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

39

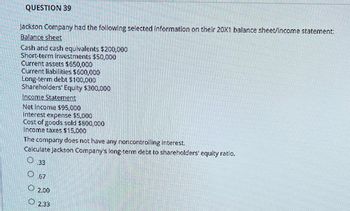

Transcribed Image Text:QUESTION 39

Jackson Company had the following selected information on their 20X1 balance sheet/income statement:

Balance sheet

Cash and cash equivalents $200,000

Short-term investments $50,000

Current assets $650,000

Current liabilities $600,000

Long-term debt $100,000

Shareholders' Equity $300,000

Income Statement

Net income $95,000

Interest expense $5,000

Cost of goods sold $800,000

Income taxes $15,000

The company does not have any noncontrolling interest.

Calculate Jackson Company's long-term debt to shareholders' equity ratio.

O33

O

.67

2.00

2.33

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- CALCULATE SPACEX'S NET CAPITAL SPENDING IN FY24arrow_forwardcalculate spaceX net capital spending in FY24arrow_forwardQuestion 24 Muscarella Inc. has the following balance sheet and income statement data: Cash $ 14,000 Accounts payable $ 42,000 Receivables 70,000 Other current liabilities 28,000 Inventories 210,000 Total CL $ 70,000 Total CA $294,000 Long-term debt 70,000 Net fixed assets 126,000 Common equity 280,000 Total assets $420,000 Total liab. and equity $420,000 Sales $280,000 Net income $ 21,000 The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average, 2.70, without affecting either sales or net income. Assuming that inventories are sold off and not replaced to get the current ratio to the target level, and that the funds generated are used to buy back common stock at book value, by how much would the ROE change? a. 4.28% b. 5.21% c. 4.73% d. 4.50% e. 4.96%arrow_forward

- Lydex Company Comparative Balance Sheet Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% Total liabilities Stockholders' equity: $ 1,260,000 This Year Last Year $960,000 0 2,700,000 3,900,000 240,000 7,800,000 9,300,000 $ 17,100,000 300,000 1,800,000 2,400,000 180,000 5,940,000 8,940,000 $ 14,880,000 $ 3,900,000 3,600,000 7,500,000 7,800,000 1,800,000 9,600,000 $ 2,760,000 3,000,000 5,760,000 7,800,000 1,320,000 9,120,000 Common stock, $ 78 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Lydex Company $ 17,100,000 $ 14,880,000 Comparative Income Statement and Reconciliation Sales (all on account) Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net income before taxes Income taxes…arrow_forwardSh19arrow_forwardBlue Water Prime Fish Balance sheet: $ 41,200 $ 20,800 Cash Accounts receivable (net) Inventory Property & equipment (net) 39,000 31,600 98,eee 143,000 41,200 403,400 84, 200 $ 405,400 $ 98,eee 66,400 Other assets 307,000 $ 804,000 $ 52,000 60,400 Total assets Current liabilities Long-term debt (interest rate: 10%) Capital stock ($10 par value) Additional paid-in capital Retained carnings 149,400 29, 200 62,400 $ 405,400 514,000 106, 200 71,400 $ 804,000 Total liabilities and stockholders' equity Income statement: Sales revenue (1/3 on credit) Cost of goods sold Оperating exхрenses Net income $ 444,eee (240,000) (161,400) $ 42,600 $ B00, 000 (400, 200) (311,200) $ 88,600 Other data: Per share stock price at end of current year Average income tax rate Dividends declered and paid in current year 22.2 17 30% $ 33,200 $ 149,000 Both companies are in the fish catching and manufacturing business. Both have been in business approximately 10 years, and each has had steady growth. The…arrow_forward

- Recent financial statements ior Madison Company follow : AssetsCurrent assets: Madison Company Balance Sheet June 30 Cash$ 21,000Accounts receivable , net160,000Merchandise inventory prepaid expenses;300,0009,000Total current assets490 ,000Plant and equipment , net810,000Total assets$1 ,300,000Liabilities and Stockholders' EquityLiabilities:Current liabilities$ 200,000Bonds payable, 10%300,000Totalliabil ies500,000Stockholders' equ:Common stock, $5 par value$100,000Retained earnings700,000Total stockholders' equity600,000Totalliabil ies and stockholders' equ$1 ,300,000Madison Company Income StatementFor the Year Ended June 30Sales$2,100,000Cost of goods sold1,260,000Gross rna rgin840,000Selling and administrative expenses660,000Net operating income180,000Interest expense30,000Net income before taxes150,000Income taxes45,000Net income$ 105,000Account balances at the beginning of the company 's fiscal year were : accounts receivable , $140,000 ;and…arrow_forwardThe most recent financial statements for Crosby, Incorporated, appear below. Sales for 2022 are projected to grow by 20 percent. Interest expense will remain constant, the tax rate and the dividend payout rate also will remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Sales Costs Other expenses Earnings before interest and taxes Interest expense Taxable income Taxes (24%) CROSBY, INCORPORATED 2021 Income Statement Net income Dividends Addition to retained earnings Current assets Cash Accounts receivable Inventory $31,335 69,745 $ 20,640 43,580 91,960 $747,000 582,000 18,000 FA $147,000 14,000 $ 133,000 31,920 $ 101,080 CROSBY, INCORPORATED Balance Sheet as of December 31, 2021 Assets Seved Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total $ 54,800 14,000 $ 68,800 MA000arrow_forwardCalculate: Net profit margin Asset utilization Equity multiplierarrow_forward

- ACCOUNTING ASAP Assume the following data: EBIT = 100; Depreciation = 40; Interest = 20; Dividends = 10. Calculate the cash coverage ratio. Select one: a. 7.0x b. 4.7x c. 14.0x d. 5.0xarrow_forwardGiven the following Year 9 selected balance sheet data: Assets Cash on Hand $136,000 255,000 230,000 $485,000 Total Current Assets Total Fixed Asset Investments Total Assets Liabilities and Shareholder Equity Accounts Payable Overdraft Loan Payable 1-Year Bank Loan Payable Current Portion of Long-Term Loans Total Current Liabilities $ 66,000 10,000 17,000 93,000 46,000 139,000 Long-Term Bank Loans Total Liabilities Year 8 Year 9 Shareholder Equity: Balance Change Common Stock (at a par value of $0.50 per share Additional Capital Retained Earnings Total Shareholder Equity Total Liabilities and Shareholder Equity 10,050 81,500 162,450 254,000 10,050 81,500 254,450 346,000 $485,000 92,000 +92,000 Based on the above figures and the definition of the debt:equity percentages (or debt%:equity%) presented in the Help section for p. 5 of the Camera and Drone Journal, the company's debt:equity percentages (rounded to 2 decimal places) and its current ratio are: Copyright © by Glo-Bus Software,…arrow_forwardh5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education