Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

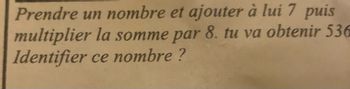

Transcribed Image Text:Prendre un nombre et ajouter à lui 7 puis

multiplier la somme par 8. tu va obtenir 536

Identifier ce nombre?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- INSTEATRINDANN~~~~~≈¦¦¦¦¦¦¦++744 1 2 3 5 6 8 9 10 11 12 13 14 15 16 18 19 20 21 17 Year Payment Amount 22 23 24 25 26 27 28 29 30 31 32 33 14 36 34 15 37 35 16 38 39 40 A 41 42 ~~~~~~ ON OG FW NOONGAWNIO 43 12 45 18 19 20 22 23 24 B 25 Nominal Rate r(m) Compounding m Effective Ann. Rate i Option A (lump sum) amount Option B (annual) amount Number of years Annuity imm. (1) or due (0) $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $1,125,000.00 $0.00 C PV factor D 3.000% 2 3.02% i= (1 + i(m)/m)^m-1 $15,000,000.00 $1,125,000.00 25 0 E 1.00000 $1,125,000.00 0.97066 $1,091,994.47 0.94218 $1,059,957.26 0.91454 $1,028,859.97 0.88771 $998,675.01 0.86167 $969,375.64 0.83639 $940,935.85 0.81185 $913,330.44…arrow_forward1. MC.14.81.ALGO 2. MC.14.96.ALGO 3. MC.11.69.ALGO 4. MC.11.112.ALGO 5. MC.15.86.ALGO 6. MC.15.125 7. MC.16.71.ALGO 8. MC.16.86.ALGO 9. MC.17.87.ALGO 10. MC.17.129 11. MC.18.58.ALGO 12. MC.18.45.ALGO 13. MC.20.81.ALGO Mocha Company manufactures a single product by a continuous process, involving three production departments. The records. indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $50,000, $60,000, and $70,000, respectively. Department 2 has transferred-in costs of $390,000 for the current period. In addition, work in process at the beginning of the period for Department 2 totaled $75,000, and work in process at the end of the period totaled $90,000. The journal entry to record the flow of costs into Department 3 during the period is Oa. Work in Process-Department 3…arrow_forwardSohr Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $51 to buy from farmers and $10 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $21 or processed further for $11 to make the end product industrial fiber that is sold for $59. The beet juice can be sold as is for $42 or processed further for $24 to make the end product refined sugar that is sold for $59. How much profit (loss) does the company make by processing one batch of sugar beets into the end products industrial fiber and refined sugar? Multiple Choice O $(4) $8arrow_forward

- Republic Industries decides to price delivery services according to the results of a recent activity-based costing (ABC) study. The study indicates Republic should charge $8 per order, 3% of annual order value for general delivery costs, $1.40 per item, and $30 for delivery. A year later, Republic collected the following information for two of its best customers: Cost driver Number of orders Number of deliveries Total number of items Annual order value Customer C Customer D 17 8 10 10 2,200 $195,000 4,400 $70,000 What are the total delivery costs charged to Customer C during the year?arrow_forwardOn January 1, 2021 Tractor Company will acquire a new asset that costs $390,000 and that is anticipated to have a salvage value of $34,000 at the end of four years. The new asset: qualifies as three-year property under the Modified Accelerated Cost Recovery System (MACRS) • will replace an old asset that currently has a tax basis of $96,000 and that can be sold on this date for $76,000 (net of selling costs) • will continue to generate the same operating revenues as the old asset ($130,000 per year). However, it is predicted that savings in cash operating costs will be experienced as follows: a total of $130,000 in each of the first three years, and $91,000 in the fourth year. ● Tractor is subject to a combined income tax rate, t, of 40% and rounds all computations to the nearest dollar. Tractor's fiscal year coincides with the calendar year. Assume that any gain or loss affects the taxes paid at the end of the year in which the gain or loss occurs. The company uses the net present…arrow_forwardFind the sum of the terms: 26 O 74.23 69.38 O 71.12 O 70.29 O 72.97 (1+0.04)² + 26 (1 +0.04)³ 26 (1+0.04)4 (Round intermediate calculations to 5 decimal places, e.g. 5.27525 and your final answer to 2 decimal places, e.g. 52.75.)arrow_forward

- Nous sommes le 31 décembre 2024. La société Endétente inc. fabrique et commercialise du mobilier de jardin confortable et résistant aux intempéries. Elle a pour projet d'agrandir ses installations afin de répondre à la forte demande. Pour ce faire, un financement de 15 millions de dollars serait requis pour le 1er janvier 2025. Deux structures de financement sont envisagées : Structure de financement A: • Une émission de 210 000 actions ordinaires à 36 $ par action, soit le prix du marché en date du 31 décembre 2024. • Un prêt bancaire à long terme pour la balance qui porte intérêt à 8,10 % par année. Le capital serait remboursable annuellement, sur 8 ans, en montants égaux, à partir du 31 décembre 2025. Les intérêts seraient payables le 31 décembre de chaque année. Structure de financement B: Un prêt bancaire à long terme de 15 000 000 $ qui porte intérêt à 9,5 % par année. Le capital serait remboursable annuellement, sur 10 ans, en montants égaux, à partir du 31 décembre 2025. Les…arrow_forwardAccess taskarrow_forwardA company that was to be liquidated had the following liabilities: Income Taxes Notes Payable secured by land Accounts Payable $ 15,000 120,000 48,000 Salaries Payable ($18,000 for Employee #1 and $5,000 for Employee #2) Administrative expenses for liquidation The company had the following assets: 23,000 Current Assets Land Building Saved 25,000 Book Fair Value Value $130,000 $115,000 60,000 100,000 175,000 220,000 Total liabilities with priority are calculated to be what amount? Multiple Choice О $106,650. $38,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education