FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

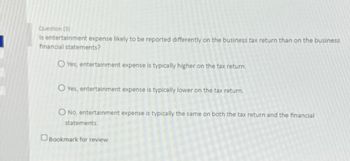

Transcribed Image Text:Question (3)

Is entertainment expense likely to be reported differently on the business tax return than on the business

financial statements?

O Yes, entertainment expense is typically higher on the tax return.

O Yes, entertainment expense is typically lower on the tax return.

O No, entertainment expense is typically the same on both the tax return and the financial

statements.

Bookmark for review

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- True (t) or False (f) ______ The LIFO conformity rule requires that if a company uses LIFO for tax purposes, it must also use LIFO for financial accounting purposes.arrow_forwardThe following relates to the different income components: Employment or loss Business income or loss Property income or loss Capital gain or loss Use the above details to answer questions 11 and 12. What are the most possible sources of income to a business, corporation or trust? Question 8 options: a) i, ii and iii b) ii, iii and iv c) i and iv d) All of the abovearrow_forward1. Under IFRS companies are required to provide a reconciliation between actual tax expense and the applicable tax rate. The purpose(s) of this reconciliation include I. Making better prediction of future cash flow. II. Predicating future cash flows for operating loss carryforwards. III. Assessing the composition of the net deferred income tax liability. IV. Assessing quality of earnings. Select one: a.I, II, III and IV. b.I, III, and IV only. c.I, II and IV only. d.I and IV only. 2. Under IFRS deferred tax assets are recognized for I. Deductible temporary differences. II. Deductible permanent differences. III. Operating loss carryforwards. IV. Operating loss carrybacks Select one: a.I and III only. b.I and IV only. c.II and III only. d.I, II, and III. 3. In determining whether to adjust a deferred tax asset, a company should Select one: a.pass a recognition threshold, after assuming that it will be audited by taxing authorities. b.take an aggressive approach…arrow_forward

- A3arrow_forwardIn computing net business income for income tax purposes, which of the following statements is INCORRECT? Question 3Answer a. Income tax paid is not allowed as a business deduction. b. Depreciation is not allowed as a business deduction. c. Capital cost allowance is not allowed as a business deduction. d. An arbitrary reserve is not allowed as a business deduction.arrow_forwardTax accounting is a service offered by public accounting firms that involves both tax planning and which of the following? Multiple Choice A.)tax compliance B.)tax avoidance C.)tax elimination D.)tax payment. Please explain incorrect and correct option without plagiarismarrow_forward

- Indicate if the following transaction from Torte Baking Company increases or decreases assets, liabilities, equity, revenue, expense, and net income. The pattern of the + and - must adhere to the balance sheet equation. Show the impact of revenue and expense on both net income and equity. If there is a + and - within one category (e.g., assets for transaction 2), then list the accounts that go up and down. Transaction (26) Recognize tax expense that will be paid later. Assets ["", "", ""] Liabilities ["", "", ""] Equity ["", "", ""] Revenue ["", "", ""] Expense ["", "", ""] Net Income ["", "", ""]arrow_forwardGross income minus tax-exempt income equals adjusted gross income. True Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education