FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

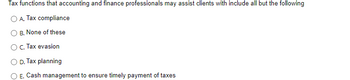

Transcribed Image Text:Tax functions that accounting and finance professionals may assist clients with include all but the following

A. Tax compliance

B. None of these

O c. Tax evasion

O D. Tax planning

E. Cash management to ensure timely payment of taxes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is a key step in the tax audit process? a) Submitting financial statements to the tax authority b) Reviewing the taxpayer's records and documents c) Negotiating a settlement with the tax authority d) Publishing the audit findings to the publicarrow_forwardWhat is the primary purpose of internal controls in an Accounting Information System (AIS )? a) To generate financial statements b) To ensure data accuracy and integrity c) To facilitate decision-making processes d) To comply with tax regulationsarrow_forward1. Under IFRS companies are required to provide a reconciliation between actual tax expense and the applicable tax rate. The purpose(s) of this reconciliation include I. Making better prediction of future cash flow. II. Predicating future cash flows for operating loss carryforwards. III. Assessing the composition of the net deferred income tax liability. IV. Assessing quality of earnings. Select one: a.I, II, III and IV. b.I, III, and IV only. c.I, II and IV only. d.I and IV only. 2. Under IFRS deferred tax assets are recognized for I. Deductible temporary differences. II. Deductible permanent differences. III. Operating loss carryforwards. IV. Operating loss carrybacks Select one: a.I and III only. b.I and IV only. c.II and III only. d.I, II, and III. 3. In determining whether to adjust a deferred tax asset, a company should Select one: a.pass a recognition threshold, after assuming that it will be audited by taxing authorities. b.take an aggressive approach…arrow_forward

- Which of the following statements best describes the anti-avoidance provision in Part IVA of the ITAA 1936? a. Voluntary disclosure of tax avoidance, the non-lodgement of the income tax return, and tax evasion. b. Fraud, non-disclosure, and non-lodgement of an income tax return. c. A financing arrangement, a deduction, and tax evasion. d. A scheme, a tax benefit, and has the dominant or principal purpose of obtaining a tax benefit.arrow_forwardA tax preparer has a client tht recently asked him about the probability ofthe IRS detecting cash transactions not reported on tax return. What are some of the issues the tax preparer should discuss with this client?arrow_forward12) ABSD INC.'s B.O.D's approved issuance of 5,000,000 share of $50 par value common stock. Currently 4,200,000 shares are outstanding. Current stock price is $60 A 4% stock dividend is declared on March 1, 2020 and paid two months later. Show journal entries required to record declaration and payment of distribution.arrow_forward

- Tax accounting is a service offered by public accounting firms that involves both tax planning and which of the following? Multiple Choice A.)tax compliance B.)tax avoidance C.)tax elimination D.)tax payment. Please explain incorrect and correct option without plagiarismarrow_forwardWhat would be the appropriate account title for funds collected by a sales tax custodial fund? A. Sales tax revenue B. Other financing sources C. Additions-tax collections for other governments D. Sales taxes receivablearrow_forwardthe conceptual framework for financial reporting states that the purpose of financial reporting is to a. provide information to management accountants for decision making b. support and enhance transparent financial reporting by governments and other public sector entities c. provide tax authorities with information to be used for tax assessment d. none of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education