Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately we cannot answer this particular question due to its complexity.

We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

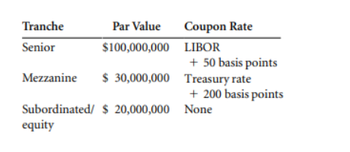

Consider the following basic $150 million CDO structure with the coupon rate to be offered at the time of issuance as shown:

Assume the following:

- The collateral consists of bonds that all mature in 10 years.

- The coupon rate for every bond is the 10-year Treasury rate plus 300 basis points.

- The collateral manager enters into an interest rate swap agreement with another party with a notional amount of $100 million.

- In the interest rate swap the collateral manager agrees to pay a fixed rate each year equal to the 10-year Treasury rate plus 100 basis points and receive LIBOR.

- Why is an interest rate swap needed?

- What is the potential return for the subordinate/ equity tranche, assuming no defaults?

- Why will the actual return be less than the return computed?

Transcribed Image Text:Tranche

Senior

Mezzanine

Subordinated/

equity

Par Value

$100,000,000

$ 30,000,000

$ 20,000,000

Coupon Rate

LIBOR

+ 50 basis points

Treasury rate

+ 200 basis points

None

Want to see the full answer?

Check out a sample Q&A hereKnowledge Booster

Similar questions

- You are given the following information: Debt tenor Account Balance b/f Repayment Balance c/f Principal repayment CFADS Max DS Less: interest Max principal repayment O $250k O $290k O $330k O $396k [1,0] Ⓒ $467k USD '000 USD '000 USD '000 USD '000 USD '000 USD '000 USD '000 DSCR. 1.50x i (% p.a.) 10.00% (250) 250 467 (70) 396 Yr 1 250.00 (41.67) 208.33 100.00 66.67 (25.00) 41.67 Yr 2 208.33 (59.17) 149.17 120.00 80.00 (20.83) 59.17 Yr 3 Yr 4 149.17 84.08 (65.08) (71.59) 84.08 12.49 120.00 80.00 (14.92) 65.08 120.00 80.00 (8.41) 71.59 Yr 5 12.49 (12.49) Out of the range of options given below, what is the most likely debt size for this example project? Note: Debt tenor = 6 years, DSCR = 1.50x, interest rate = 10%, CFADS as represented in the image. 120.00 80.00 (1.25) 78.75 Yr 6 120.00 80.00 80.00arrow_forwardComplete the following using present value. (Use the Table provided.) (Do not round intermediate calculations. Round the "Rate used" to the nearest tenth percent. Round the "PV factor" to 4 decimal places and final answer to the nearest cent.) On PV Table 12.3 PV of amount Amount Period Length of time desired at Rate Compounded Rate used PV factor used desired at used end of period end of period 24 10,500 3 years 6 % Monthly ePrev. 5 of 18 Next *े कके ****** ....* cer Σarrow_forwardQ. 42. Calculate Proprietary ratio from the following : 12,80,000 7,20,000 5,60,000 3,30,000 2,20,000 1,90,000 Fixed Assets Current Assets 8% Debentures 10% Mortgage Loan Bank Overdraft Trade Payablesarrow_forward

- Consider the following balance sheet Expected Balance Sheet for XYZ Bank Assets Yield Liabilities Cost Rate sensitive $ 1300 8% %$4 1700 8% Fixed rate $500 9% $1500 5% Non earning $ 5100 $. 1800 Equity 1900 Total $ 6900 $6900 What is the Net Interest Margin (NIM)arrow_forwardIf $2,000,000 of 10% bonds are issued at 97, the amount of cash received from the sale is a. $2,100,000 b. $1,940,000 c. $2,060,000 d. $2,000,000arrow_forwardCalculate market value of debtarrow_forward

- The attached table shows the risk-free cash flows over the next two years from owning three securities (R, S and T) and their current market prices. What is the no-arbitrage price of asset U (P)? No arbitrage pricing-security Updf 49 KB A. $42.00 B. $36.42 OC. $33.00 D. $48.47 OE. $30,00 Reset Selectionarrow_forwardConsider the Föllowing balance sheet Expected Balance Sheet for XYZ Bank Assets Yield Liabilities Cost Rate sensitive $ 1900 7% %$4 1300 9% Fixed rate $ 500 9% %$4 1900 6% Non earning $ 2700 %$4 800 Equity 1100 Total $ 5100 $ 5100 What is the Net Interest Income (NII)arrow_forwardezto.mheducation.com/ext/map/index.html?_con%=con&external_browser%3D0&launchUrl=https%253A%252F%252Fblackboard.waketech.edu%252Fwebapps%252Fportal%252Fframeset.jsp%25 Paul Havlik promised his grandson Jamie that he would give him $6,900 5 years from today for graduating from high school. Assume money is worth 6% interest compounded semiannually. What is the present value of this $6,900? (Use the Table provided.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Present value Bcerarrow_forward

- RNOA + FLEV X Spread X NCI Ratio = ROE 25.89% +FLEV X 24.37% X 1.0026 =50% What is FLEV? Please show stepsarrow_forward1. Based on the following information: Trial balance trade investment Equity Sale Sale allowances trade payables Cos CAD $ 300,000.00 $2,000,000.00 $3,000,000.00 $ 250,000.00 $ 800,000.00 $ 800,000.00 long term debt Cash $ 300,000.00 salary advance slow moving Inventory $ $1,000,000.00 70,000.00 $ 300,000.00 fast moving inventories $ 500,000.00 Pre payment $ 500,000.00 bad debt receivables non current asset long term investment $ (50,000.00) $ 400,000.00 $2,000,000.00 $ 450,000.00 Accumulated Depreciation $ (800,000.00) Calculate the following ratios: a. Company working capital b. Current ratio c. Quick ratio d. Inventory turnover e. Receivable turnover f. Asset turn overarrow_forwardGiven Discount rate 14% Year 5 multiple 5.00 Debt $ 2,100,000 Year Cash flows 1 $ 1,100,000 2 1,149,500 3 1,201,228 4 1,255,283 5 1,311,770 Solution a. Enterprise Value b. Equity Valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you